Today we will look at why we think Sayona Mining shares (ASX:SYA) has great potential upside in our SYA share price forecast and analysis.

Sayona Mining (ASX:SYA) is an up-and-coming multi-asset miner based in Australia.

The company is on the verge of commencing operations at its Northern American Lithium (NAL) project in Quebec.

The company has had a head-spinning 1670% rally since its acquisition of NAL in December 2020 and brought it online in record time and at budget.

While the stock has been soft this year with a 21.1% underperformance to the ASX200 due to a correction in lithium prices, it is still rather fairly valued with a high chance of a serious re-rating once it commences downstream production and develops other assets.

Table of Contents

- 1 About Sayona Mining Shares (ASX:SYA)

- 2 Location, Green Power, Demand, and Asset Portfolio Are Strengths

- 3 Execution Risk, Fallibility of Resource Estimates, and Potential Dilution are Weaknesses

- 4 Graphite and Gold Assets Hold Big Potential

- 5 Recession and Lithium-Ion Obsolescence Are Threats

- 6 Sayona Mining shares (ASX:SYA) Financials

- 7 Sayona Valuation: Downside Capped

- 8 Sayona Mining (ASX:SYA): Very Attractive In Context

Sayona Mining is an emerging clean energy material and precious metal miner with a presence in North America and Australia.

Its portfolio gives it access to two extremely mineral-rich regions with very low sovereign risk and abundant sources of green energy to power net zero operations.

The company owns a total of 10 projects in its portfolio spread over Quebec in Canada and Pilgangoora in Australia.

Its asset base includes six lithium assets in Quebec between the Abitibi lithium hub and Northern lithium hub while the company also owns lithium, graphite, and gold prospects in the extremely rich Pilbara region in West Australia.

At the current SYA share price, Sayona Mining shares have a market capitalisation of A$1.59 billion.

Source : Sayona Mining

Location, Green Power, Demand, and Asset Portfolio Are Strengths

Sayona’s biggest strength is its asset portfolio, spread over Canada and Australia, priming it to serve the burgeoning Chinese and American electric supply chains for stationary storage and EV.

Both countries have very well-developed natural resource mining ecosystems with low sovereign risk, as compared to other new mines coming up in South America and Africa, where nationalization risk is high and there are other considerations such as infrastructure and skilled labor.

The location of the company’s asset portfolio is also a big beneficiary of large incentive packages in Canada and the US such as the Inflation Reduction Act, which gives downstream battery makers such as LG Chem and Tesla (both of which are customers of Sayona’s JV partner) credits to manufacture batteries.

Since Canada and Australia are both Free Trade Partners of the US, materials sourced from both satisfy requirements for incentives and open up markets for the company.

Further, its presence in Australia also gives it a strategic location to service the massive Chinese market and the rapidly developing Asian economies such as India, which are becoming big beneficiaries of the China+1 manufacturing model.

Lastly, lithium mining requires energy infrastructure, and there is likely to be a huge demand for net zero lithium ore, which plays right into the hands of Sayona as Quebec is blessed with cheap abundant green energy in the form of hydropower while Australia is rapidly developing one of the best solar infrastructures in the world.

The company’s first operational project, Northern American Lithium, is completely powered by hydropower, making it perfect to service the burgeoning demand for green lithium.

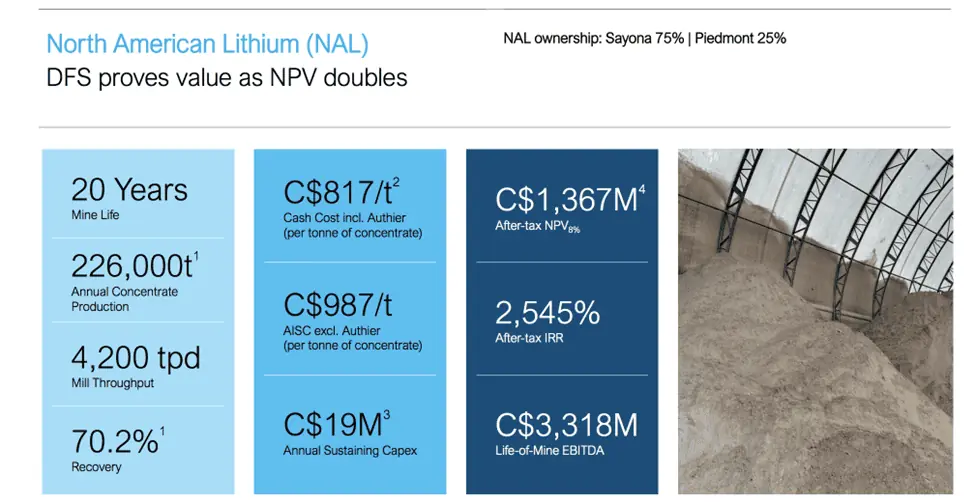

Sayona Mining’s key asset is the Northern American Lithium project at the Abitibi mining hub in Quebec.

The mine was purchased by Sayona and Piedmont under a 75-25 JV in 2021 for C$94M.

The mine was previously owned by Chinese battery major CATL but was put into bankruptcy after lithium prices fell sharply in 2019.

Sayona Mining plans to combine ore from the mine along with ore from its nearby Authier mine in a 67-33 mix to improve ore and pricing outcomes from both mines.

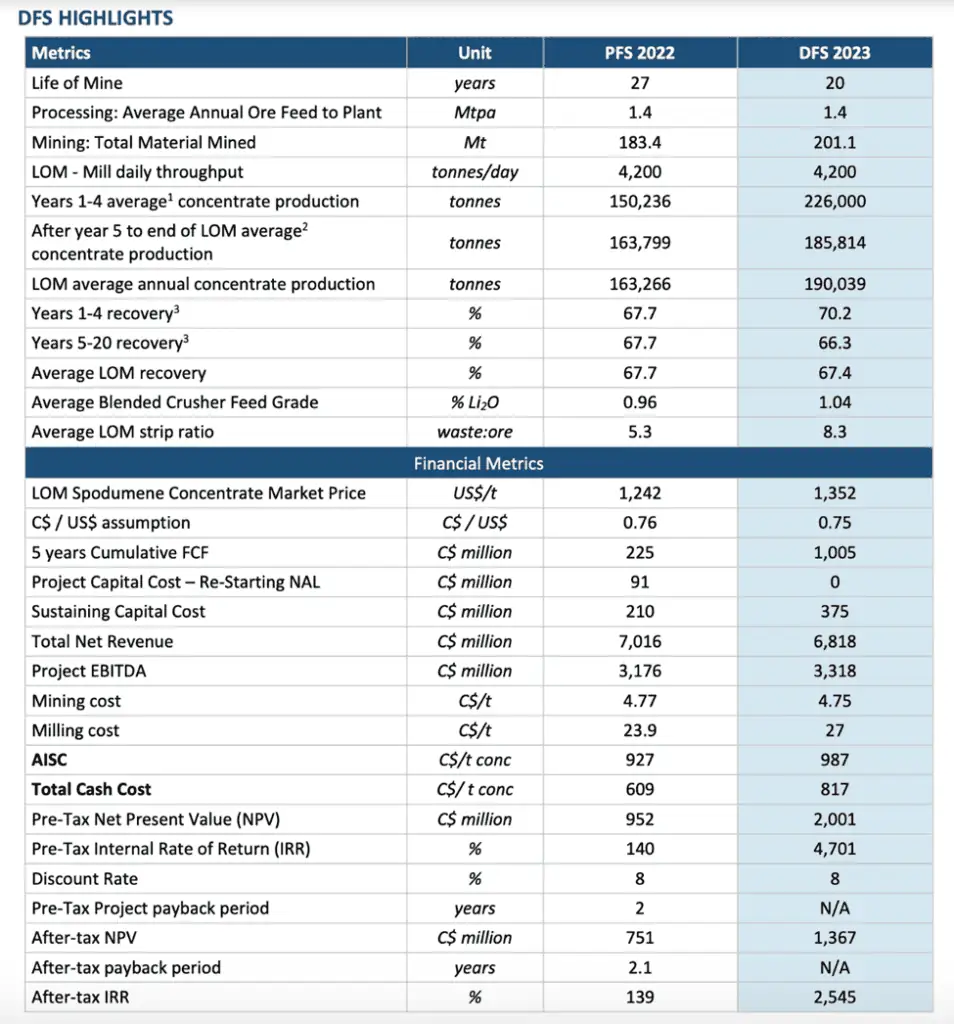

In April of this year, the company announced a Definite Feasibility Study for its North American Lithium and Authier project, which is its current flagship asset and the only one in operation.

The DFS yielded very favorable results as the after-tax mine NPV stands at A$1.52 billion (C$1.357B) and it has started initial production, nameplate capacity is planned to kick in during FY24.

The company also currently has 181k tonnes of inventory.

The North American Lithium project is a 700-hectare project with a 4.52Mt spodumene concentrate resource to be mined over 20 years at 226k tonnes per year.

Under the JV, the company is to sell the higher 50% life of mine/113ktpa of production to Piedmont under an offtake with a price ceiling of about C$1200 vs an all-in-sustaining-cost of about C$987, representing a profit of about 21%.

The price floor stands at C$655 in a dire scenario.

However, the company is free to market the remainder of production at market prices.

Further, under the JV terms, the company can route full production to a downstream facility should it materialize.

The company is currently planning to commission a lithium carbonate processing facility by 2027 at its North American Lithium facility, which would result in significant pricing power and operating leverage.

Source : Sayona Investor Presentation

Apart from North American Lithium and Authier, the company owns the Tansim project in Abitibi which at first scoping shows spodumene reserves between 5M and 25M tonnes.

Its Abitibi assets represent a mining resource of 75.4 Mt.

Apart from the Abitibi mining region, the company also owns 3 projects in the Northern hub in Quebec, namely, Moblan, Lac Albert, and Troilus.

The Moblan project is owned as a 60-40 JV with Investissement Québec, the official investing arm of the government of Quebec while Lac Albert and Troilus were acquired by Sayona.

The Northern hub represents a total measured plus indicated resource of 51.4 Mt.

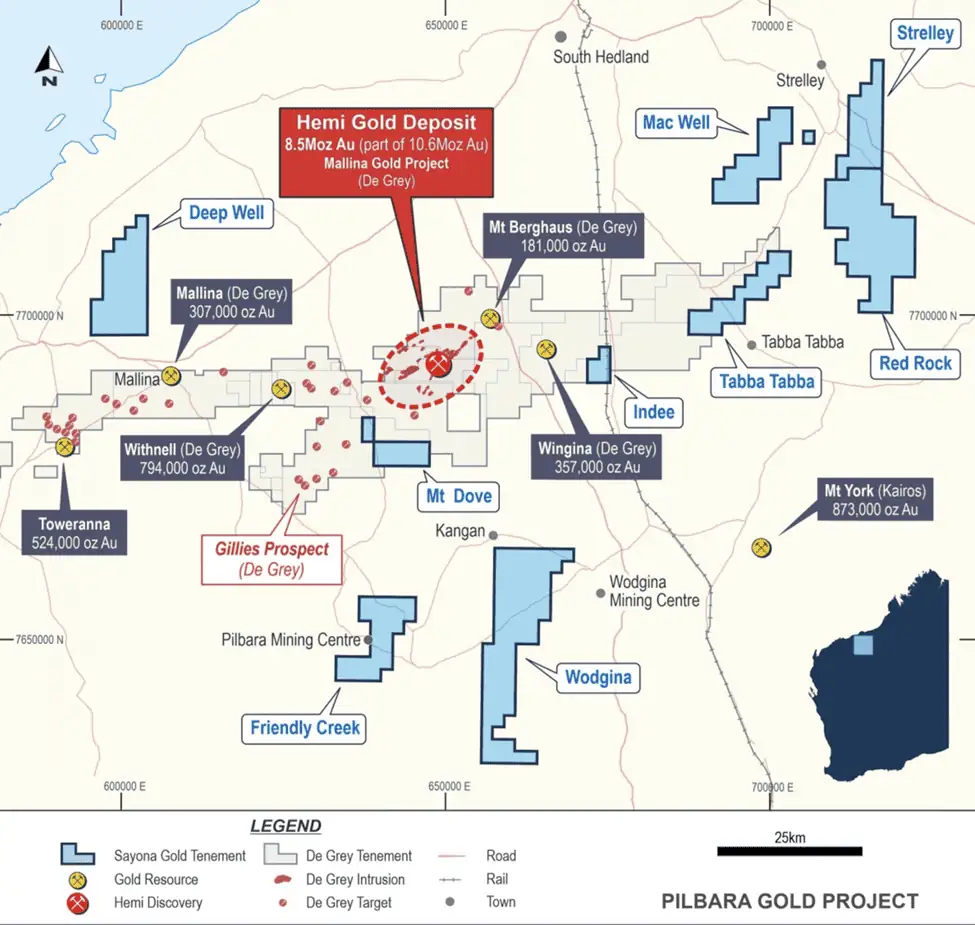

In Australia, the company owns the rights to about 1072 sq km in the Pilbara, Yilgarn, and East Kimberley regions, which are proven to be extremely rich in lithium, gold, and graphite.

For exploration, the company entered into an earn-in (equity share in lieu of exploration) with Morella Mining (formerly Altura Mining) to scope out the quality and extent of deposits in the Pilbara with the remaining assets being owned by the company outright.

The company has set aside A$5M for drilling and assessment in the remaining regions while Morella must spend A$1.5 million in exploration to earn 51% in the asset, should a resource be found.

Overall, Sayona Mining Shares (ASX:SYA) has a solid asset base in some of the most mineral-rich areas currently known to the industry with production kicking in by FY24.

The scope for the company to grow with downstream processing and development of other owned assets is immense along with low sovereign risk and big government incentives.

Execution Risk, Fallibility of Resource Estimates, and Potential Dilution are Weaknesses

The main weakness the company faces is that it is still in the early phase of production and most of its assets are in a very premature stage.

Over time, investors in the company face serious execution risks apart from the general risk of long-term lithium pricing.

Further, the extent of deposits in company assets is based on initial assessments and nearby discoveries.

Should the quality or quantity of ore fall short of expectations, it could negatively impact valuation regardless of the execution of matured projects.

There is also the risk of delays or termination of projects due to pushback from environmental groups, who have been varying of miners in Quebec and expect the highest levels of environmental protection.

Lastly, the development of assets, even if they are indeed of indicated size and quality, will probably require further fundraises from the company, leading to dilution of the current shareholder base.

Graphite and Gold Assets Hold Big Potential

The major opportunity awaiting Sayona Mining shares (ASX:SYA) is monetizing and developing its gold and graphite assets.

Graphite is a very exciting opportunity for the company as the material is another key material used in lithium-ion batteries along with lithium.

Graphite is used to make lithium-ion battery electrodes.

At present, graphite is almost completely dominated by China, and given its vitality in battery production, the opportunity for players from Australia is immense.

Not to mention, having both lithium and graphite will give the company a differentiated offering with better pricing power, particularly when the company builds its lithium carbonate refining plant.

The Kimberley region, where Sayona Mining shares (ASX:SYA) owns 100% rights to 4 tenements, is home to multiple high-grade graphite deposits.

The company, however, has not commenced any scoping work on the site yet.

The company also owns gold assets, mainly the Mt Dove project in Pilbara, which is adjacent to De Grey Mining’s mega Hemi gold discovery.

Gold is a very interesting proposition as the weaponization of the dollar post the Ukraine war, spiraling US debt, and uncertain global macros are pushing central banks such as those of China and Russia to hold record levels of gold.

To add to the fire, US and China face serious conflict over Taiwan, and China dumping US Treasuries for gold is a reasonable probability event should the conflict worsen.

Further, global gold production by investment in new mines has been on a downtrend over the past decade due to environmental concerns.

If the value of gold skyrockets on the back of geopolitical turmoil or macro-issues, Sayona Mining shares (ASX:SYA) valuation may be re-rated regardless of where it stands on the execution timeline.

Source : Sayona Mining

Recession and Lithium-Ion Obsolescence Are Threats

The two main threats facing the company are a severe recession in the developed world and the demise of lithium-ion battery technology.

With inflation abating but slowly, central bankers are to keep rates high if not hike further in the developed world.

China, one of the biggest lithium and graphite markets in the world is reeling from its own real estate and economic crisis, while Europe has entered recession.

The US which is the largest market for Sayona Mining shares (ASX:SYA) is holding up well, but the Fed’s pursuit of bringing inflation to 2% may eventually break the economy.

Not to mention that higher rates are already killing purchasing power of consumers due to higher financing costs, particularly for large items such as cars.

Secondly, the two biggest drivers for the company, namely lithium and graphite are completely dependent on lithium-ion batteries being the dominant form of energy storage in the years to come.

However, due to high costs and supply chain constraints, a serious amount of effort is underway worldwide to replace lithium-ion with cheaper, more environmentally friendly, and abundant battery chemistries such as sodium-ion batteries.

Should a new battery technology emerge that is cheaper or better, the company could face existential risk.

There are no operating financials available for the company at present as it has not yet commenced full-fledged operations at its North American Lithium project, its first operational project.

Earlier in the year, the company raised C$50M in Canada through dilution and that was followed up by a recent A$200M fundraise at A$0.18/share.

The A$200M fundraising was mainly done to finance the final stages of the Northern American Lithium and Authier projects, assess plans for downstream lithium carbonate production, and exploration/development projects in the Northern Hub while the remainder will be used for working capital needs and minor exploration in Australia.

The company has about A$98.2 million cash on its books.

Sayona Valuation: Downside Capped

Unfortunately, the same problem as financials persists with valuation.

The lack of operations prevents earnings and efficiency ratios.

The diverse mix of assets prevents book value comparisons as there are no miners with like-for-like assets.

However, the Feasibility studies show that the market capitalisation of A$1.59 billion at the current SYA share price is only about 5% higher than the NPV of its Northern American Lithium project (A$1.52 billion/C$1.357 billion), representing a bargain for all its other assets.

The study assumes a very modest US$1352/tonne of spodumene price over the life of mine, partly due to the Piedmont offtake which has a ceiling of US$900/ton.

However, it still has market pricing power on half the production and the study price is a fourth of the current prices being realised by Australian miners.

Source : Sayona Mining

The downstream expansion into lithium carbonate by FY27 will vastly improve the operations and earnings as Sayona won’t be bound to the offtake to Piedmont and will be able to exercise full market pricing power for all its production plus the value added by refining it into battery-grade lithium carbonate.

Lastly, the company has a spodumene stockpile of 181,000 tonnes in inventory.

Even assuming a modest US$900/tonne, its Piedmont offtake price and about 78% off the current China CIF prices, that’s another A$240M (US$900/ton x 181k tonnes) on its books, bringing the total value of the NPV + inventory to A$1.76 billion (A$1.52 billion NPV of project + A$240M).

The A$1.76 billion figure is about 10% higher than its market capitalisation of A$1.59 billion at the current SYA share price and doesn’t take into account any value of its other projects under development or the potential growth in earnings from going downstream into lithium carbonate production.

While investors may face some dilution as the company develops its other assets, the dilution should come at a higher valuation as operations grow, particularly if spodumene prices stay strong.

Sayona Mining (ASX:SYA): Very Attractive In Context

Sayona Mining owns a portfolio of top-tier assets in geopolitically stable regions with a high probability of ore quality discovery, significant regulatory incentives, and market tailwinds.

The company is also primed to serve the market of green ore due to the availability of cheap hydropower in Quebec, where it is on the verge of commencing its flagship NAL project.

The stock is currently priced rather conservatively given the current lithium gold rush as it represents minimal downside and a big potential of a re-rating once margins improve from downstream processing and other projects are developed.