People Infrastructure Ltd (ASX PPE), a workforce management company, provides contracted staffing and human resources outsourcing services in Australia and New Zealand. The company offers recruiting, on-boarding, rostering, timesheet management, payroll, and workplace health and safety management services. It serves community service, mining, general industrial, infrastructure, construction, food processing, childcare, government, landscaping, and hospitality sectors.

People Infrastructure shares are currently Australia’s largest listed workforce management business, employing over 13,000 people in FY18. More than 3,000 clients diversified by geography and sector, with about 50% of the business being generated from non-cyclical industries.

People Infrastructure shares was floated in November in FY17 at A$1.3, and its price has increased by 53% to A$2 within a year. In FY18, its revenue increased 14% to A$219M, with pro forma EBITDA increased 30% to A$13M. PPE currently sits at about A$134M market capitalisation.

People Infrastructure is a top high growth stock to buy for 2019 and a top small cap to buy.

Figure: PPE – Share Price History

Table of Contents

Well established within the industry

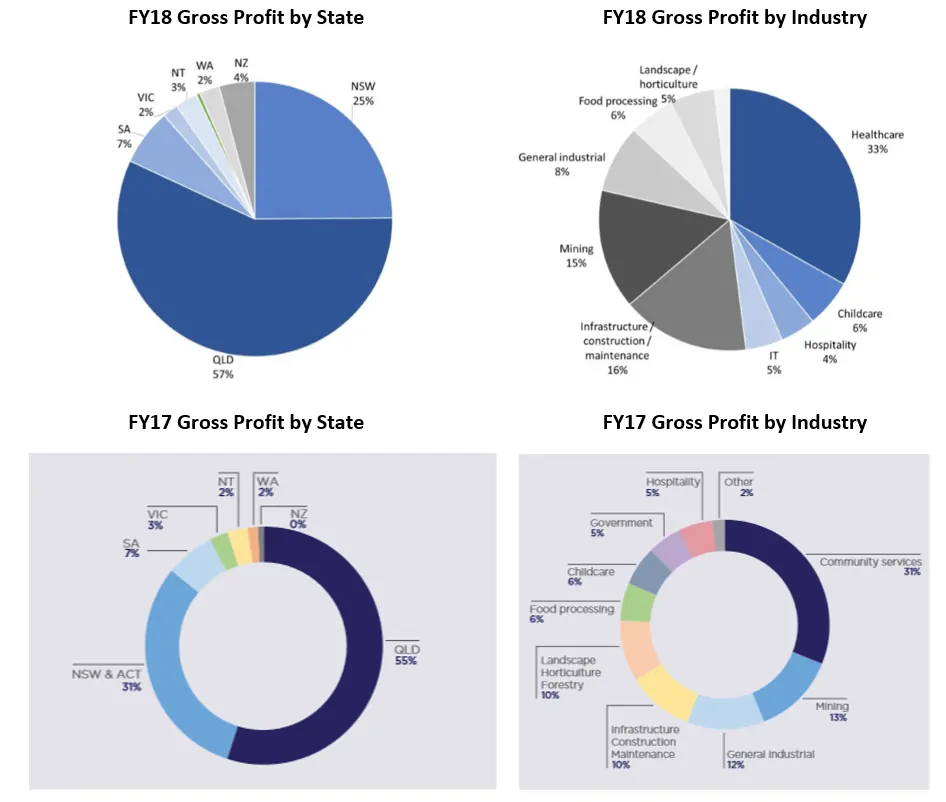

Well established position in the industry with a national footprint. PPE has customer locations that span through Australia, with 57% of gross profit coming from Queensland, 25% from NSW and 18% from other states in FY18. Moreover, PPE serves a diversified portfolio of sectors, including disability care, nursing and childcare, IT, infrastructure, mining, food processing, and landscape horticulture, with more than 40% of gross profit coming from community services. Furthermore, PPE has grown to have 19 locations across Australia and New Zealand, with 159 employees servicing over 3,000 clients.

Figure: People Infrastructure Shares – FY17-18 Gross Profit Source

Source: FY18 PPE Investor Presentation and FY17 PPE Prospectus

Long-standing client relationship but risky revenue source. PPE has a relatively low client churn rate, the average tenure of the top 20 clients across the business is more than five years. However, PPE generates a significant amount of revenue from a limited number of key customer relationships and a loss of business from these key customers could result in a material impact on earnings. Moreover, PPE usually provides services to clients under a relatively short-term agreement, under which reduction or termination of the use of PPE service comes at a low cost and relatively short notice (Source: FY17 Prospectus).

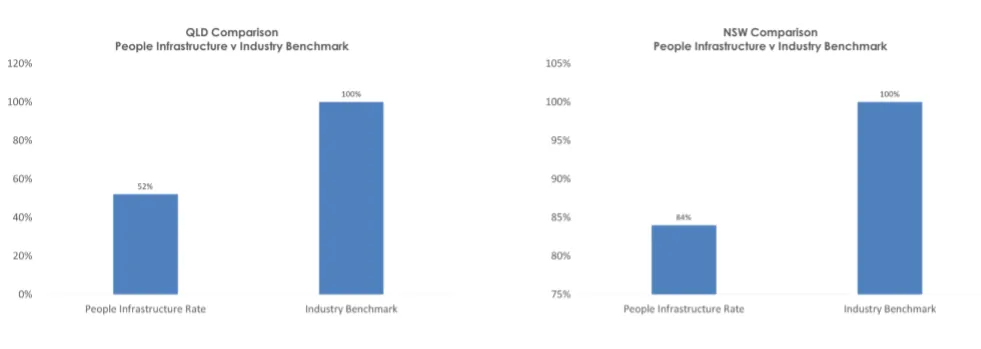

Strong focus on safety lowers Employee and Litigation Risk. PPE is subject to employee and litigation risk due to its business model, but it has reduced this risk significantly by an established system for safety risk. PPE carries joint responsibility under occupational health and safety law for the staff it places in other businesses and thus could be liable for claims should adverse events related to the employees’ health and safety occur. However, with well-established health and safety policies and procedures, PPE has reduced the number of incidents, illness and injuries to a level lower than the industry average (See illustration).

Figure: PPE – FY18 Workcover rate*

Source: FY18 PPE Investor Presentation

*QLD data is a comparison of average work cover rate versus industry work cover rate. NSW data does not provide an industry work cover rate, and therefore the data used is the premium payable compared to the industry calculated tariff premium

Earning-accretive but acquisition risk. PPE is continuously seeking acquisitions that are significantly EPS and DPS accretive to expand its business. Earning-accretive acquisition happens when a high P/E company acquires a low P/E one to boost the post-acquisition EPS and encourage a rise in the price of shares. However, such an acquisition could decrease the overall earning quality should the integration does not go well, and synergies are not realized.

Well positioned in a strong growth industry

Total employment and wages growth. The contracted workforce industry is supported by total employment and wages growth. Total employment in Australia is projected to increase from 12.55 million to 13.44 million people (a 7.06% increase) over the five years to 2023. The employment wage price index (WPI) for Australia over the 20 years to 2017 has recorded an average growth rate of 2.1% per annum.

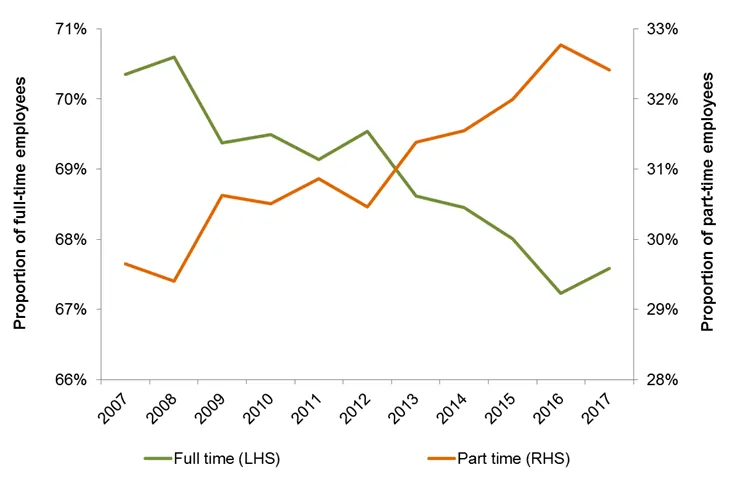

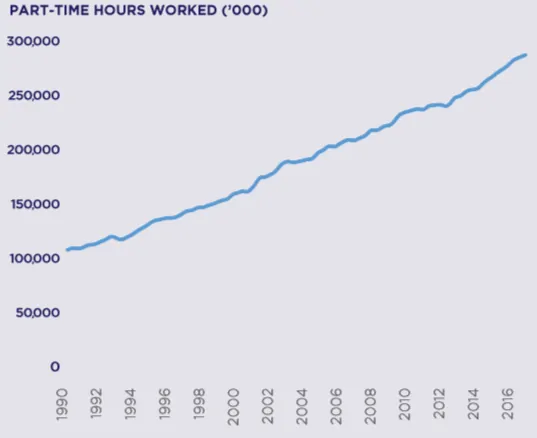

Casualisation of the workforce. Industrial growth is further driven by a casualisation of the workforce. This trend is demonstrated by the growth of part-time employment. The percentage of part-time employment in the Australian workforce has grown from 29% in 2007 to 33% in 2016. Besides, total part-time hours worked as a proportion of overall hours worked in the economy has expanded significantly, from 8.9% in 1990 to 16.8% in 2017, representing a 3.7% CAGR. This phenomenon reflects a growing preference for flexible work arrangements by both employees and employers during periods of political and economic uncertainty, which is further accentuated by the trade war between U.S and China and a dimmer global projection of economic growth.

Figure: Proportional share of full-time and part-time employees

Source: ABS (Source)

Figure: Part-time hours worked (‘000)

Source: ABS (Source)

Strong growth from the community sector. PPE has the largest industry exposure on the community sector, and strong growth in this sector is expected to benefit PPE’s bottom line considerably.

With more than 40% of its gross profit generated from healthcare, childcare, and hospitality, People Infrastructure is a key provider of contracted workforce and HR outsourcing by operating in the community services for more than ten years.

The Australian community service sector is experiencing high growth and driving strong demand for labor requirement. This growth is underpinned by the aging population of Australia, and more importantly, the roll-out of NDIS, a major government disability funding program. In 2015-16, the total Australian government expenditure on community services was estimated at $30.7 billion, equivalent to 1.9% of GDP and 10% of total government spending. Total government funding for disability services was $8.4 billion in FY16, with annual growth in funding for the sector averaging 7.6% over the prior ten years. Of this total, $4.1 billion (48.3%) related to accommodation services, which is a key sub-sector of disability services where People Infrastructure clients operate. Implementation of the scheme is expected to drive major demand for employees in the sector, with growth in the disability workforce forecast to increase by 24% per annum by 2019.

Figure: Total real growth in government spending by functions – 2017-18 to 2020-21(a)

Source: Australian Budget 2017-18 (source)

Figure: Forecast workforce in community sector required to service demand

Source: NDIS Market Position Statements

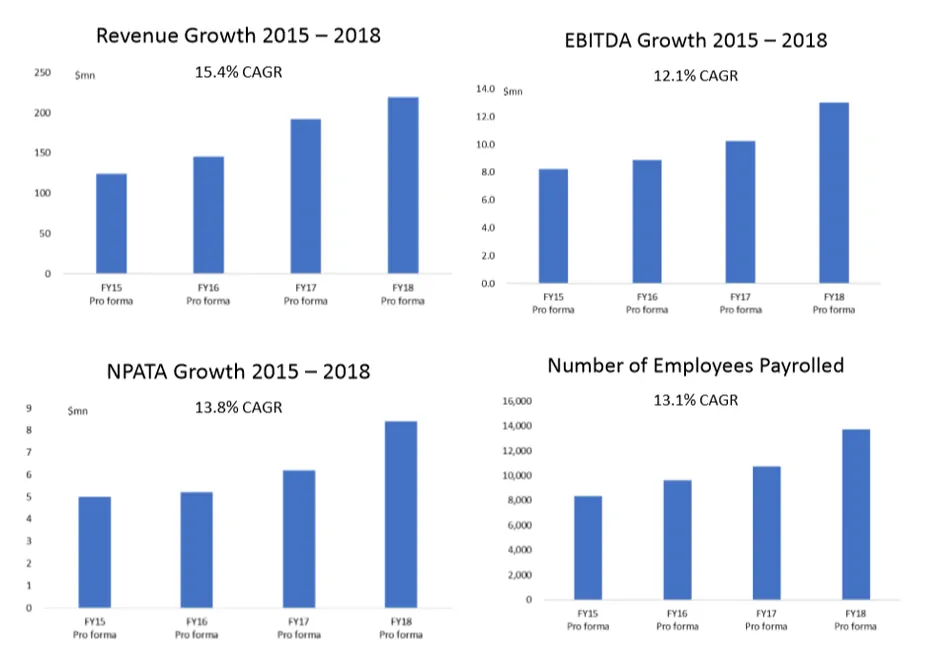

Figure: PPE – FY15-18 Pro forma Financial Performance

Source: FY18 PPE Investor Presentation

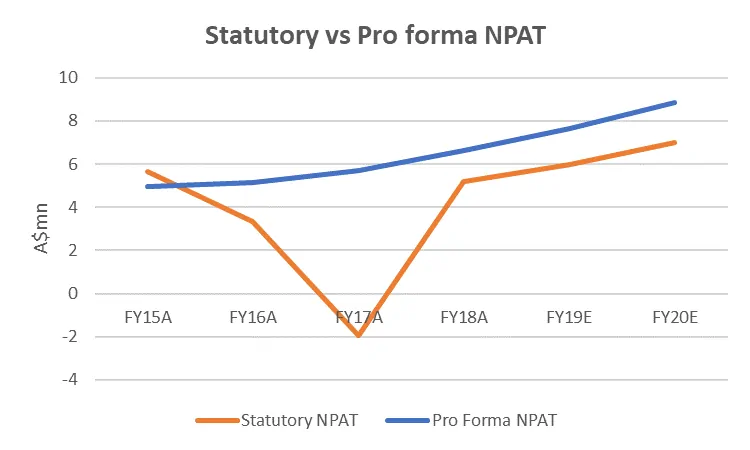

Double-digit growth in profitability. Over four years, PPE’s revenue increased 15.4% CAGR to 219M, EBITDA increased 12.1% CAGR to 13M, NPATA increased 13.8% CAGR to 8M, and the number of employees rose 13.1% CAGR to 14,000. However, it is also worth noting that the statutory NPAT is shown consistently less favorable, as illustrated below. Moreover, since PPE is listed only for one year and all profit figures before FY18 are pre-listed, this positive trend of earning may not be very informative.

Nevertheless, the reason why statutory NPAT is much lower than the pro forma NPAT in FY17 is that the FY17 statement excludes AWX and Edmen before their acquisition. In summary, the profitability trend is very positive.

Low debt but future funding needed. Net debt/EBITDA has decreased from 37.2x to 0.7x FY17-18, and most of the debts are financed by raised capital. Despite its low debt level, People Infrastructure shares only has 4.8M cash on hand, and it would need debt or equity funding soon should it want to sustain its high pace of expansion.

A leader amongst its peers

Rubicor Group Limited (ASX RUB), Ashely Services Group Limited (ASX ASH), Clarius Group Limited (ASX CND) and AWF Madison Group Limited (NZSE AWF) are selected as the peers of PPE due to the similarity of the nature of these businesses, size of the company and their geographic locations. These four companies operate primarily in the Australasian area by providing recruitment services, with revenue all ranging between $1M to $3M.

Source: S&P IQ Capital and Company report

*PPE doesn’t have FY17-Jun Price available because it was listed on Nov

**RUB doesn’t have FY18-Nov Price available because it ceased trading

***CND didn’t have positive earnings in FY17-18

No.1 in EBITDA margin. As illustrated, PPE has the highest growth of EBITDA margin, with EBITDA margin increased 3.9% FY17-18. RUB ranked the second, with EBITDA margin rose 1.7%. Furthermore, in FY18, PPE has the highest EBITDA margin at 4.8%, followed by AWF at 4.0%, ASH at 2.4%, RUB at 0.5% and CND at -0.7%.

Highest Growth in EPS. PPE has the highest growth in EPS FY17-18. PPE’s EPS rose 17c, followed by ASH up by 7c, CND down by 1c, AWF down by 2c and RUB down by 11c. PPE has the second highest EPS in FY18 at 0.1 and AWF has the highest EPS at 0.15.

Highest P/E and P/B. PPE has a P/E ratio of 20 compared to other competitors at 8-13, and it has a P/B ratio at 3.25 while other competitors sit at 0.3-1.7. This is expected has PPE has experienced strong growth and the market is pricing in growth in the future.

People Infrastructure shares saw high growth in profitability and share price since it listed by positioning itself in the fast-growing community sector and by actively seeking for opportunities of earning-accretive acquisition. With total employment and wage growth, casualization of workforce and strong growth from community sector in Australia, and its superior profitability reflected in its EBITDA and EPS, People Infrastructure shares are well positioned for long-term growth in its share price.