Today we will look at why we think Corporate Travel Management shares (ASX:CTD) has good potential upside and a solid business in our CTD share price forecast and analysis.

Corporate Travel Management (ASX:CTD) is a travel services provider based in Australia with operations across the globe.

After being one of the worst-hit sectors during the COVID pandemic, the sector is finally showing a strong rebound after a couple of false starts through 2021 and 2022.

The company is well-placed to capitalize on demand surpassing pre-COVID levels with excess capacity on hand to meet demand and synergies from acquisitions on the cusp of kicking in.

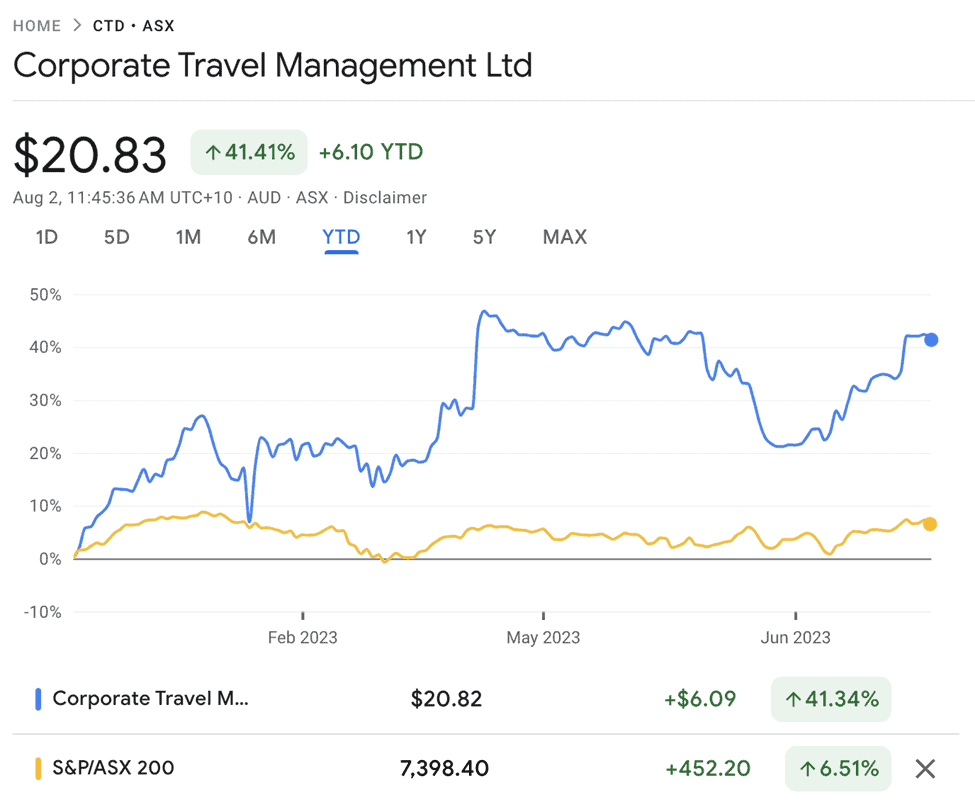

Corporate Travel Management has returned 41% YTD, having outperformed the ASX200 by nearly 35%.

Table of Contents

- 1 About Corporate Travel Management Shares

- 2 Strong Economics With Scale

- 3 Macro Environment And Slow Demand Recovery Are Weaknesses

- 4 Massive Organic And Inorganic Growth Opportunities

- 5 The Rise of Generative AI and Climate Change Are Threats

- 6 The Best Is Yet To Come on The Financials

- 7 Corporate Travel Management Shares (ASX:CTD) Valuation

- 8 Conclusion – Price Has Run-Up But Medium-Term Outlook Looks Bright

Corporate Travel Management (CTM) is a travel services company that provides corporates with a bouquet of travel services such as travel/itinerary planning, event travel planning, etc.

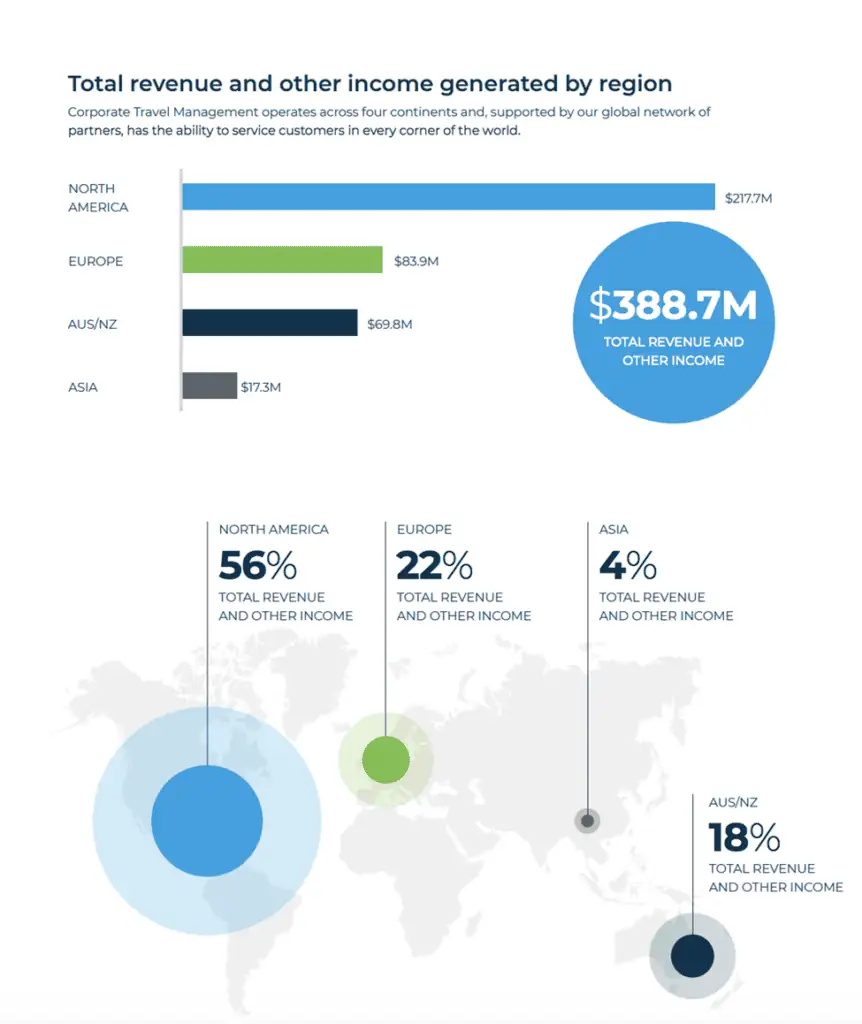

The company’s operations are spread out over North America, Europe, Asia Pacific regions, and ANZ.

CTM is a very technology focussed company that provides bespoke travel software that gives them access to global locations with transparent pricing, planning, and capacity availability along with other metrics.

CTM has a market capitalization of A$3.01 billion.

Source – CTM FY22 Annual Report

Strong Economics With Scale

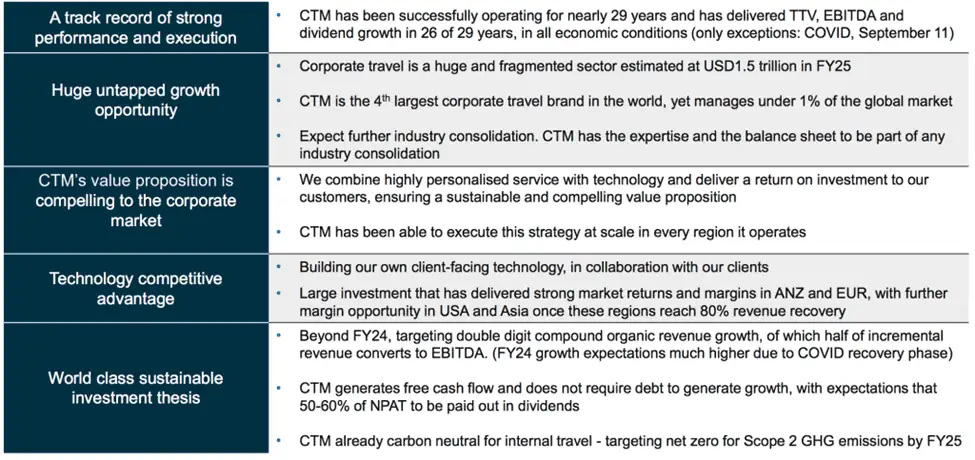

Corporate Travel Management’s (ASX:CTD) strength lies in its high-margin asset-light business model with a sticky customer base which has high switching costs due to proprietary software.

The company has a solid EBITDA margin zero-debt business with a customer base made up largely of SMEs, thereby reducing dependence on large clients and increasing bargaining power for the company.

Also, CTM has most clients locked into CPI increases by contract, thus removing downside exposure to inflation.

Source – CTM FY22 Annual Report

CTM’s global operations also open up huge markets for the company while allowing technology to be subsidized by a larger client base.

Corporate Travel Management (ASX:CTD) has managed to grow across continents very successfully with serious operations across North America (49% of revenue), Europe (16% of revenue), ANZ (28% of revenue), and Asia (7% of revenue).

The company’s global operations give it protection against business cycle shocks in particular regions.

The need for global operations and functionalities also puts its proprietary software among the best in the world.

The company’s technology offers solutions hard to replicate for smaller players such as fare forecasting, travel risk management, itinerary planning, and analytics such as carbon footprints.

The company’s software also allows corporates to set travel constraints such as budgets within which employees can plan their trips, thus increasing efficiency by digitally pre-approving trips based on the rules set by the employer.

The combination of extremely powerful software with on-call agents from the company gives corporate clients efficient yet personalized services.

Further, the company’s vast proprietary data will allow the company to develop use-case-specific generative AI solutions for customers, thus improving efficiency.

Overall the company offers a valuable product for customers through an extremely economical business model which is cash-flow accretive, scalable, and zero debt.

Macro Environment And Slow Demand Recovery Are Weaknesses

A major weakness for the company lies in its services to its corporate clients.

We are currently amid precarious macroeconomic conditions across the world with the fastest rate hiking cycle on record, war in Ukraine, and tensions between China and the US.

Under these conditions, should there be any economic slowdown, it would lead to serious cuts in corporate travel spending which could severely hurt the company over the short-to-medium term as travel would be the first on the chopping block for corporates.

Further, the company is overstaffed at the moment as management preps for uptake in the demand, which would be a further liability in this scenario.

Massive Organic And Inorganic Growth Opportunities

The two major opportunities available to CTM are to grow further in existing and new regions through acquisitions of smaller players and to become a software services provider to smaller companies in the same space.

Source – 1H’23 Results Presentation

Corporate Travel Management (ASX:CTD) has tremendous growth opportunities as the corporate travel market is a massive US$1.5 trillion market in which the company has just about 1% market share, despite being the 4th largest player in the world, thus showing the fragmented nature of the market along with scope for consolidation.

CTM understands this opportunity very well and has regularly acquired smaller players across regions to leverage synergies such as providing its cutting-edge software to its newly acquired client base and removing redundancies such as excess office space.

However, the scope to juice this avenue for growth is still massively untapped as there are huge untapped

fragmented markets across the globe where the company can grow by acquiring smaller players such as India, South America, Africa, etc.

The company also recently opened an office in Japan.

While growth through the acquisition of smaller players is a major opportunity, the scope to scale its technology platform to small players across the globe is an even bigger opportunity with lower costs and speed on its side.

As we mentioned above, the global corporate travel services market is extremely fragmented with small players dominating various pockets of regions.

However, these players do not have the scale and resources to develop cutting-edge technology to serve clients the way CTM does.

Therefore, CTM has a serious opportunity to directly monetize its technology with great upside potential for the CTD share price.

The Rise of Generative AI and Climate Change Are Threats

There are two major threats facing the company, the rise of increasingly capable generative AI and climate change.

Over the past year, generative AI models like ChatGPT have dominated headlines and our attention.

Generative AI models have seen uptake and user growth across various segments unlike any digital consumer product before and the developer community is aggressively trying to build on its functionality.

As generative AI grows more capable and benefits from an ecosystem built around it for use cases, it could disrupt or severely curtail the need for service providers such as CTM as models are already pretty capable at building itineraries, mapping permutations of flights and other modes of travel, checking for accommodation, etc.

While Corporate Travel Management (ASX:CTD) is building its solutions in the same space, seriously capable general chatbots and new SaaS competition could be a threat.

Secondly, rapidly increasing climate awareness and growing pressure on companies from investors regarding sustainability could lead to a secular decrease in corporate travel, especially aided by the rise of remote work during the pandemic.

Companies may deliberately reduce long-distance travel to lower emissions or flying may get more expensive due to airlines having to buy offsets, both scenarios could hurt the company over the long term.

The Best Is Yet To Come on The Financials

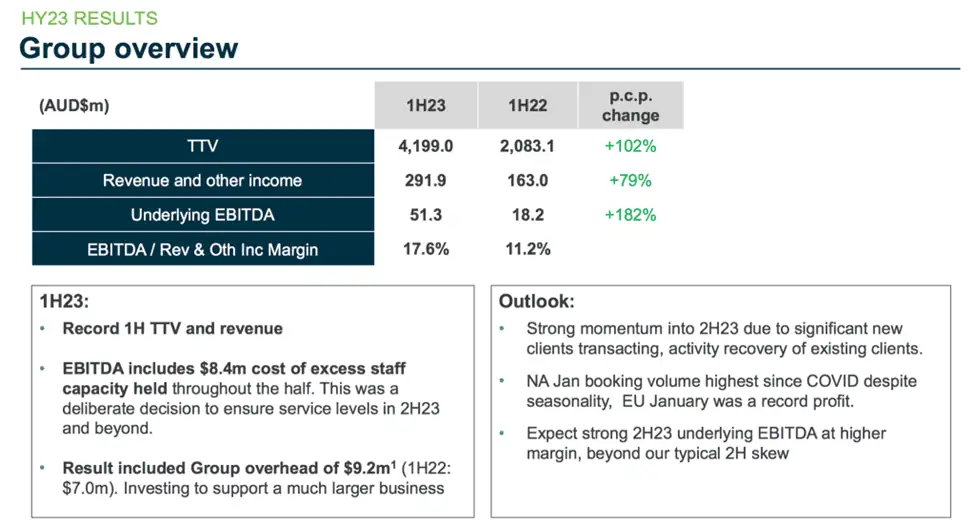

Source – 1H’23 Results Presentation

For 1H’23, CTM reported revenues of A$291.9 million (up 79% YoY), EBITDA of A$51.3 million (up 182% YoY), and NPAT of A$21.9 million, after increased amortization and depreciation expenses from acquisitions.

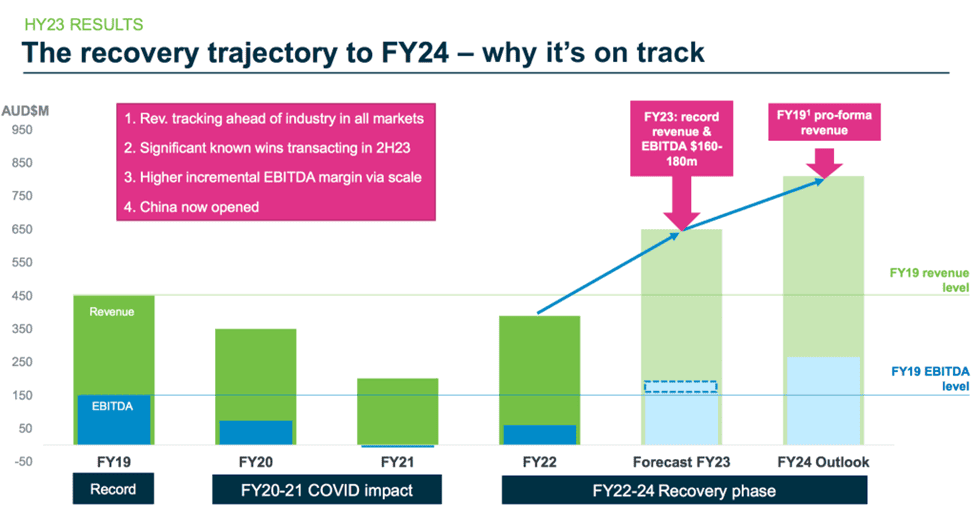

For the full year, Corporate Travel Management (ASX:CTD) has guided EBITDA of A$160M-A$180M with Q4 revenues nearly at FY19 levels (90% recovery).

The company reported new client wins of A$2.95B (Total Transaction Value), of which the company makes about 2% in EBITDA.

Goldman Sachs expected the bulk of the new contract will kick in during FY24 and project EBITDA of A$275-A$293 million (between 62%-71% up YoY).

The business has been booming in 2H’23 with an EBITDA run-rate of A$20M/month and EBITDA margins up to about 31% from about 17.5% in 1H.

The company is positioned to vastly improve margins moving forward as it is currently overstaffed due to delays in demand recovery in key markets such as the US.

When demand returns, operating leverage will kick in heavily.

CTM has no debt and cash on hand of A$110 million as of December’22.

We will be comparing Corporate Travel Management shares (ASX:CTD) to American Express Global Business Travel Group (NYSE: GBTG) and Flight Centre (ASX: FLT), both of whom are in the corporate travel space.

| Metric | CTM | American Express GBTG | Flight Centre |

|---|---|---|---|

| Price/Sales | 6.01 | 1.57 | 2.98 |

| Price/Book | 2.81 | 20.18 | 6.38 |

| Price/FCF | 99.82 | (FCF negative) | 397.82 |

As you can see, at the current CTM share price, Corporate Travel Management Shares (ASX:CTD) is the cheapest in terms of Price/Book and Price/FCF while it is more expensive in Price/Sales.

However, Price/FCF will improve further substantially as the 2H’23 numbers come in.

CTM also has far higher growth opportunities than GBTG and Flight Center.

Conclusion – Price Has Run-Up But Medium-Term Outlook Looks Bright

Corporate Travel Management shares (ASX:CTD) has delivered a stellar turnaround in 1H’23 with clear evidence that the business is on the cusp of breaching pre-pandemic business performance with a serious growth runway ahead.

The company’s performance came on the back of a slightly slow-to-recover American region, which has posted solid economic performance in Q2, and a closed China, both of which will be serious revenue contributors in 2H’23.

Source – 1H’23 Results Presentation

Analysts expect the stock to carry serious momentum into FY24 and the bulk of new client signings in 2H to kick in then.

While the stock has run up strongly, there is a strong fundamental stance backing further upside for teh CTD share price.