Today we will look at Qantas shares (ASX:QAN) and why we think they are well positioned for post-lockdown upside in our QAN share price forecast.

The coronavirus pandemic has impacted almost every business sector in a way that hasn’t been seen before in the modern world.

The travel and hospitality industries have faced an existential threat due to a practical standstill in tourism and business travel.

However, the hardship brought by the pandemic might prove to be a boon for industry leaders as it weeds out smaller or weaker competitors.

This has been the case for Qantas Airways (ASX:QAN).

After Virgin’s bankruptcy, Qantas is in a position to dominate Australia’s domestic sector with solid liquidity and a near-monopoly.

Additionally, Qantas has been named as one of the world’s most financially secure airlines during the pandemic.

Furthermore, the recent lockdown could be an upside catalyst for the stock as the vaccination rate accelerate across Australia.

At the current QAN share price, Qantas shares have outperformed the index by about 5% over the past year.

Table of Contents

- 1 About Qantas Shares (ASX:QAN)

- 2 Strong Market Position but Pandemic Remains a Threat

- 3 Recent Sydney Lockdown Presents Qantas Opportunity

- 4 Significant Opportunity to Boost Successful Loyalty Program

- 5 Business Travel Revenues May Never Recover

- 6 Qantas (ASX:QAN) Financials

- 7 Qantas (ASX:QAN) – Comparative Valuation

- 8 Qantas Is a Great Opportunity if Australia Picks Up Vaccination Pace

Qantas Airways Limited (ASX:QAN) is Australia’s flagship carrier.

The company has in place a two-tiered structure to cater to different market segments.

International and domestic operations are operated under the QantasLink banner, while Jetstar addresses the low-cost segment.

Across both segments, Qantas flies to 115 destinations in 23 countries.

Since the onset of the pandemic, Qantas has been forced to ground aircraft to cut costs and align flying capacity with travel demand.

The airline currently has in service about 70% of its fleet of 314 aircraft.

Strong Market Position but Pandemic Remains a Threat

Qantas’ biggest strength is its dominant position in the domestic sector.

After its bankruptcy, the new owners of Qantas competitor Virgin intend to operate the company in a very defensive manner, with a focus on regional services.

However, they would probably have to cut down operations to between 30 and 60 planes compared to Qantas’ 95 to make the deal work.

This is good news for Qantas in terms of market share, and consequently also for its loyalty business.

According to the Australian Competition and Consumer Commission’s latest airline sector report, Qantas has a domestic market share of almost 70%, up from 60% before the pandemic.

This number is set to rise as the government intends to keep borders closed till at least 2022.

With international travel under a cloud, so to speak, pent-up demand would almost certainly seek out domestic destinations as an alternative.

As validation, in a recent press release, Qantas (ASX:QAN) stated that travelers are converting canceled international tickets into multiple domestic trips.

Qantas has the resources and fleet to take full advantage of this developing market situation.

The company will also benefit from the ticket subsidy program under which the government will subsidize 50% of the cost on 8,00,000 tickets between April and July.

Qantas projects that 550,000 of those 800,000 tickets would be used on its planes.

However, the airline’s prospects could be weakened by Australia’s slow progress in vaccinating its population.

According to the OECD, Australia is dead-last among 37 major countries in terms of vaccinations with just 7.57% of Australian adults fully vaccinated despite it being three months since the rollout began.

This seeming inertia in the country’s vaccination drive could lead to flare-ups in virus case counts and knee-jerk reactions such as lockdowns.

Even short lockdowns at important cities like Brisbane, Perth, Sydney, etc. proved to be very expensive for the company.

Recall that just a 3-day lockdown in Perth last month and Brisbane in March cost the company $15 million and $29 million in EBITDA respectively.

Given that four major cities (Brisbane-3 days, Sydney-2 weeks, Darwin-5 days, and Perth-4 days) are under lockdown/were under lockdown until recently), the company could take a hit on earnings.

The recent 2 week lockdown in Sydney, now extended to three weeks will be a significant hit to Qantas’ earnings.

Recent Sydney Lockdown Presents Qantas Opportunity

This lockdown could serve to be a positive development for Qantas (ASX:QAN).

The main issue with the Australian vaccine rollout is complacency and as stated previously, Australia is dead-last among 37 major countries to get vaccinated.

The recent lockdown is now serving as a strong wake up call for the Australian population and the Federal Government as to how important it is to get vaccinated.

Australia is now moving towards a new stance regarding the virus.

Rather than going for an elimination strategy which isn’t working, the Federal and State governments are heading towards a policy where we are vaccinated and learn to live with the virus.

We are already seeing this policy starting to move, with vaccinations moving at a much faster clip as the AstraZeneca vaccine is now been distributed to under 40 year old’s.

This means that with the much faster rate that we are vaccinating, the potential date for when we will open international borders will be brought forward.

If the vaccination rates continue to gather pace, we should see a rally in the QAN share price as investors prepare for Australia to open back up to the rest of the world.

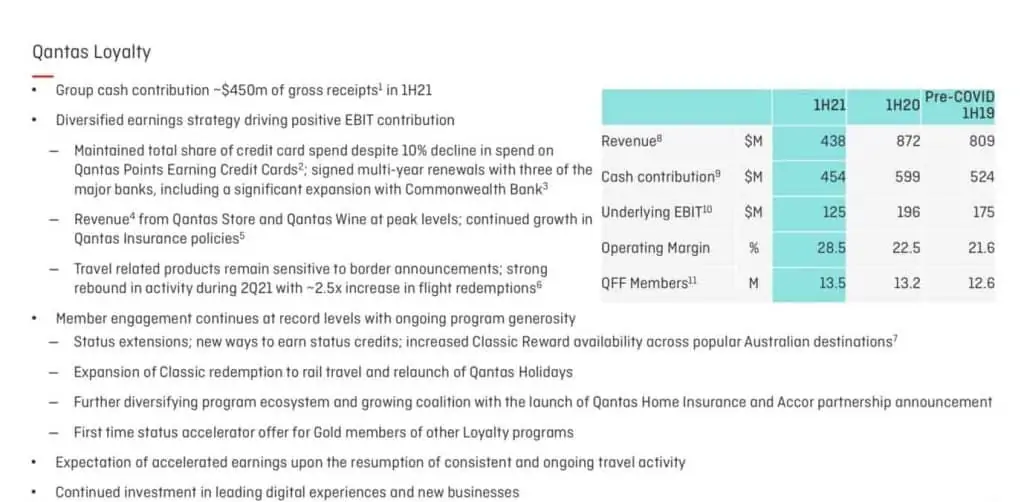

Significant Opportunity to Boost Successful Loyalty Program

The stress on the airline sector brought upon by the pandemic is an opportunity for Qantas (ASX:QAN) to fortify its already industry-leading loyalty program.

Before the pandemic, the Loyalty business generated 68% of its revenue as free cash flow, made up a significant part of the group’s total cash flow and contributed 20% to EBIT.

Due to rising market share, the loyalty business should strengthen significantly as more travelers enroll in the program, thus giving the company a leg up on rivals due to the stable cash-flows it generates.

This will create a virtuous cycle as members would prefer to repeat-fly Qantas to avail the incentives offered by the loyalty program.

Source: Qantas 1HFY21 Report

Business Travel Revenues May Never Recover

A threat for Qantas shares and the airline sector, in general, is the structural change the pandemic has brought in work culture.

The pandemic forced companies to shift to remote and online work proving that a large chunk of corporate work could be done in this manner.

There is therefore a high probability that business travel may never return to pre-pandemic levels.

Qantas itself has stated that it expects overall business travel to decline by 13% of pre-pandemic levels, permanently.

The same issue has also been reiterated by Virgin Australia’s CEO, Jayne Hardlicka.

Qantas (ASX:QAN) Financials

In 1HFY21, the company reported group revenue of A$6.9 billion, EBITDA of $86 million, and a loss before tax of A$1.034 billion.

The half-year showed sizeable recoveries in domestic travel.

Qantas Domestic and Jetstar, which make up the domestic segment, reported occupancy of 58.1% and 70.5% respectively on active routes.

This segment reported a net positive cash flow of $540 million (excluding one-offs of $1.9 billion).

Qantas Domestic reported an EBITDA of $28 million and noted that 99% of all flights were cash-flow positive.

On the other hand, Jetstar reported an EBITDA of $43 million from Australian operations but a total EBITDA loss of $74 million due to the grounding of planes in other Asia markets such as Japan and border shut-downs.

Qantas International declared an EBITDA of loss of $291 million.

In sum, the first half showed that the domestic segment buoyed the company’s financials, and this state of affairs is likely to persist over the next 12 months until borders reopen.

Furthermore, the airline has in place a recovery plan to lower costs and improve operating cash-flows through planned savings of A$600 million in FY21, A$800 million in FY22, and A$1 billion in FY23.

The company is therefore positioning itself to benefit from improving operating leverage both due to volume recovery and lower costs.

The company has plans to invest $500 million of these savings into the domestic segment by FY23.

Source: Qantas 1HFY21 Report

Qantas had projected 2HFY21 EBITDA at between $350 million and $450 million, but due to recent lockdowns, the company might underperform these figures.

Lastly, the company has a very strong liquidity position with net debt of A$6 billion and total liquidity of A$4.2 billion.

This includes undrawn but committed credit of A$1.6 billion and cash/cash equivalents of A$2.6 billion.

The company also has unencumbered assets of A$2.5 billion.

Qantas (ASX:QAN) – Comparative Valuation

We compare Qantas Airways to Singapore Airlines and Cathay Pacific, its biggest APAC rivals.

| Metric | Qantas | Singapore Airlines | Cathay Pacific |

| Price/Book | 11.92 | 0.93 | 0.58 |

| Return on Equity (ROE 5 year avg.) | 10.53% | -3.4% | -6.48% |

| Asset Turnover | 0.36 | 0.11 | 0.22 |

At the current QAN share price, Qantas shares has outperformed its peers in terms of ROE because of its dominant position in its local market.

Qantas shares are also significantly more efficient in the use of its assets compared to Singapore Airlines and Cathay Pacific, a factor that is important in a capital-intensive business like aviation.

While Qantas shares are significantly more expensive in terms of price/book, there are a number of reasons for that.

Qantas has been named as one of the world’s most financially secure airlines with a strong balance sheet.

Singapore Airlines and Cathay Pacific are both in much worse shape than Qantas and circling bankruptcy, even before the pandemic.

The higher Price/Book ratio is therefore, not much of a concern.

Qantas Is a Great Opportunity if Australia Picks Up Vaccination Pace

Qantas (ASX:QAN) is by far the most dominant airline in Australia, named one of the world’s most financially secure airlines with huge upside potential for when international borders open.

According to the IATA, global travel volumes will surpass pre-pandemic levels by 2023 which bodes well for the QAN share price.

In what might be construed as validation of the airline/travel sector’s prospects, Sydney Airport (ASX:SYD) on Monday received a A$22.26 billion (US$16.7 billion) bid from a group of infrastructure investors.

Sydney is one of the country’s most important aviation hubs with 4 million monthly passengers, and the bid, placed at a 42% premium over the airport’s Friday close, could be an indication that marquee investors are betting on a big post-pandemic travel recovery.

Meanwhile, Qantas shares have the liquidity to weather any further disruptions from the pandemic and is well-positioned with operating leverage to benefit from the sector’s recovery.

With borders shut for at least the next 12 months, the domestic flights market could happily take up the slack with Qantas in pole position.

However, the potential for strong upside in the QAN share price could come sooner rather than later if Australia continues to pick up its slack in getting the population vaccinated and border openings are brought forward.