Today we’ll look at why we think Xero shares (ASX:XRO) have good upside potential in our XRO share price forecast and analysis.

Xero is one of Australia’s biggest and most successful tech companies.

The company has slowly morphed from a niche SaaS (Software-as-a-Service) company into a tech conglomerate due to strong sector tailwinds and gradual but consistent growth.

Even through the rough macro environment of 2022, the company managed to grow reasonably well owing to the product’s non-discretionary nature.

The pandemic accelerated the already rapid growth of digitisation and business processes, a trend from which Xero has benefited hand over fist.

However, At the current XRO share price, Xero shares have corrected about 42% from its all-time high despite doubling the Lifetime Value of its customer base and growing its monthly revenue run rate by 34%.

At the current XRO share price, Xero shares have been a stellar performer so far this year with a gain of 27.98% against 1.10% for the ASX200.

Table of Contents

- 1 About Xero (ASX:XRO)

- 2 High Operating Leverage, Non-Discretionary Product With Great Growth Prospects, But The Low-Hanging Fruit Has Been Picked

- 3 Xero (ASX:XRO) expands into international markets through strategic mergers and acquisitions (M&A) and local partnerships.

- 4 Big Opportunities In Data and App Ecosystem But Macro Environment and Execution Risks Remain

- 5 Strong Financial Performance Through A Tough Year

- 6 Xero Shares (ASX:XRO) Valuation

- 7 Xero (ASX:XRO) Is Managing to Clock Growth Through Difficult Macro Conditions, Yet Its Pivot In Favor Of Profits Is Timely

About Xero (ASX:XRO)

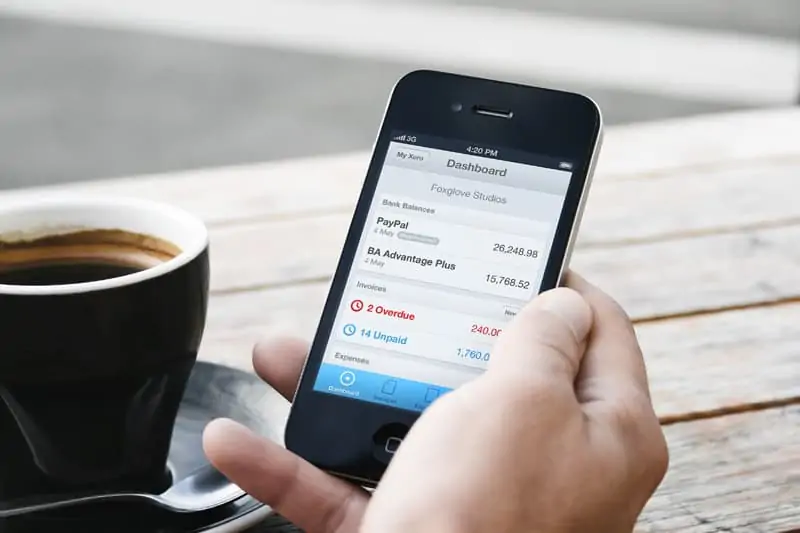

Xero (ASX: XRO) provides cloud-based accounting software for small and medium-sized enterprises (SMEs) with the goal of automating and simplifying complex accounting procedures.

The platform offered by the company provides businesses with an all-in-one solution for managing various business operations including cash-flow management, multi-currency accounting, banking integration, payroll management, taxation, expenses, inventory, invoicing, and workflow.

Xero’s business model is based on subscriptions, which ensures steady and predictable cash flows for the company while also providing clients with a flexible and cost-effective solution.

At the current XRO share price, Xero shares have a market capitalisation of A$12.78 billion.

High Operating Leverage, Non-Discretionary Product With Great Growth Prospects, But The Low-Hanging Fruit Has Been Picked

Cloud-based commerce platforms like Xero shares (ASX:XRO) and Shopify have seen increased adoption due to the COVID-19 pandemic, as businesses were compelled to shift to digital platforms.

A report by McKinsey indicates that the pandemic has hastened global digitization by at least three years.

Xero estimates a potential market size of 45 million customers worldwide, presenting a massive opportunity, as its current subscriber count stands at just over 3.5 million.

Xero’s non-discretionary product and successful growth strategy are its core strengths, reflected in its best-in-class SaaS metrics with high operating leverage.

Xero stands out from other SaaS peers in the current macro environment, as its product is non-discretionary, making it more defensive than most enterprise SaaS products.

The company has raised prices by more than 40% over the past two years, depending on the plan tier, and still experienced robust subscriber growth.

Despite the unprecedented rate hike cycle implemented by central banks to cool economic activity in 2022, Xero grew subscribers by 16% YoY in 1H’23.

The product’s LTV/CAC figure is another significant metric, showing the lifetime revenue of a client is nearly seven times the cost to onboard that client, making it best-in-class for enterprise software.

Xero (ASX:XRO) expands into international markets through strategic mergers and acquisitions (M&A) and local partnerships.

The company has acquired several niche SaaS products such as Planday, Tickstar, and LOCATE, which are essential functions for SME businesses.

Xero’s goal behind acquisitions is to improve its value proposition to customers, leading to higher LTV, new subscribers, and ARPU as shown in the chart above.

Xero’s recent acquisition of Planday has made it a significant player in the digital employee management space as more people work from home or anywhere else.

Employee management integrates well with Xero’s core product features such as payroll management, workflow management, and expense reimbursements.

In the first half of 2023, Planday’s user base grew by 18% YoY, and the number of employees paid through Planday increased by 21%.

Payments volume through Planday also increased by 40% during the same period, contributing to Xero’s SaaS metrics, such as ARPU.

To gain traction in new markets, Xero follows a two-pronged strategy of acquiring local SaaS players and partnering with local accounting firms.

For example, Xero acquired TaxCycle, which offers digital income tax filing for SMEs and has a client base of 4,000 accounting firms in Canada.

Xero now has an end-to-end pipeline for accounting operations from clients to the firm in Canada.

In the US, the company recently partnered with Avalara, a tax automation firm that helps users navigate state-wise sales taxes, enabling direct and accurate automatic invoicing, pan-America tax analytics of a business, and direct tax filing.

Xero faces challenges when it comes to expanding its user base and revenue outside of the ANZ region, where most of its revenue is generated as shown by the chart below.

The company’s international growth is hindered by steep customer acquisition costs, which are nearly three times higher than in ANZ, as well as a 49% lower LTV per customer.

This makes it difficult for Xero shares (ASX:XRO) to compete with local players, as developing features for specific international markets is not cost-effective.

Furthermore, the emergence of venture capital-funded local players in high-potential markets makes growth expensive and challenging.

The increasing digitization of tax filing in major jurisdictions have been a tailwind, but lower-than-expected uptake in some regions such as for the UK’s Make Tax Digital scheme highlights growth risks for Xero.

Big Opportunities In Data and App Ecosystem But Macro Environment and Execution Risks Remain

There are two major opportunities for the company.

One is for Xero (ASX:XRO) to leverage the data generated by its accounting services.

With access to detailed financial and banking data through its clients’ bank feeds, Xero has the potential to partner with financial institutions or develop its own loan platform to capitalize on SMEs’ increasing need for credit.

The company’s existing loan platform allows real-time loan applications and has the potential to provide a competitive advantage and high-margin fees if scaled successfully.

In light of higher interest rates, the cost of doing business will be all the more crucial, particularly for SMEs who are very dependent on credit for their smooth functioning and growth.

Another opportunity for Xero (ASX:XRO) is its profitable third-party app development platform, which already has over 1,000 apps (see illustrative slide below) and plans to charge a 15% commission on revenues generated by these third parties.

This has the potential to be a significant profit driver for the company, especially with major publishers like Stripe, PayPal, and Square already on board.

However, attracting more third-party developers will depend on the continued growth and relevance of the Xero platform.

Overall, Xero has reported a 31% YoY revenue growth in 1H’23 and continues to contribute to the company’s top line.

However, the company is facing a significant threat in terms of realizing the value of its acquisitions, especially due to the global economic slowdown.

This is evident in the recent announcement made by the company about its decision to write down Waddle, an acquired platform for invoice financing.

Another challenge for the company is the unfavorable macroeconomic scenario that is likely to result in reduced spending by businesses, which will negatively impact ARPU growth in the medium term.

The company has acknowledged this risk and has taken measures to mitigate it, including an 800-personnel reduction and other restructuring initiatives, with the goal of improving operating margins from approximately 15% in FY23 to 25% in FY24.

Finally, there is the risk associated with the recent departure of CEO Steve Vamos, who had steered the company to significant growth over the past five years.

The new CEO, Sukhinder Singh Cassidy, has an impressive technology background and is well-suited for the job.

However, the transition in leadership comes at a challenging time given the current economic environment, which may lead to some uncertainty and risk during the transition.

Strong Financial Performance Through A Tough Year

In 1H’23, Xero shares (ASX:XRO) reported revenues of NZ$658.5 million (up 27% YoY in constant currency terms) while operating expenses rose to NZ$552 million, representing slightly higher costs.

The EBITDA was NZ$108.6 million (up 10.7% YoY), the net loss was NZ$16.1 million (up 172% YoY) and the free cash flow for the year was NZ$15.6 million (up 143% YoY).

The company took a hit to EBITDA and suffered a net loss mainly due to a write-down of NZ$25.9 million on Waddle.

However, the bulk of the growth in absolute terms was still driven by the ANZ region.

The company currently has total liquidity of NZ$1.125 billion.

Xero reported solid improvements in terms of its SaaS metrics.

ARPU grew to NZ$35.6 (up 13% YoY), LTV grew NZ$3.1 billion to NZ$13 billion (up 30% YoY), and Subscribers grew to 3.496 million (up 16% YoY).

CAC months, or the number of months of subscription required to recoup acquisition cost, dropped marginally to 15.3 from 15.5 (down 1.3% YoY) while churn, or subscriber losses, was 0.91% (up 3.4% YoY).

The company maintains its guidance of an 80%-85% operating expense ratio for FY23.

As mentioned above, Xero’s plans to cut 800 jobs and streamline operations for efficiency.

This announcement led to a sharp spike in its stock price.

The company has clearly changed its priorities of profits over growth as it gears to drop operating expenses to the 75% range.

The effects of these changes will be seen clearly in FY24.

We compare Xero (ASX: XRO) to Intuit (NASDAQ: INTU), a US-listed software accounting company that is the world’s largest in the space, and Sage (LON: SGE), a UK-listed enterprise software firm and one of the biggest accounting software firms in the world by market share.

| Metric | Xero Ltd | Intuit | Sage |

|---|---|---|---|

| Price/Sales | 11.18 | 8.03 | 3.99 |

| Price/Book | 12.91 | 6.93 | 5.56 |

| Price/Free Cash Flow | 54.35 | 26.86 | 28.44 |

| Return on Equity | -1.02% | 12.38% | 20.37% |

| 5 Year Sales Growth | 30% | 19.62% | 2.57% |

As you can see, At the current XRO share price, Xero shares (ASX:XRO) are more expensive compared to peers based on every metric.

However, these premiums can be justified by the company’s substantially higher growth rate than both peers.

This has long been the case for Xero as far as relative valuation is concerned.

Notably, over a five-year period, Xero’s stock performance has been superior to both rivals.

Xero (ASX:XRO) Is Managing to Clock Growth Through Difficult Macro Conditions, Yet Its Pivot In Favor Of Profits Is Timely

Xero would have ended in the green in the first half of FY23 but for a write-down in the value of an acquisition.

With a crackdown on costs in hand, the company is taking timely steps to preserve profitability.

Despite being optically expensive, Xero has outperformed rivals such as Sage and Intuit on the stock market.

The cloud-based, SaaS model operated by Xero has proved to be robust over the recent years, particularly after the massive shift to digitisation and remote operations after the pandemic.

This trend is not reversible and coupled with the basic ‘sticky’ nature of its product in the hands of customers, enhances Xero’s value proposition and long-term potential.

Moreover, there is scope for generating additional revenue streams via the availability of client data and the fast-developing app ecosystem built around Xero accounting.

The stock has corrected sharply from over $150 levels in November 2021 in the general malaise that gripped tech stocks.

However, the stock has started to uptrend again and presents a buying opportunity.