Today, we will look at why we like Domino’s shares (ASX:DMP) and some analysis for our share price forecast.

We first looked at Domino’s back in mid-July, 2018 when the DMP share price was trading at around $46.

Today, Domino’s shares trade at over $95 p/share, with room to grow.

Domino’s has thrived in the Covid-19 environment where online sales of food and a crush in disposable income helped to drive record revenue growth.

DMP’s approach to targeting their niche market and the use of technology is unrivalled by any other fast-food company in the world.

With automation of delivery such as drone deliveries around the corner, we expect Domino’s to have good upside coming into the next few years.

Domino’s will release its earnings on the 17th of February.

Considering the fact the stock is trading at its highs and to avoid earnings risk, it will be worth waiting for the earnings to be released and for a dip in the price, before considering a new position in DMP.

Table of Contents

Domino’s Pizza Enterprise Limited (ASX:DMP) is a locally owned company that is engaged in the operation of retail food outlets and provides franchise services for Domino’s branded food outlets.

Its revenue mainly comes from three markets: Europe, Japan, and ANZ (Australia & New Zealand).

Source: DMP Annual Report FY20

The closure of restaurants brought by COVID-19 has crippled many food brands, but DMP is not one of them.

On the contrary, DMP rode the tide of COVID-19, by selling 209 million pizzas in FY20, opened 163 new stores, hired 65,000 new team members and purchased more than 15.5 million items of PPE in 2020, all of which reflected its robust FY20 financial performance.

DMP Share Price History

The DMP share price has outperformed the S&P/ASX200 by more than 70%, and the S&P/ASX Food Products Index by more than 85% since Jan-2020.

Source: S&P Capital IQ

Domino’s (ASX:DMP) Strategic Positioning

Domino’s has adopted a hybrid strategy: cost leadership and differentiation.

Price – Value Champion

DMP’s low-cost strategy expanded its market share by targeting middle-class consumers who generally place higher importance on the price factor.

Therefore, DMP frequently offers discounts and coupons, such as a $5 voucher for large pizzas and $8 deal for extra-large pizzas to capture this niche market.

Differentiation

Fast Delivery

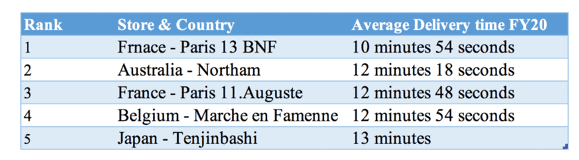

Domino’s is known for its fast delivery service. In June 2016, DMP announced Project 3/10, a long-term goal that aimed to have freshly made pizzas ready for pick up in three minutes and delivered to a customer’s house in 10 minutes.

Even though this has yet to be achieved by all Donino’s stores, some stores have tried to reduce their delivery time to reach the goal.

Source: DMP FY20 Annual Report

Food Innovation

Domino’s is also focusing on food innovation to attract new customers.

For example, in FY20, the new ‘Vegan Taco Fiesta Pizza’ won the PETA Vegan Food Award.

In addition, two new side offerings, the Cheese Garlic Scrolls and the Southern Fried Chicken Mega Box, rapidly hit the market.

Domino’s (ASX:DMP) Core competitiveness

Externally, COVID-19 provided new customers and unprecedented demand for DMP.

Internally, Domino’s shares achieved strong financial performance in FY20 through its focus on overseas integration, digital innovation, and rapid store expansion.

Integration and localisation

In addition to the same basic operating framework that all stores adopt to ensure brand awareness and quality control, Domino’s has also adapted its business model to local cultural diets and consumer preferences.

The branch in the Japanese market, which accounts for 39% of the company’s total annual EBITDA, has adapted its menu to cater to local tastes.

While maintaining its image as the food of choice for special occasions, it has rolled out new and ‘fun’ pizzas such as the bubble pearl pizza.

Digital Innovation

Digital App investment

In the ANZ market, Domino’s “Play to Win” strategy with food delivery such as Deliveroo, Uber Eats and Menulog increased DMP’s visibility and volume of orders.

For example, Domino’s base sales increased by 40% due to hitting a deal of ‘always-on promotions’ with Uber Eats.

In Japan, DMP invested in customer-facing technology such as ‘Just in Time Cooking’ and the ‘Coupon App’, to boost efficiency and reduce costs.

At its highest, DMP’s technology platform, OneDigital, was processing more than 1400 orders every 5 minutes in Japan.

Against a backdrop of unprecedented demand for online ordering during COVID-19, DMP’s investment in technology has paid off, with sales increasing by 38% (and 18.4% on a Same Store Sales basis) in FY20.

Autonomous technology

Aiming to give customers greater visibility over their orders and deliver better quality pizzas, DMP has developed DOM Pizza Checker, which is an ‘electronic eye’ that will instantly scan pizzas’ quality.

Scan results will be sent to customers in real-time via an app coming soon to Google Play and App Store.

Source: DMP Official Website

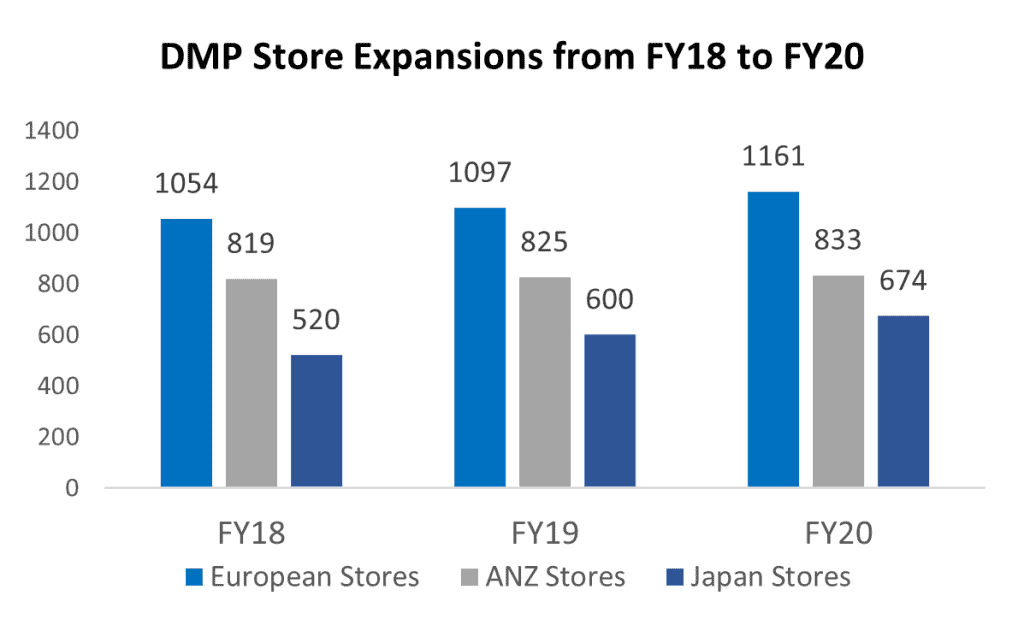

Domino’s focused on expanding its market share internationally during the past three years, by opening 163 new stores in FY20, with 78 stores additions in Europe, 10 in ANZ, and 75 in Japan.

Source: DMP Market Presentation for the Year Ended 28 June 2020

Consumer demand for DMP’s pizzas is driven by the competitive industry environment, health consciousness, and the trends in household discretionary income.

Competitive Industry

Growth in revenue and profit in the Quick Service Restaurant and Fast-Food industry have declined during the past 5 years, and they are estimated to decline by 0.1% and 0.7% p.a respectively in FY16-21.

Competition in this industry is high with other main players jumping on the healthy food bandwagon by providing plant-based alternatives such as Hungry Jack’s vegan ‘Rebel Burger’.

Source: DMP Investor Day 30 Nov 2020

Among the main players, Domino’s has the lowest market share (4%), as illustrated, and thus DMP has committed to a rapid store expansion strategy.

Moreover, market share concentration has declined as new smaller players that focus exclusively on healthier foods have emerged, further intensifying competition in this slow-growth industry.

Rising Health Consciousness

Although Australian on average spent 32% of their weekly food budget on fast food, the increasing health consciousness might reduce the demand for traditional fast food in the future.

Decline in Real Household Discretionary Income

Household discretionary income has decreased slightly in the last 5 years with the on-going effects of COVID-19 likely to exacerbate this downward trend in 2021.

Despite DMP’s low priced menu options, the decline in household discretionary income may depress spending on fast food, with more consumers opting for homemade meals to stretch their budget.

Source: DMP FY20 Full Year Result & S&P Capital IQ

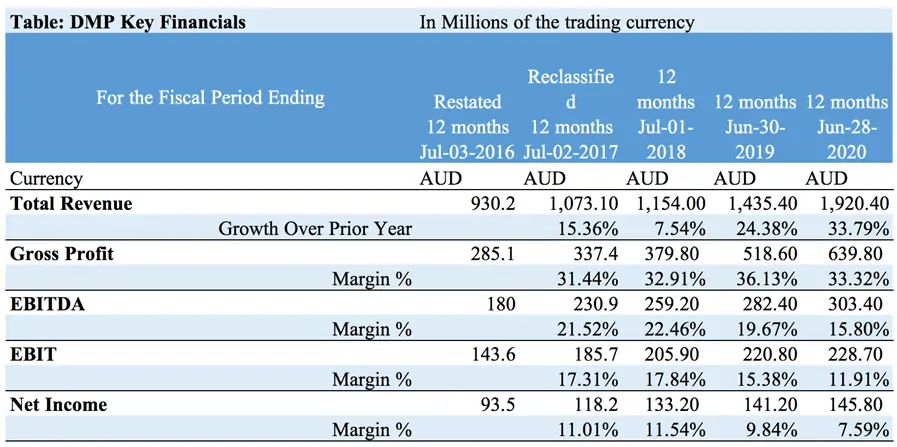

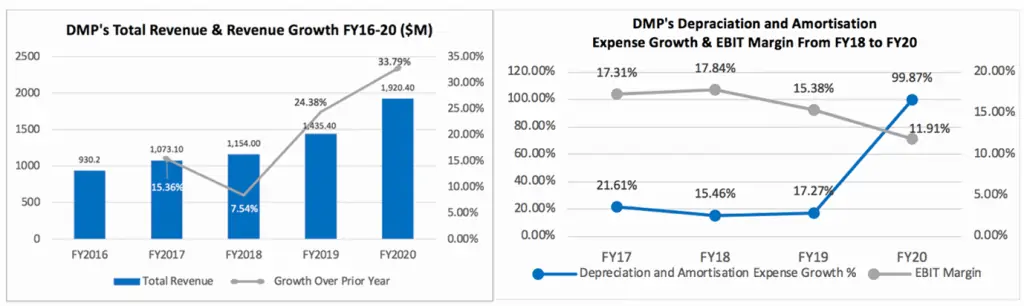

Domino’s shares total revenue has more than doubled from $930.2M to $1920.4M in FY16-20, and the revenue growth increased from 15.36% to 33.79% in FY17-20.

However, DMP’s EBIT margin and net profit margin decreased during FY18-20.

This was not surprising since Domino’s purchased a large amount of PPE in 2021 and it has increased interest costs from loans that financed its recent share buy-backs and acquisitions.

Source: DMP Annual Report from FY16-FY20

Domino’s shares saw great organic growth in 2020.

Domino’s opened 163 new stores which contributed 30.4% to the group’s total network sales.

Around 60.6% of the network sales growth was contributed by the Japanese market in FY20, while network sales in ANZ and European markets did not contribute to a significant increase.

Source: DMP Market Presentation for the Year Ended 28 June 2020

This was consistent with Domino’s shares’ EBITDA performance in FY20.

EBITDA growth in Japan was 42.3%, compared to -1.5% and -5.8% in the European and ANZ market, respectively.

These lower EBITDA growth in European and ANZ markets might be due to stricter lockdown measures and additional cost for store support in these particular markets.

Source: DMP Market Presentation for the Year Ended 28 June 2020

Source: Morningstar & MarketLine

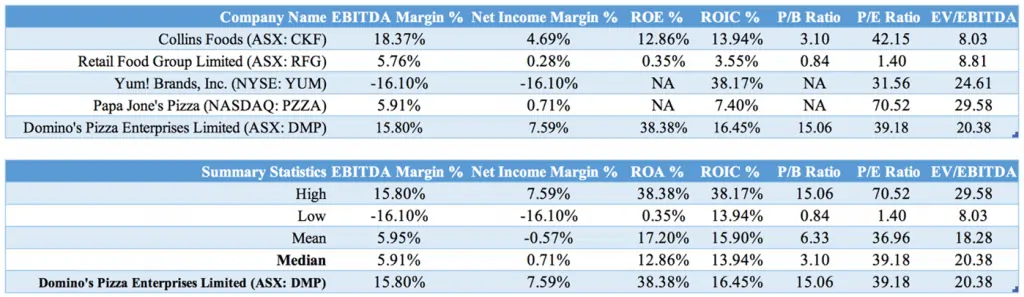

High Profitability, ROA, and ROIC.

In terms of profitability, Domino’s shares had the highest net income margin (7.59%) among its peers.

Also, Domino’s shares’ EBITDA margin (15.8%) was nearly three times the median of its peers (5.91%).

Additionally, DMP has the highest ROE (38.38%) amongst its peers.

Domino’s shares also had a relatively higher percentage return on its invested capital with its ROIC (16.45%) being higher than the median (13.94%) of its peers.

Highest P/B, Median P/E, and EV/EBITDA.

In terms of valuation, Domino’s had the highest P/B (15.06), median PE ratio (39.18), and median EV/EBITDA (20.38).

The high P/B ratio might be due to the recent acquisitions done by Domino, which is also reflected in its accelerated amortization in FY20 (see graph).

Source: DMP Annual Report from FY16-FY20

Conclusion

As a pizza delivery company, Domino’s has managed to weather the COVID-19 pandemic by showing stellar financial performance in FY20.

Rising health consciousness, declining real household discretionary income as well as the competitive fast-food industry will likely have a negative impact on the fast-food industry in the short term.

However, Domino’s is overcoming this challenge by investing in food and digital innovation to increase efficiency, reduce cost and provide better customer service.

COVID-19 has accelerated the digitization of food delivery and it will not go away even if the pandemic is over.

With drone technologies that are likely to further reduce delivery fees per mile and revitalize the stagnant fast-food industry, the DMP share price has a lot of potential upside, a traditionally defensive stock but with a new taste of ‘technology’ in its menu.