The three ASX indices (200, 300, and All Ordinaries) closed last week lower by 1.16%, 1.23%, and 1.30% respectively.

The week gone by was done in by COVID, at first due to the rising number of infections across the globe, particularly in Europe, and later due to the discovery of a new, highly mutated variant of the virus in South Africa.

Other factors that impacted the market were the reappointment of Jerome Powell as Fed Chair and a 5-nation move to rein in oil prices with a release from strategic reserves.

With fresh growth worries arising from the new virus mutation, energy stocks were therefore under a cloud.

Understandably, the travel sector took it badly on the chin.

However, mining companies bucked the trend following a rally in iron ore prices.

Wall Street had a holiday-shortened week for Thanksgiving, and that made for thin markets given to volatile moves.

Stocks

Travel stocks were brutally sold off from virus-related fears of lockdowns, travel restrictions, and quarantines for travellers.

Flight Centre (ASX:FLT) was (-12.99%), Webjet (ASX:WEB) (-9.78%) and Qantas (ASX:QAN) (-7.75%).

Corporate Travel Management (ASX:CTD) plunged 11.79%, while Regional Express (ASX:REX) ended 3.74% lower.

Energy stocks were weighed under by a stockpile release and the new virus mutation.

Santos (ASX:STO) fell by 0.31% and Oil Search (ASX:OSH) plunged nearly 3%, and Woodside Petroleum (ASX:WPL) closed flat.

Yancoal (ASX:YAL) fell 1.89%, though Whitehaven Coal (ASX:WHC) moved up a shade by 0.83%.

Meridian Energy (ASX:MEZ) lost 3.15% on the week.

It will sell its Australian business to Shell Energy and Infrastructure Capital Group for an aggregate of A$729 million.

In more news on the energy sector, APA Group (ASX:APA) gained 5.36% after indicating an interest in Basslink, a Tasmanian operator of an electricity interconnector between Victoria and Tasmania that is currently under voluntary administration.

APA has purchased an interest in the debt of Nexus Australia Management Pty Ltd, the borrowing entity for Basslink, at a discounted price.

However, a five-day winning streak in iron ore prices helped miners beat the virus blues.

BHP (ASX:BHP) was up 4.54%, Rio Tinto (ASX:RIO) gained 4.35%, South32 (ASX:S32) rose 2.30%, and Fortescue shot up over 8%.

According to analysts, mining stocks were also upbeat on the prospects of Chinese stimulus that could bolster key economic sectors.

BCI Minerals (ASX:BCI) jumped 4.30% on the week after the company won governmental approval for its Mardie Salt and Potash project.

However, gold mining stocks headed the other way.

Northern Star Resources (ASX:NST) fell 5.05%, St Barbara (ASX:SBM) plunged 7.82%, and Newcrest Mining (ASX:NCM) closed lower by 1.54%.

Evolution Mining (ASX:EVN) fell 6.38%, and Gold Road (ASX:GOR) fell by 8.9%.

Northern Star announced a $95-million deal to acquire gold producer Newmont Corporation’s power business.

Banks were down with Commonwealth Bank (ASX:CBA) continuing its losing ways, lower by over 3%. Westpac (ASX:WBC) declined by 4.44%, National Australia Bank (ASX:NAB) slumped over 3.62% and ANZ Banking (ASX:ANZ) fell 0.51%.

The Australian Competition and Consumer Commission has greenlighted NAB’s purchase of Citigroup’s consumer business after the regulator concluded the deal would not be anti-competitive.

NAB will get to own a substantial and well-developed credit card business.

Wealth manager AMP Ltd (ASX:AMP) slumped by 12.28% after it noted additional impairment charges of $325 million in its fiscal 2021 accounts.

The development comes as it approaches a demerger of its AMP Capital business unit.

Technology stocks were under the weather following a slump on the Nasdaq amidst fears of higher rates.

Next DC (ASX:NXT) plunged 7.57%, Wisetech (ASX:WTC) cracked 9.33%, and computer hardware distributor Dicker Data (ASX:DDR) fell over 5%. Xero (ASX:XRO) plunged 7.21%.

However, AI software provider Appen (ASX:APX) was the stand-out loser, declining 21.77% on the week after investment bankers Macquarie reportedly derated the stock from “neutral’ to “underperform.”

BNPL fintech darlings Zip Co Ltd (ASX:Z1P) and Afterpay (ASX:APT) plunged 8.82% and 5.14% respectively.

Laybuy Holdings (ASX:LBY) crashed 32.95% because the BNPL provider lowered its full-year sales forecast after its UK market underperformed.

EML Payments (ASX:EML) soared over 25% after its Irish subsidiary was permitted to onboard new customers.

Further, Computershare (ASX:CPU) gained marginally by nearly a percentage point.

Investigative analytics and intelligence software provider Nuix Ltd (ASX:NXL) fell nearly 9% on the week after it was slapped with a class-action suit by shareholders alleging the company had issued misleading sales forecasts for the 2021 financial year.

The healthcare sector closed out the week with a mixed performance.

While Sonic Healthcare (ASX:SHL) gained 0.68% and Fisher & Paykel (ASX:FPH) put on 3.18%, Resmed CDI (ASX:RMD) fell 2.03%, CSL Limited (ASX:CSL) declined 0.95% and Ramsay Health Care (ASX:RHC) continued its downtrend, falling 1.28%.

Fisher & Paykel intends to plough in about A$668 million into real estate investments over the next five years to ensure it has a bank of sites for future manufacturing plans.

“We’re planning to add three manufacturing facilities outside New Zealand over the next five years with the first being the third building in Mexico which is in progress,” the company said on its earnings call.

Despite the market woes, real estate generally fared better.

Scentre Group (ASX:SCG) and Stockland (ASX:SGP) rose 1.61% and 2.30% respectively, property giant Goodman Group (ASX:GMG) was up by 1.32%, Lendlease (ASX:LLC) was 3.45% higher, Mirvac Group (ASX:MGR) gained 3.57%.

However, property manager Charter Hall (ASX:CHC) ended flat.

Vehicle parts, accessories, equipment, and services provider Bapcor (ASX:BAP) slipped 18.46% over the week following the shock announcement of the retirement of Chief Executive Officer and Managing Director, Darryl Abotomey, after a decade leading the company.

This week in ASX Stocks

Corporate reports and events

Collins Foods Ltd (ASX:CKF) will report its results for the 2022 half-year on Tuesday, November 30, 2021.

Upcoming Listings between 29 November – 03 December

November 29, 2021

Alloggio Group Limited (ASX:ALO), which provides short-term rental accommodation in Australia and manages a current portfolio of over 879 holiday properties and 13 mid-market hotels, will list ordinary fully paid shares of A$0.20 each from its A$16.5 million issue.

Andean Mining Limited (ASX:ADM) is an Australian mineral exploration company with operations in Colombia South America.

The Company’s flagship project is a high-grade copper-gold project named El Dovio.

It will list ordinary fully paid shares of A$0.20 each from its A$6 million.

November 30, 2021

Biome Australia Limited (ASX:BIO) is an Australian company that licenses, develops, and markets innovative, evidence-based, complementary medicines, including nutraceuticals (food-based vitamins and weight-management products) and live biotherapeutics (probiotics).

It will list ordinary fully paid shares of A$0.20 each from its A$8 million issue.

December 1, 2021

Cosmos Exploration Limited (ASX:C1X) which is exploring for Gold, Copper, and Nickel deposits in Australia, will list ordinary fully paid shares of A$0.20 each from its $5 million issue.

December 2, 2021

Close the Loop Ltd (ASX:CLG), a company engaged in resource collection, recycling, and packaging will list ordinary fully paid shares of A$0.20 each from its A$12 million issue.

December 3, 2021

8 Au Limited (ASX:8AU) has assembled a diverse, strategic holding of tenements located in proximity to significant recent discoveries in Tier 1 Exploration regions.

These holdings have the potential for gold and green economy minerals, such as nickel, copper, and PGE’s.

The company will list ordinary fully paid shares of A$0.20 each from its $12 million issue.

Orange Minerals NL (ASX:OMX), a gold and copper exploration company with projects on the historic Lachlan Fold Belt in New South Wales and the Eastern Goldfields in Western Australia, will list ordinary fully paid shares of A$0.20 each from its $7 million issue.

Economic News And Market Outlook

In the US, sales of existing homes rose 0.8% month-over-month during October, following a 7% increase in September.

According to one economist, this year’s homes sales are on track to surpass six million homes, which would be the strongest performance since 2006.

Meanwhile, sales of new homes during October rose 0.4% to a seasonally adjusted annual rate of 745,000 units against analysts’ expectations of an 800,000 rate.

However, the median new house price soared 17.5% in October to $407,700 from a year ago, raising concerns on housing affordability and the crunch in the number of existing homes coming to market.

During the July-Sep Quarter, US GDP grew a modest 2.1% annually, well below the gains recorded of 6.3% in the first quarter this year and 6.7% in the second.

The reason for the latest, somewhat muted growth has been attributed to a spike in virus cases and disrupted supply chains.

However, the expectation is that the US economy in the current October-December quarter could grow at the strongest pace this year – as high as 8%.

A slump in aircraft orders caused US durable goods orders during October to fall unexpectedly by 0.5%.

The number, which underperformed the consensus expectations of a rise of 0.2%, followed a 0.4% decline in September.

The sombre numbers above were tempered by a solid drop in US initial jobless claims to 199,000, a level not recorded since November 15, 1969.

For perspective, Dow Jones had estimated the reading to be as high as 260,000.

The minutes of the November 2-3 FOMC meeting showed that the members were worried about rapidly rising inflation and that they would raise interest rates sooner than expected should inflationary conditions warrant the action.

The minutes also showed that some members were in favour of accelerating the pace of tapering to create leeway for rate hike actions if need be.

As expected, the Reserve Bank of New Zealand raised the official cash rate by 25 basis points to 0.75% in its final policy meeting of the year last Wednesday, marking its second rate hike in as many months.

“Given the heat in the economy, we think the RBNZ is far from done,” said Ben Udy, an economist at Capital Economics.

“We expect the bank to continue to hike rates next year to about 2.0% by the middle of next year.”

On Friday, data showed that Australian retail sales surged 4.9% in October, building upon the bounce of 1.7% seen in September.

The latest print completely overtook economists’ expectations of a 2.5% jump and showed that shoppers celebrated the removal of lockdown restrictions by revenge shopping.

It also offered comfort that the country’s economics were improving rapidly after the pandemic shock.

In the coming week (Sydney time) Australian GDP data for Q3 will release on Wednesday, December 1 and retail sales data will be available on Thursday, December 2.

US CB Consumer Confidence data for November will release on Wednesday, December 1.

On Thursday, December 2, the following US data prints will release:

- ADP Nonfarm Employment Change (Nov);

- ISM Manufacturing PMI (Nov) and

- Crude Oil Inventories.

On Friday, December 3, US data on Initial Jobless claims would be released.

The all-important data on US non-farm payrolls will be released on Saturday, December 4, at 00:30, Sydney time.

Chinese Manufacturing PMI (November) will be received on Tuesday, November 30.

Forex Outlook

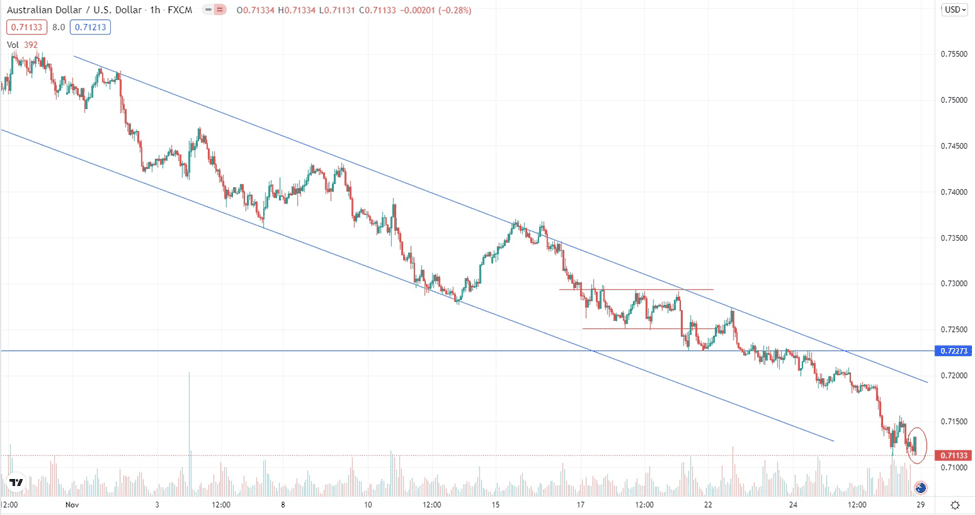

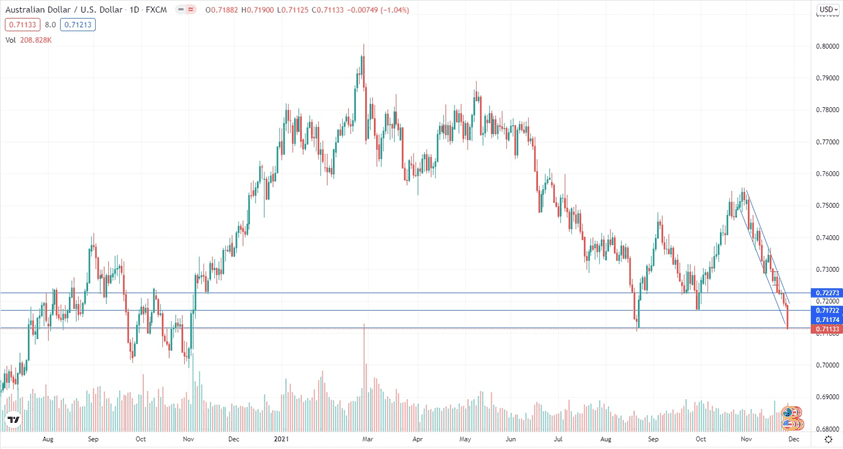

AUD/USD ended the week at 0.71133, well below last week’s close of 0.72273, and traded negatively for the week once it touched the upper trend line of the falling channel, and then plunging below 0.72273 after a brief flirtation.

Similar to last week, the worrying thing is that it closed at the day and week’s low – 0.71133 – which also happens to be a significant previous low (see daily chart).

It is likely to open gap down below this line given the worsening drum beat on the new South African mutation of the virus and the implications for a risk-on currency such as the AUD/USD

If that happens, there are no more supports before 0.70000.

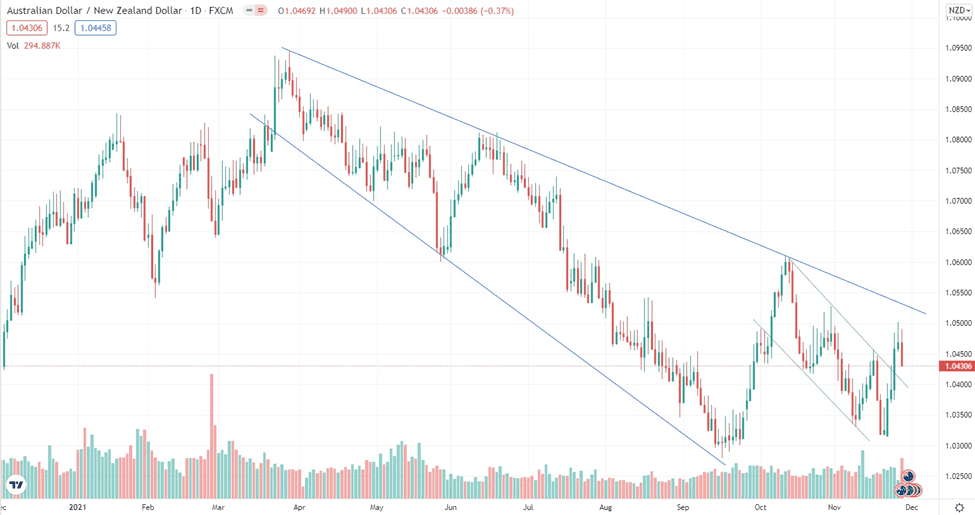

The AUD/NZD closed the week at 1.04306, well above its previous close of 1.03246.

Bulls appear to have wrested the initiative, taking advantage of oversold conditions.

It is significant that AUD/NZD closed higher on the first four days of the week despite the RBNZ rate hike decision, and broke out of the falling channel (green lines) inside the longer term falling channel (blue lines).

However, the longer-term trajectory still appears bearish.

The new week will show the path forward, in particular, how the new virus fears will affect commodity currencies.

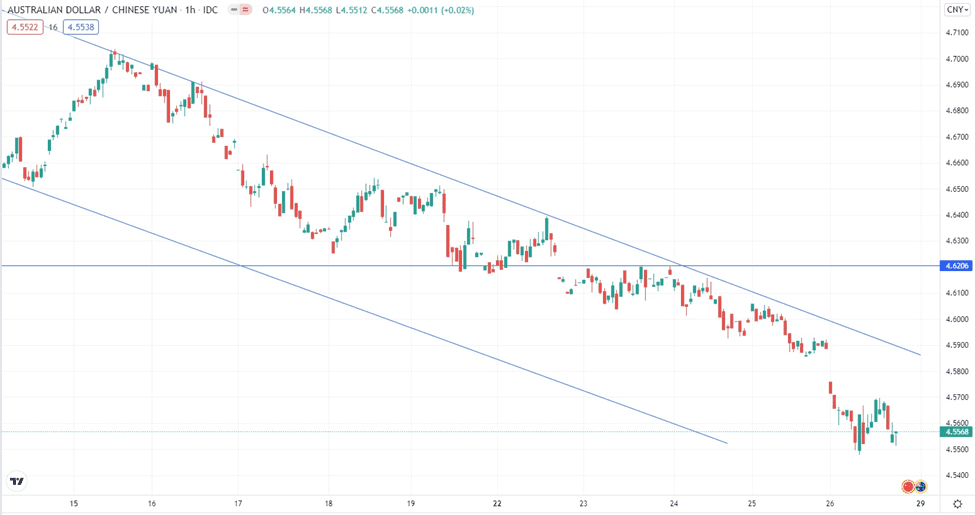

AUD/CNY closed the week at 4.5568, well below the previous week’s close of 4.6206.

The violation of the 4.6206 level likely sets up AUD/CNY for a fresh leg down in the direction of the downtrend that started from the 5.15 level in February 2021.