Today we’ll look at why we think IGO shares (ASX:IGO) have good upside potential in our IGO share price forecast and analysis.

IGO Limited (ASX: IGO) is an Australian-based mining company that focuses primarily on the exploration and production of nickel and lithium with a market value of $10.57 billion. Their operations are divided between these two valuable metals, which are essential components for batteries and other electronics.

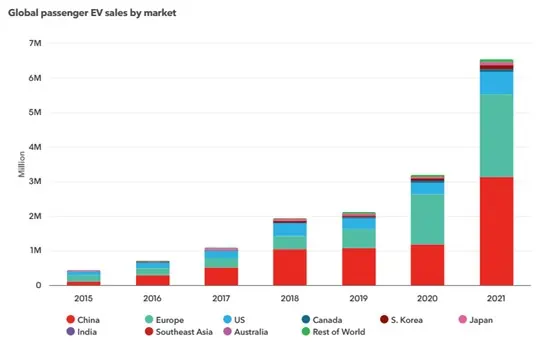

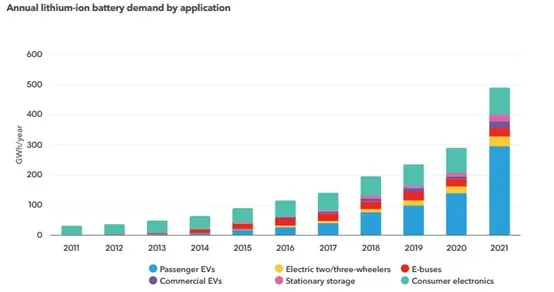

The booming EV market has driven the increase of demand for lithium-ion batteries in electric vehicles and brought significant benefits through the strategic shift towards lithium production.

Despite a downturn in the lithium price due to oversupply, we believe lithium will make a comeback in the near future as the EV market continues to boom and demand starts to outstrip supply.

Table of Contents

- 1 IGO’s operations and Lithium Projects

- 2 IGO Shares (ASX:IGO) Diversified Revenue

- 3 Lithium Prices Drop Amid Weaker Demand and Excess Supply, However Recovery is happening

- 4 IGO’s Joint Takeover Bid for Essential Metals Rejected, However the Mine can Maintain Process Capacity for at least 20 Years

- 5 Skilled and Experienced Management Teams Play a Pivotal Role in Success

- 6 IGO Shares (ASX:IGO) Financial Performance

- 7 IGO Shares (ASX: IGO) Valuation

- 8 Lithium Industry analysis

- 9 IGO Shares (ASX:IGO) have Strong Potential Upside When Lithium Prices Recover

IGO’s operations and Lithium Projects

Exploration

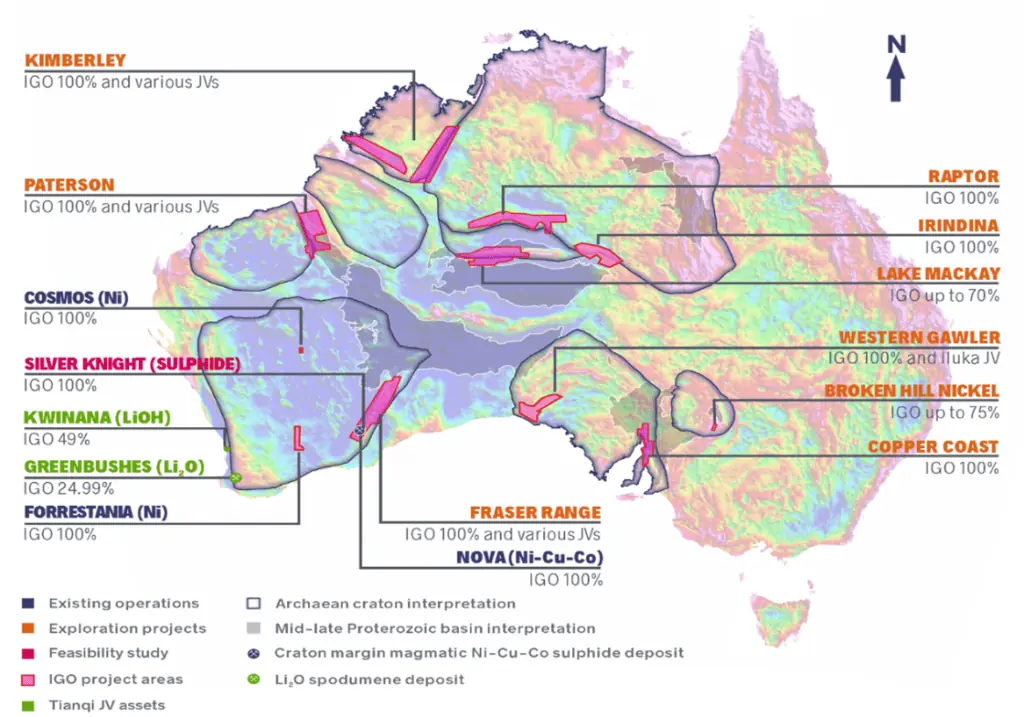

IGO’s exploration strategy combines geoscience expertise and exploration execution capabilities, leveraging geophysics, geochemistry, technology, and innovation to drive discovery success.

IGO’s exploration projects are associated with belt-scale gravity ridges along cratonic margins

(Source: IGO Website)

IGO’s FY22 exploration budget of A$65M is primarily focused on the Fraser Range, with an increasing emphasis on prospect-scale target generation.

Nova Nickel-Copper-Cobalt Operation

Located in Western Australia, the Nova operation is a top-tier mine that began production in 2017. For FY23, the mine is anticipated to yield 26-28k tonnes of nickel, 11-12.5k tonnes of copper, and 850-1,050 tonnes of cobalt.

Greenbushes Lithium Mine and Kwinana Lithium Hydroxide Facility

In 2020, IGO (ASX:IGO) announced a partnership with Tianqi Lithium Corporation, a leading new energy materials company with lithium. That makes IGO with a 24.99% stake in the Greenbushes lithium mine and a 49% stake in the Kwinana lithium hydroxide facility, demonstrating its commitment to becoming a significant player in the lithium market.

The Greenbushes lithium mine, located in Western Australia, has a production capacity of 1.34 million tonnes per annum (Mtpa) of lithium concentrate.

The Kwinana lithium hydroxide plant in Western Australia is a modern facility with two production lines and a total capacity of 48,000 tons per year, serves global battery makers and offers strong environmental and ethical standards with a transparent supply chain.

Nova Operation has generated over $2 billion in revenue and over $1 billion in free cash flow since it began commercial operations in 2017. In FY22, the Nova process recorded a 35% increase in annual sales revenue, reaching $900.6 million, with an operating profit before tax of $456.8 million, marking a 74% increase from the previous year.

For FY22, IGO’s share of net profit from TLEA was $176.7 million.

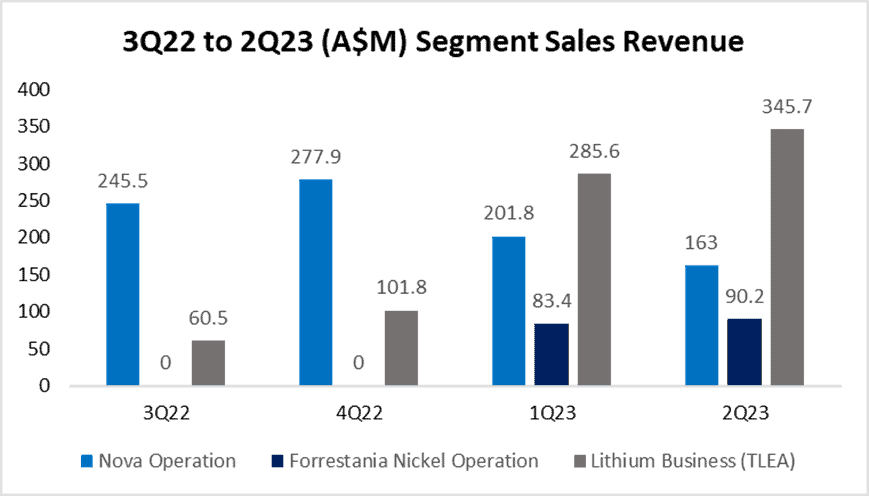

(Source: IGO Quarterly Report (Ended 31 Dec 2022))

The sales revenue in the lithium sector is experiencing growth. It’s projected that the sales revenue could reach $345.7 million in 2Q23, surpassing the combined revenue generated from the company’s other businesses.

Lithium Prices Drop Amid Weaker Demand and Excess Supply, However Recovery is happening

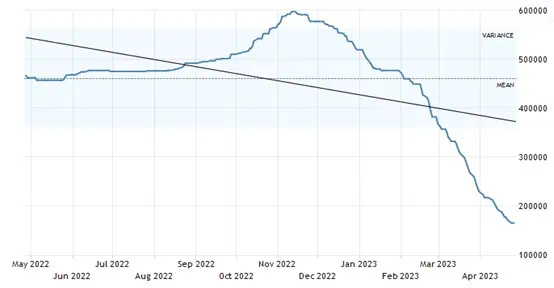

Lithium carbonate prices dropped to an 18-month low in April, down 70% from November 2022, due to abundant supply and weak demand. The Chinese government ended cash subsidies for new energy vehicles, causing slower sales growth in Q1 of 2023. Overproduction of batteries and high inventory levels also contributed to the price decline.

(Source: TradingEconomics, *priced labelled in CNY)

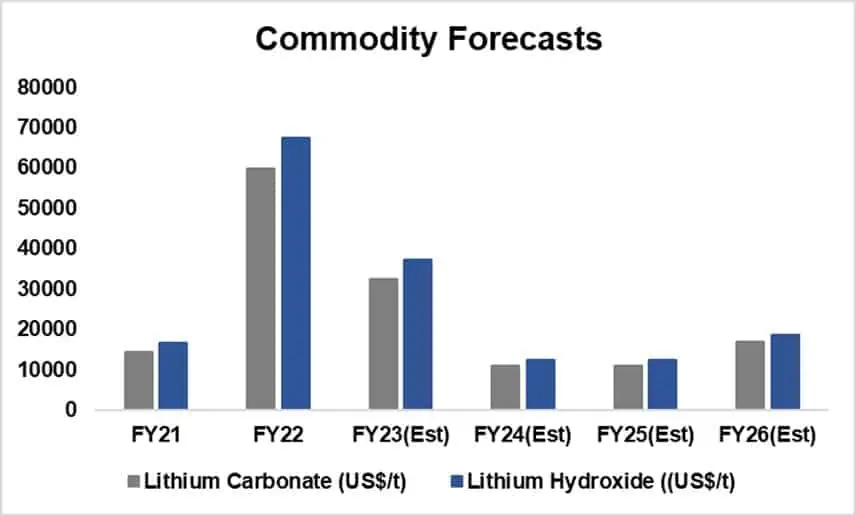

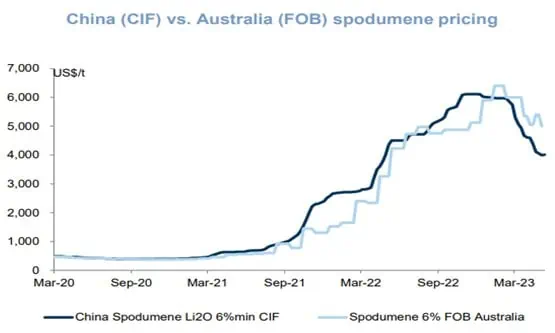

(Source: Goldman Sachs, Australian Lithium Coverage, *priced labelled in USD)

Demand Recovery Will Prevent Lithium Prices from Falling in the Second Quarter. It is anticipated that a resurgence in electric vehicle demand will help offset a drop in Lithium prices.

IGO’s Joint Takeover Bid for Essential Metals Rejected, However the Mine can Maintain Process Capacity for at least 20 Years

On the 20th April, Essential Metals rejects Tianqi Lithium- IGO takeover bid. Essential Metals’ shareholders turned down a A$136 million ($92m) joint takeover offer from IGO (ASX:IGO) and China’s Tianqi Lithium. This outcome hinders IGO’s plans to expand its footprint in the Australian lithium market.

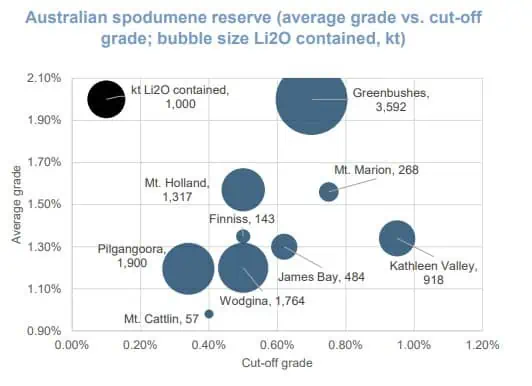

(Source: Goldman Sachs Global Investment Research)

However, the recent unsuccessful takeover attempt won’t impact the company’s capability to operate in lithium mining. Greenbushes is the world’s largest lithium mining operation and accounted for 38% of the global mined lithium output in 2021. The mine has a current expected life of more than 20 years. The lithium business has a solid foundation for consistent production and revenue generation of the significant lithium endowment. In FY22, Greenbushes safely oversaw a significant expansion of processing capacity and is preparing for further expansion over the next several years.

| JORC Reserves and Resources Including Stockpiles | Central Lode | Tailings Storage Facility |

| Ore Reserve (August 2021) | 138.5Mt @ 2.0% Li2O | 10.1Mt @ 1.4% Li2O |

| Mineral Resource | 294.4Mt @ 1.5% Li2O | 18.3Mt @ 1.3% Li2O |

(Source: IGO Website, IGO Annual Report)

* Li2O, or lithium oxide, is a chemical compound consisting of lithium and oxygen, commonly used in the production of lithium-ion batteries and ceramics.

* JORC, or Joint Ore Reserves Committee, is a set of standards for reporting mineral resources and ore reserves in the mining industry, ensuring consistency and transparency in reporting practices.

Skilled and Experienced Management Teams Play a Pivotal Role in Success

The IGO management team has an impressive average of over 25 years of experience, with key members having worked in leading companies like Rio Tinto, Gold Fields, and WMC Resources. Their wide-ranging backgrounds cover exploration, resource development, technical studies, corporate development, and executive leadership across various continents. This extensive experience and industry knowledge help the company succeed in handling market changes and seizing growth opportunities.

A well-implemented strategy, along with a strong management team, ensures the long-term success of the company and strong potential upside for the IGO share price.

(Source: IGO Annual Report)

IGO updated its quarterly activities report on 1 Jan 2023

(source: IGO Annual Report)

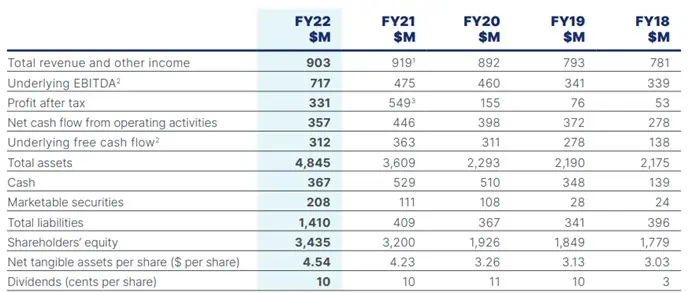

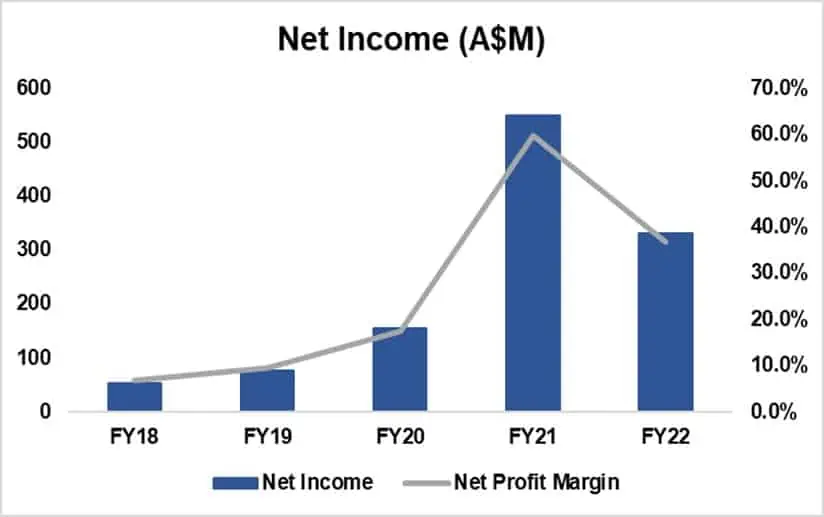

(Source: IGO Financial Report)

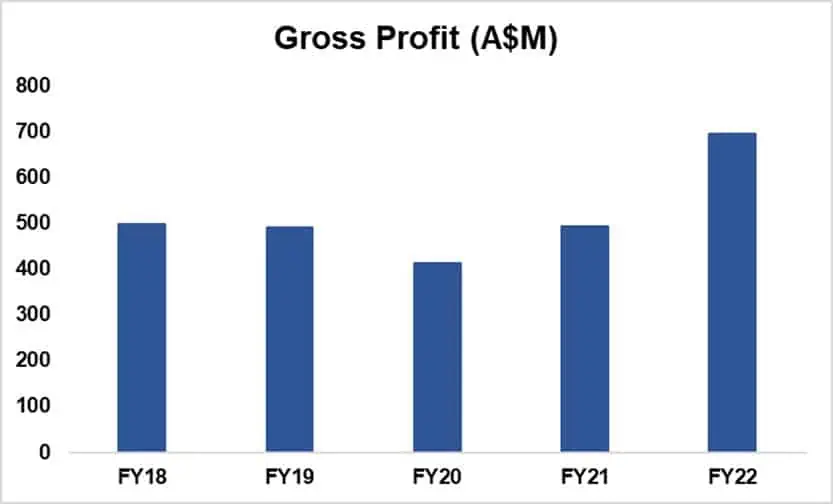

IGO shares (ASX:IGO) financial performance in FY22 showcased growth in key areas, with a notable increase in underlying EBITDA to $717 million, up from $475 million in FY21. Total assets and shareholders’ equity saw significant growth, reaching $4,845 million and $3,435 million, respectively. Despite a decrease in profit after tax to $331 million, it still outperformed previous years.

In Q1 FY23, the adjusted dividend per share experienced notable growth, reaching 14 cents and exceeding the annual total of previous years.

(Source: Investing.com)

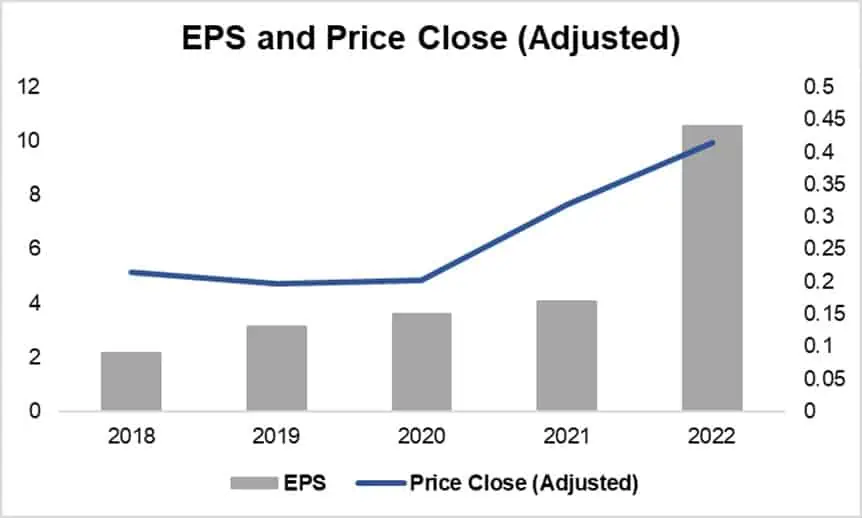

Looking at the earnings per share (EPS), we can see a consistent increase over the years. The net income for FY22 stands at $330.9 million, with weighted average diluted shares amounting to 759.9 million, resulting in an EPS for FY22 of $0.44. The EPS has grown at a compound annual growth rate (CAGR) of 37.71%.

The company’s financial performance demonstrates resilience, stability, and a commitment to shareholder returns through consistent dividend payouts.

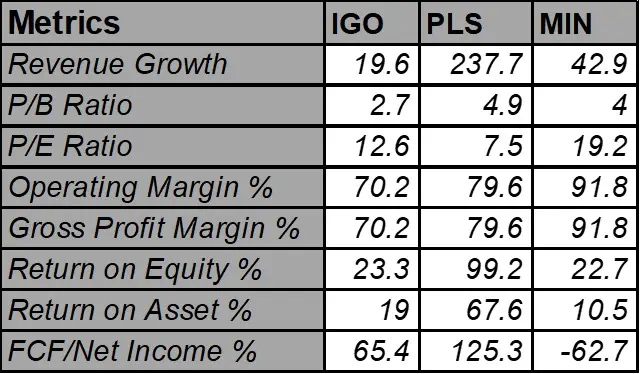

We will focus on evaluating Mineral Resources Limited (ASX: MIN) and Pilbara Minerals Limited (ASX: PLS) for comparison. All three companies are involved in the mining and production of minerals, with a particular focus on lithium, which is essential for the growing electric vehicle market and battery industry.

(Source: Investing.com)

At the current IGO share price, IGO shares (ASX:IGO) shows a lower P/B ratio and a more reasonable P/E ratio than MIN, indicating that it may be a better value. Additionally, IGO has a strong operating margin and gross profit margin, which showcase its operational efficiency. The company also has a positive FCF/Net Income percentage, reflecting its ability to generate cash.

Although IGO’s return on equity and return on assets are not the highest among the three, its stable financial position and the market cap of A$10.435 billion indicate the growth potential. Overall, IGO offers a solid investment option, with a well-valued stock and a strong foundation for long-term success in the growing lithium market.

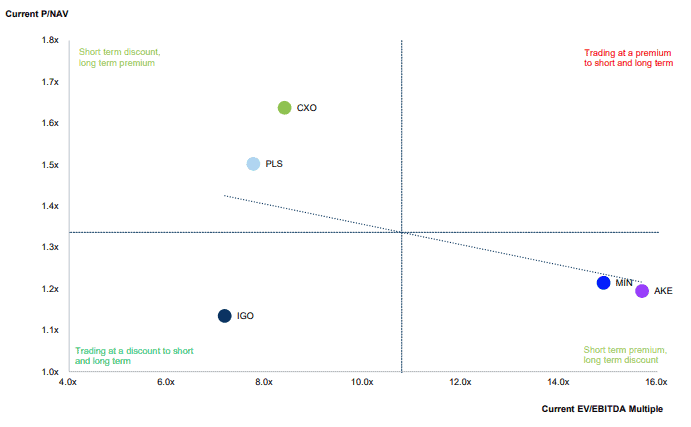

In addition, we will be examing Allkem Limited (ASX:AKE) and Core Lithium Limited (ASX:CXO) by comparing Price/NAV vs EV/EBITDA among those 5 companies.

(Source: Goldman Sachs Global Investment Research)

At the current IGO share price, IGO shares (ASX:IGO) are currently undervalued relative to its peers, trading at a discount over both short and long-term periods. It provides an opportunity to buy shares at a lower price than its net asset value, and if the market corrects this pricing discrepancy over time, investors could enjoy capital appreciation as the stock’s market price converges towards its net asset value.

(Source: Goldman Sachs Global Investment Research)

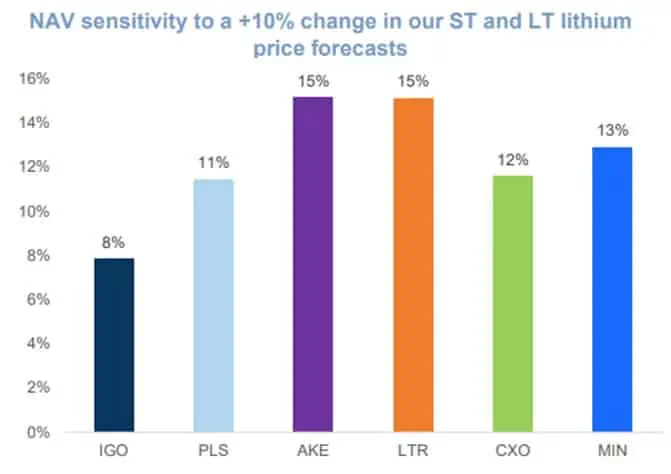

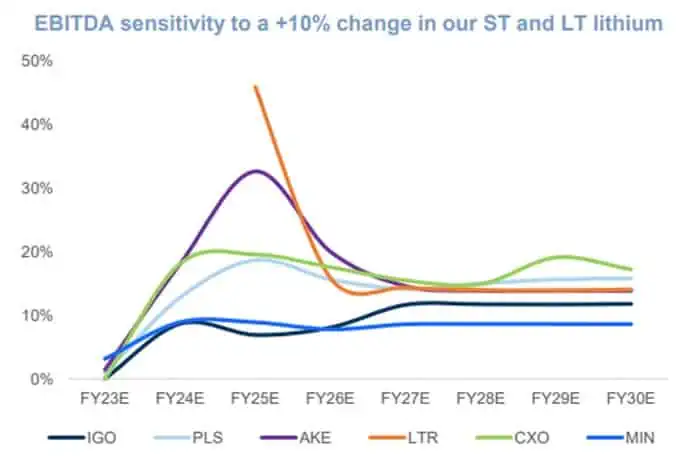

The NAV and EBITDA sensitivity analysis for those companies reveals that IGO demonstrates less volatility in response to short-term or long-term price changes compared to the other firms, thus establishing it as a more stable company compared to its peers. This stability suggests that IGO is able to maintain consistent performance and profitability, even when lithium prices vary.

(Source: Goldman Sachs Global Investment Research)

A consistent Free Cash Flow (FCF) yield compared to its peers support the stability of IGO shares (ASX:IGO), indicating a positive financial outlook. This stability suggests the company’s robust financial health, and its ability to fund operations and provide returns to shareholders without relying on external financing.

Lithium Industry analysis

(source: BloombergNEF)

(source: BloombergNEF))

The rapid increase in EV adoption can be attributed to several factors, including government incentives, decreasing battery costs, and a growing awareness among consumers about the environmental advantages of electric vehicles.

The global lithium market is estimated to reach more than 490 lithium carbonate equivalent kilotons by the end of this year. It is estimated to register a CAGR greater than 19% during the forecast period. The demand for lithium-ion batteries is expected to skyrocket as a result.

The lithium market is driven by the growing demand for electric vehicles and the increasing use of portable consumer electronics. However, concerns over demand-supply gaps may hinder growth. The expanding adoption of smart grid electricity offers potential opportunities for the market. Asia-Pacific dominates the global market, with high consumption in countries such as China, South Korea, and Japan.

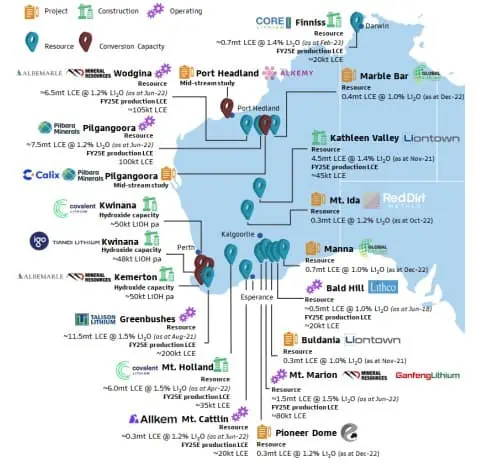

Australia, with its rich lithium resources, is well-positioned to capitalise on the growing lithium market. The country currently accounts for about 21.3kt, 47% of the global lithium supply, making it the largest lithium-producing nation in the world.

(source: Geoscience Australia)

(Source: Australian Bureau of Statistics)

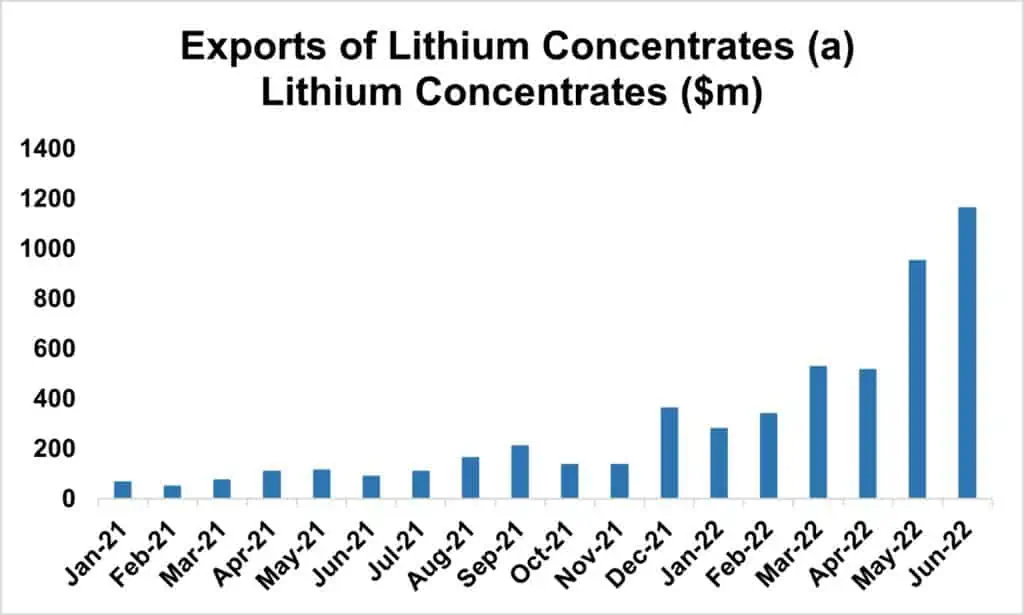

In June 2022, Australian lithium concentrate exports reached a record high of $1,163m, an increase of 1189% from June 2021, with Western Australia accounting for over 99% of the exports since January 2021.

(Source: Goldman Sachs Global Investment Research, An Overview of Australian Hard Rock Projects)

For IGO, their Greenbushes project, located in Western Australia, which is the world’s largest lithium mining operation, accounted for 38% of the global lithium output in 2021 and is expanding to meet increasing demand. With a mine life of over 20 years, Greenbushes achieved high production levels of 1,135kt spodumene in FY22 while maintaining low unit costs despite inflationary pressures, ensuring its continued significance in the global lithium market.

IGO Limited is an Australian mining company focusing on lithium and nickel, which are important for the growing electric vehicle market and battery industry.

They have teamed up with Tianqi Lithium Corporation and invested in major lithium projects, showing their dedication to this market.

With a strong financial record, diverse income sources, and skilled leaders, the company is well-prepared for future growth.

Furthermore, IGO’s recent investments in lithium production and strategic partnerships signal their commitment to a sustainable future. As lithium and nickel demand rises, IGO shares (ASX:IGO) offers a solid investment option with great potential for long-term success, making it a stock we like with strong potential upside.