Today we’ll look at why we like EML Payments (ASX EML).

EML Payments is a financial services company offering payment services such as gift and reward cards.

They have seen strong growth in the EML share price on the back of record YoY growth in revenue and earnings.

We first became interested in this stock and recommending it to our clients in late August 2019 when the stock was trading at around $3.60.

Since then, the stock has rallied to over $4.40, or 22% higher in about two months time.

We think that EML payments continue to have good potential and this is why we like EML.

Table of Contents

About EML Payments

EML Payments Limited is a financial services company in Australia, issuing mobile, virtual, and physical card solutions to corporate brands.

It manages more than 1200 programs across 23 countries in North America, Europe, and Australia.

It offers its prepaid payment service in the four variants of payout cards, incentive and reward cards, gift cards, and supplier payment cards.

Source: Morningstar. 2019

EML’s revenues and profitability have been on an uptrend over the past five years, showing the robustness of its business model.

For FY2019, EML reported an impressive YoY increase of 42.9% in revenue, 144.54% in EBITDA, and 72.58% in gross profit showing solid growth parameters.

During FY2019, EML acquired competitors PerfectCard DAC and Flex-e-card Group to boost its market share. Revenue from these and other acquisitions accounts for 32% of the company’s total revenue.

The acquisition of the PerfectCard business was significant for EML because it allowed the company to issue its own branded cards in Europe through an Irish eMoney license.

EML has a strong track record of acquiring businesses that add to its earnings and expand its presence in new markets.

Strategic Overview

EML’s business consists of three segments, namely, Gift and Incentive (G&I), General Purpose Reloadable (GPR), and Virtual Account Numbers (VANS).

The Gift and Incentive (G&I)

The Gift and Incentive (G&I) segment, which provides single load gift cards for shopping malls and incentive programs across the world, is the largest segment of EML.

In FY2019, EML served over 900 shopping malls (600 in FY2018) globally, including many of the largest retail property groups.

During the last financial year, G&I generated $66.4M in revenue and gross profit of $52.4M.

Its presence in Dubai gives the company a base from which it can expand further into the Middle East and potentially Africa.

General Purpose Reloadable (GPR)

General Purpose Reloadable (GPR) is a full-service card offering, providing issuance, processing, and program management to a wide range of industries.

EML launched two new GPR programs in Europe with alternative banking providers Instabank in the Nordics, and Swirlcard in Ireland.

EMLs’ solutions include delegated authorization, which allows partners to make authorization decisions at the individual transaction level.

The GPR product offers flexibility and strength in its diversified applications in gaming, salary packaging, and alternative banking.

This program reported $23.9M of revenue and $15.8M of gross profit.

Virtual Account Numbers (VANs)

Virtual Account Numbers (VANs) on the EML platform give client organizations the ability to issue multiple payment types without ever having to change existing processes.

This feature reduces costs, at the same time improving control. Businesses also gain a competitive edge with proprietary technologies and custom solutions for Virtual Account Numbers.

The segment contributed $6.4M of revenue and $4.4M of gross profit in the last year.

This business segment exhibited the fastest growth within EML. It has further potential because EML shares the merchant fees with the businesses that use the product.

It, therefore, becomes a revenue-earning center within that business.

Industry Analysis

The growth in global eCommerce, the increasing preference for ease-of-use, and the vast size of the unbanked or underbanked population are the key drivers for the prepaid card market.

At the end of 2017, there were 1.7 billion adults without access to a bank account globally, while nearly half of unbanked adults live in just seven economies.

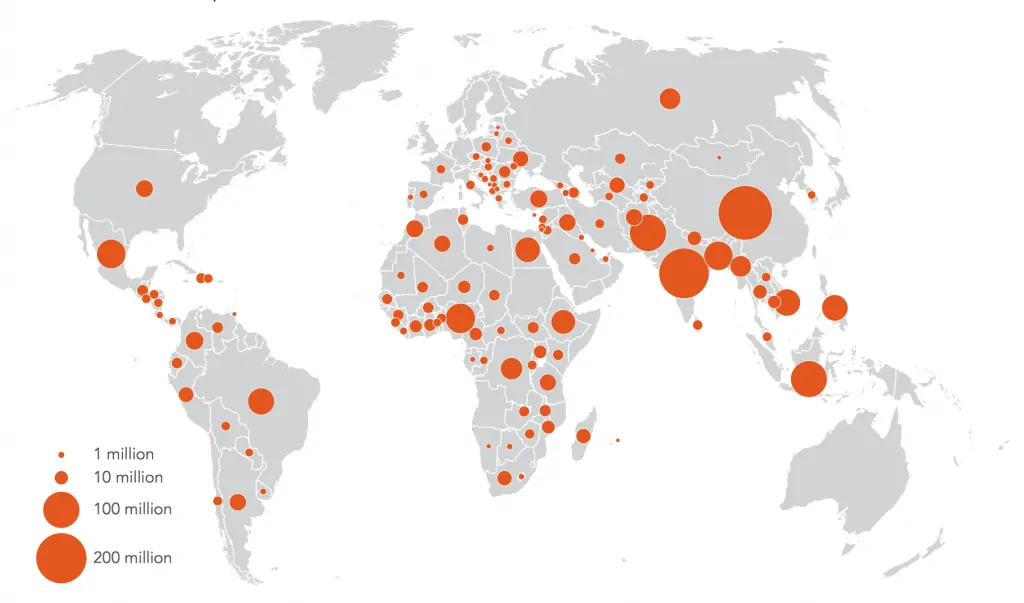

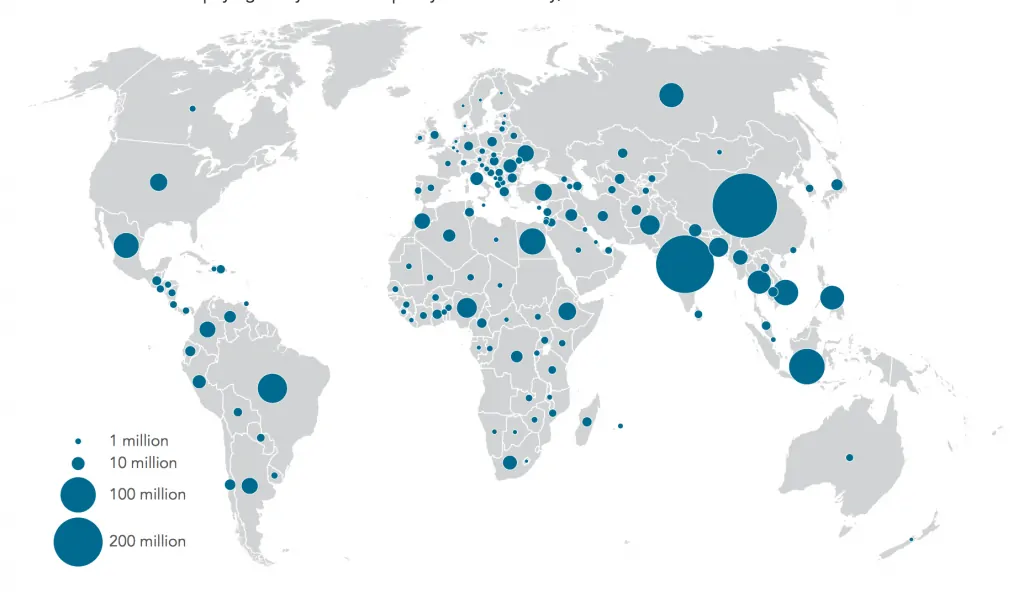

The distribution of the unbanked population across the world is shown below.

Globally 1.7 Billion people do not have a bank account.

Source: Global Findex Database

Source: STATISTA, Global Findex Database

However, two-thirds of unbanked adults have a mobile phone, which means there is a huge potential market for mobile-based and virtual payments.

In India, 90 per cent of unbanked adults possess proof of identity issued by the national government and are therefore eligible to get access to an account.

Once global banking becomes more inclusive, the current unbanked population will offer a huge potential market for the pre-paid and digital solution industry.

A growing number of people use their bank accounts for digital payments. However, nearly a billion of them still pay utility bills in cash.

Source: Global Findex Database

The prepaid card market is projected to grow at a compounded annual growth rate of 22.7% during the period from 2016 to 2022.

This market, therefore, has the potential to grow from $896 billion to a size of $3,653 billion by 2022.

The leading players in this market are Green Dot, TSYS, JPMorgan Chase, American Express, Mango Financial, and Kaiku.

The general-purpose reloadable card is the dominant product and is expected to continue to lead the growth within the prepaid card market.

Source: Allied Market Research

The market size for the reloadable card in North America, Europe, and Australia is estimated at $90 billion, $38 billion, and $12 billion, respectively.

North America is the dominant region in the market.

As the federal government regulates US banks, non-banks such as EML are currently taking share through various forms of payment systems.

Source: Allied Market Research

By industry verticals, retail establishments are the dominant segment in the global market because they offer prepaid cards, payroll cards, and travel cards.

Source: Allied Market Research

Security is a major concern. Since gift cards are low-value denominations that generally do not need any documentation, they are easily and frequently exploited for illegal financing or other illicit purposes.

Recent frauds in the prepaid card industry have shown that gift cards are the preferred channel for criminals.

However, physical cards are giving way to virtual cards loaded into digital wallets or individual credits sent via message services directly to the end-customer.

The ability of EML to detect the use of cards for money laundering or other illegal activities will, therefore, strengthen with the decline in the use of physical cards.

Key advantages and risks

EML is the largest provider of payment solutions and gift cards to the salary packaging industry, with more than 175,000 benefit accounts already in the market.

Salary packaging (also known as salary sacrifice) is an arrangement between employees and employers whereby the former pay for some items or services straight from their pre-tax salary. This method reduces the employee’s taxable income.

EML has entered an 8-year agreement with Smart Group to serve as its general-purpose reloadable card program provider.

Reloadable cards are the prepaid segment with the most potential future growth.

EML also signed an agreement with leading German malls operator ECE for a gift card program in German.

Due to restrictions by the federal government and regulations surrounding US banks, non-banks such as EML are stepping in for certain payment systems such as betting.

The following image highlights the opportunity available should more US states legislate to allow sports betting.

EML has signed an agreement with bet365 for a branded reloadable card program and with PointsBet for gaming in New Jersey in the US.

The initial program in New Jersey will launch after receiving regulatory approvals.

EML holds an Australian Financial Services License from the Australian Securities and Investments Commission (ASIC).

EML Payments DAC holds an E-money license from the Central Bank of Ireland, making EML BREXIT-proof.

EML has a high-security level. EML’s technology has the highest industry standards of security, including Tier 1 PCI-DSS level 1 and soc1/ssae-18.

Further, EML’s prepaid card-holders are required to set a PIN in addition to their card’s 16-digit personal account number for verification and security.

If the card is stolen or lost, the card-owner can ask EML to suspend the relevant card to restrict unauthorized or fraudulent use.

The Group has $5,742,000 (2018: $5,775,000) of trade receivables that are overdue but not impaired.

Historically, the Group has had insignificant losses from bad debts. Therefore, we do not expect a large credit loss from these receivables.

Financial performance

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

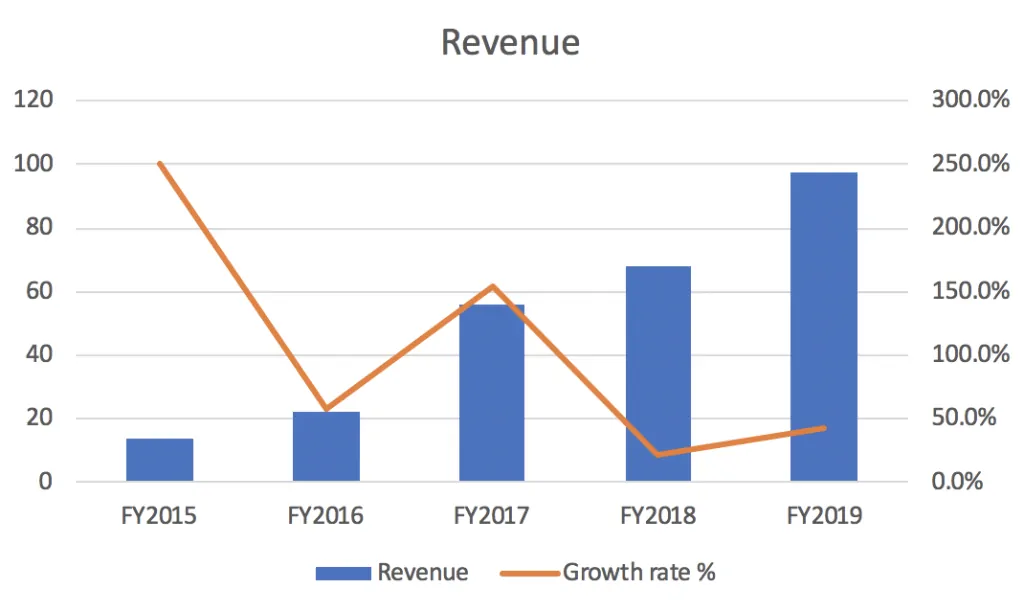

| Revenue ($Million) | 14 | 22 | 56 | 68 | 97.2 |

| Growth % YoY | 250.0% | 57.1% | 154.5% | 21.4% | 42.9% |

| EBITDA | -3.85 | 1.42 | 6.27 | 11.90 | 29.10 |

| Margin % | -27.5% | 6.4% | 11.2% | 17.5% | 29.9% |

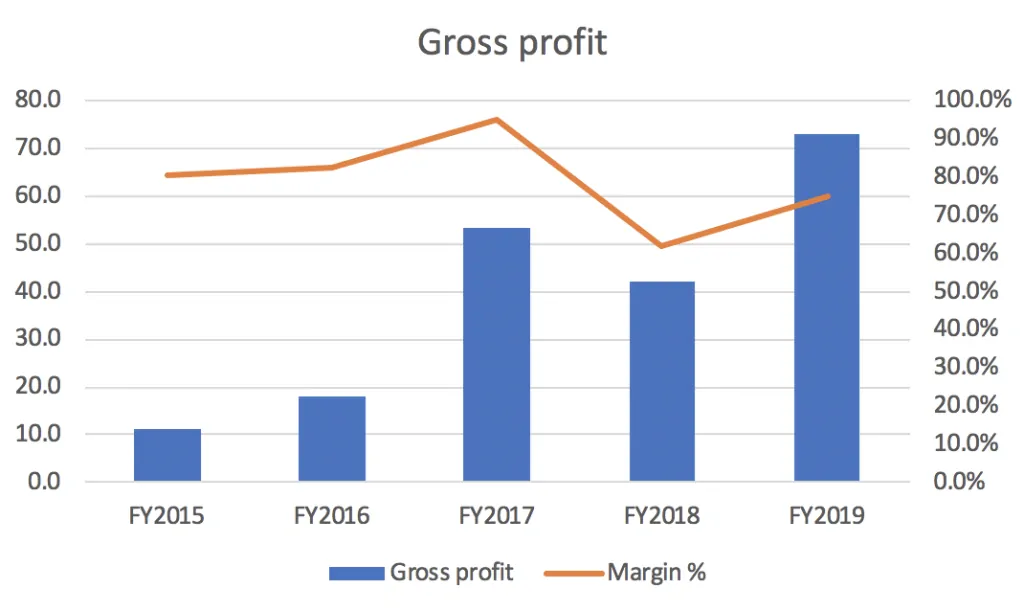

| Gross Profit | 11.3 | 18.2 | 53.3 | 42.3 | 73.0 |

| Margin % | 80.6% | 82.7% | 95.2% | 62.1% | 75.1% |

| P/E Ratio | 29.5 | 453.6 | – | 143.9 | 318.4 |

| P/B Ratio | 2.0 | 2.6 | 3.3 | 2.7 | 6.0 |

Source: EML’s 2019 Annual Report

Over the past five years, EML has shown consistent growth in its revenues.

During FY2019, revenues grew 42.9% year-on-year to $97.2 million.

However, the growth rate curve is showing a declining trend due to the low base effect from earlier years.

EML turned EBITDA-positive in FY2016. EBITDA grew from $1.42 million in FY2016 to $29.10 million in FY2019.

In the same year, the EBITDA margin at 29.9% reached its highest in five years.

The company is, therefore, very profitable.

The Gross profit increased from $11.3 million in FY2015 to $73 million in FY2019.

The gross margin of EML is relatively stable at an average of 79.1% over the past five years.

The company does not pay dividends.

However, unless the company makes further acquisitions, it has enough cash funds to consider various capital management initiatives such as dividends.

The company’s policy in this regard would become clear at its AGM in November 2019.

Conclusion

EML’s strategy of focusing on the pre-paid industry within its payment solutions products has paid off well during the past few years with significant growth in its revenue and profit.

Given the size of the world’s under-banked population and the rising adoption of digital payments, the industry is expected to continue to grow.

We believe that EML has an early mover advantage in a potentially huge global market.

Additionally, as more states legalize sports betting in the USA, a huge new market is opening up for payment systems and prepaid cards relating to the betting industry.

The future for EML, therefore, looks bright.

The next catalyst for a move higher in the share price is likely to come from the company’s Annual General Meeting scheduled on November 13, 2019.

There is a high probability that the company may upgrade its guidance at the Meeting.

In addition, the chance of a future dividend payment has increased, given that the company is proposing to amend its Constitution relating to the manner of payment of dividends.