Today we will look at why we think A2 Milk shares (ASX:A2M) having been sold off so heavily may now present an opportunity. We’ll also go through some analysis of our A2M share price forecast.

A2 Milk Company Ltd (ASX:A2M) has been a stock market darling over the past few years due to its fast-growing business and robust performance.

However, contrary to initial assessments, COVID-19 handed a blow to the company’s fortunes.

The pandemic severely impacted one of A2M’s major sales channels, hurt the company’s outlook, and resulted in multiple downgrades.

As with all hyper-growth stocks, any perceived apprehensions about the company’s operations will trigger a severe correction.

The A2M share price is down 50% year-to-date and 71% from its all-time high, but may now be priced right for a long-term fundamental play.

The recent three child policy announced by China as well as expectations of borders openings could revitalise the daigou revenue channel in mid-2022.

Even though there are China trade tension and headwinds, we expect demand to continue to rise along with a recovery in revenue in the Daigou channel.

Table of Contents

- 1 About A2 Milk (ASX:A2M)

- 2 Positive business outlook in China and the USA, but USD weakness could hurt margins

- 3 A2 Milk shares have a new growth opportunity in China

- 4 COVID and political issues biggest threat to A2 Milk

- 5 A2 Milk (ASX:A2M) financials: Is there a bargain amongst the daigou debris?

- 6 A2 Milk (ASX:A2M) peer analysis

- 7 Despite daigou sales channel issues, A2 Milk (ASX:A2M) is growing well in China and the USA

About A2 Milk (ASX:A2M)

The A2 Milk Company is a New Zealand-headquartered specialty milk producer and baby formula maker.

The company has been growing in popularity over the past few years due to a global tilt towards healthy eating.

A2 milk has a higher nutritional value and is easier to digest.

Further, the company’s major success and growth driver is its baby formula line which showed solid growth up to FY20 and has been very successful in international markets such as China and the USA.

The company has two major product lines:

- A2 Milk – This line includes whole milk, reduced-fat variants, and creamers.

- A2 Nutrition – This line includes formulas and milk for various stages in the toddler life cycle and the mother’s nutrition.

The company is in the process of acquiring a 75% stake in Mataura Valley Milk for NZ$268.5 million, which will help the company strengthen its manufacturing base.

Positive business outlook in China and the USA, but USD weakness could hurt margins

A2M’s biggest strength is its growing presence in China, where the demographics and market dynamics are a natural fit for the company.

China is a very attractive market for infant nutrition and A2 milk and the country has seen huge demand for foreign baby nutrition products due to a 2008 scandal that hurt consumer confidence in local baby formula products.

As a result, A2 Infant Nutrition enjoyed robust growth in the region over the past few years and has been the overall growth driver for the company.

Further, A2 milk is easier to digest and enjoys a good product-market fit in the region due to a tendency towards lactose intolerance.

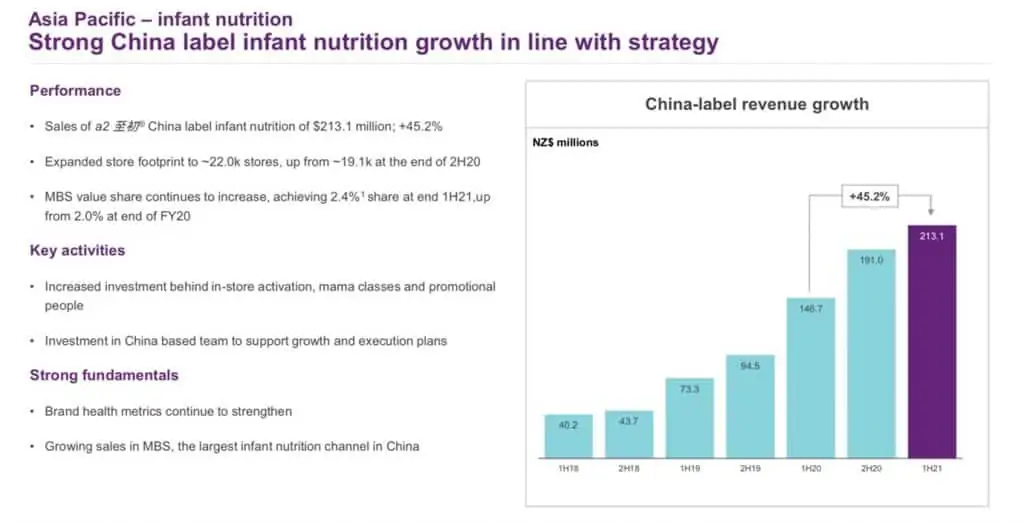

A2M’s China labeled nutrition and China milk sales reported revenue growth of 45.2% and 107% respectively during 1H21 (July 1, 2020, to December 31, 2020) despite pandemic disruptions and lower birth rates.

Infant Nutrition grew MBS’s (Mother and Baby Stores) market share by 20% to 2.4%.

A2 Milk (ASX:A2M) has also been making progress towards growing its presence in the US market.

The company grew its revenue 22% in 1H21 despite COVID and lower consumer spending resulting from it and EBITDA margins have improved by almost 50%.

Source: A2M FY21 Interim Report

However, A2 Mlik may face currency headwinds because 52.8% of its revenue is US dollar (USD) denominated.

The USD has been weakening relative to the Australian dollar (AUD) and New Zealand dollar (NZD) due to inflation concerns in the US, a rotation out of expensively valued stocks, and low interest rates.

This could hurt the company’s margins over the next few quarters because receipts in the home currency may be lower.

A2 Milk shares could benefit in the long term from China’s recently announced three-child policy.

The new policy can lead to a spurt in birth rates and boost the company’s nutrition business.

Even though there are concerns in China regarding the ability of young couples to have children, the policy can still have a significant impact.

As with most demographics, the majority of people lie on a scale going from those who can’t afford to have more children to those who can but are restricted due to policy.

Even if a small subset of people who are on the margin and restricted by policy decided to have a third child, with China’s huge population, this subset could be substantial.

Additionally, A2M nutrition has shown impressive growth over the past five years despite new Chinese childbirths declining from 18 million in 2016 to just 12 million in 2020.

Either way, the new measures could be considered to be a positive tailwind for the company’s China label products.

COVID and political issues biggest threat to A2 Milk

The biggest threat to A2 Milk shares is a prolonged COVID-related disruption.

COVID has severely dented daigou sales, which are a crucial avenue of sales for the company.

Daigou is the local purchase of products in Australia and New Zealand (ANZ) by Chinese students, tourists, and expats, which are then shipped back to China and sold for a profit.

Daigou sales had been growing over the years due to online availability, and lax customs and tariffs because consignment sizes are small.

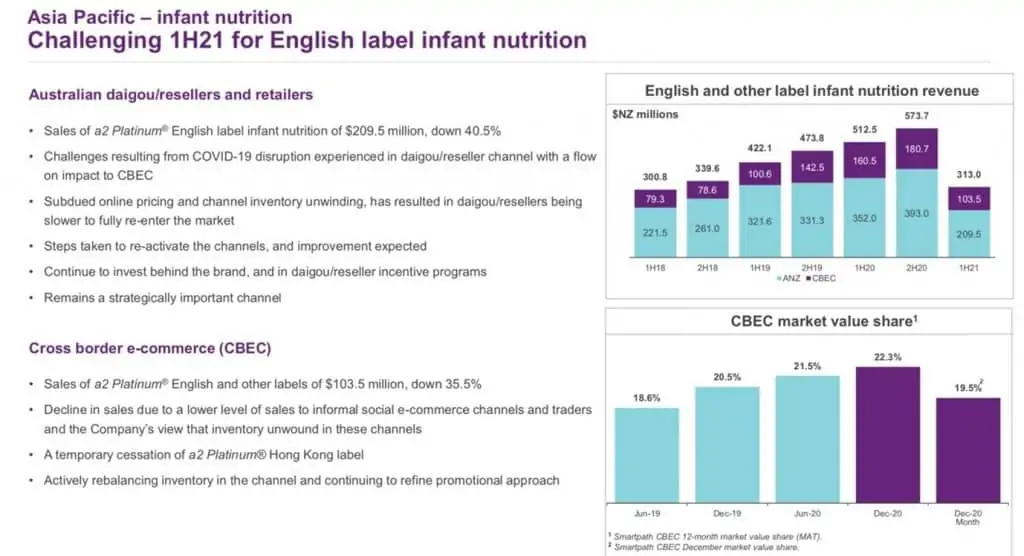

The effect of lower daigou sales is apparent from the ANZ region figures.

In 1HFY21, sales were down 32%, EBITDA was down 48.5% and English label infant nutrition was down 40.5%.

Extensions of travel bans and other COVID-related disruptions could continue to hurt the company by choking off the lucrative daigou channel.

Source: A2M FY21 Interim Report

Another concern for the company is its outsized dependence on the China market, even though it has proved to be a fast-growing territory.

It accounted for 48% of the company’s revenue in 1HFY21 – the bulk of which was from baby nutrition products.

In 2019, the Chinese government pledged that domestic infant nutrition companies would increase their market share from 40% to 60%, a red flag for A2 Milk.

To make matters worse, Chinese and Australian diplomatic relations are currently strained.

Souring trade ties could lead to embargos on certain imports, especially those where the government is incentivizing domestic production.

However, one of the main revenue streams that were hit for A2 Milk was the Daigou channel.

This channel is relatively under-regulated due to the relatively small individual volumes that go through this channel.

This means that as long as there is still demand in China, smaller channels such as this would be less impacted by China relations with Australia.

In addition, to counter this threat, A2 Milk (ASX:A2M) has been making efforts towards building deep relations in China.

The China Animal Husbandry Group, a subsidiary of the state-owned China National Agriculture Development Group (CNADG), will continue to be a 25% minority partner in Mataura Valley Milk after A2M completes its acquisition of a 75% stake.

CNADG also owns a logistics company that is A2M’s distribution partner in China.

A2 Milk (ASX:A2M) financials: Is there a bargain amongst the daigou debris?

A2 Milk has had an abysmal year financially. This is reflected in the highly disappointing performance of the A2M share price.

The company announced four profit guidance downgrades over the past year.

As a result of these successive profit downgrades, the company is facing a potential class-action lawsuit from investors.

For 1HFY21, the company reported revenue of NZ$677.4 million (down 16% YoY) and EBITDA of NZ$178.5 million (down 32.2% YoY).

Most of the declines were driven by lower daigou sales.

Since daigou sales originate in the ANZ region and then ship to China, a major impact can be seen in the ANZ region sales, which were down 32% YoY.

However, the company showed robust performance in China and America.

If, as expected, the daigou sales channel recovers by mid-late FY22, we can expect reported figures at FY20 levels in that year, and 25%-30% growth thereafter.

We believe a buying opportunity exists here.

According to company guidance, revenue for FY21 is expected to be NZ$1.4 billion which is higher than 2019 revenues by 7.6%.

Furthermore, EBITDA for FY21 is estimated to be NZ$378 million (excluding M&A costs), which is only slightly lower than the 2019 EBITDA of NZ$414 million.

However, compared to the A2 Milk share price of A$17.12 on July 1, 2019, the stock price currently is down 66% to only A$5.7.

We believe the A2M share price has been oversold.

A2 Milk (ASX:A2M) peer analysis

We will compare A2 Milk (ASX:A2M) to Fonterra and Clover Corporation.

Fonterra is one of the world’s largest dairy companies while Clover Corporation is an Australian producer of nutritional products.

| Metric | A2M | Fonterra | Clover Corporation |

| Price/Earnings | 14.11 | 10 | 26.45 |

| Price/Sales | 2.64 | 0.27 | 3.4 |

| Net Profit Margin | 20.02% | 2.71% | 12.94% |

| Return on Equity | 29.61% | 7.93% | 19.61% |

Source: Yahoo Finance

A2 Milk shares are superior to both their peers in terms of profit margin and ROE.

At the current A2M share price, A2 Milk shares are substantially cheaper than Clover while it is more expensive than Fonterra in terms of price multiples.

However, Fonterra is a far more mature company and may not have the same growth potential as A2M shares.

The much stronger net profit margin and return on equity which indicates a higher-quality revenue stream can make the higher PE versus Fonterra palatable.

Despite daigou sales channel issues, A2 Milk (ASX:A2M) is growing well in China and the USA

We believe the A2M share price has been unduly punished and its current guidance supports a much better price.

The stock last traded at these levels in September 2017, but A2M’s business has not deteriorated commensurately.

Going by the company’s guidance, A2M shares should only slightly underperform FY19 levels in terms of EBITDA in FY21.

Meanwhile, despite the daigou blip, A2 Mlik has been growing apace in China and the USA.

We believe that A2 Milk has a positive business outlook and the severe correction in the A2M share price these past 12 months presents a buying opportunity.

However, A2M is still in a pretty strong downtrend. Buying now would be considered a high-risk play.

For a lower risk play, it may be prudent to wait for a sustained recovery in the A2M share price as well as more clarity around border openings in the near future.