Markets worldwide had a volatile, holiday-shortened week after being hit by a flurry of significant rate hikes from major countries and Russia signaling intense aggression over its war with Ukraine.

The US Fed hiked rates by 0.75% for a third time on the trot to a range of 3.00%-3.25% as it sought to douse inflation.

Fed Chair Powell was extremely hawkish: “We have got to get inflation behind us. I wish there were a painless way to do that,” he said.

“There isn’t”.

And added: “We want to act aggressively now, and get this job done, and keep at it until its done.”

It appears recessionary fears are on the back burner compared to inflation, and markets are figuring that a hard landing is increasingly becoming the probable economic scenario over the next 12-24 months.

All the 11 ASX sectors ended the week in the red.

The biggest three losers were Technology (-6.84%), Real Estate (-5.53%), and Consumer Dicretionary (-5.5%).

Consumer Staples (-2.87%), Financials (-2.61%), and Materials (-1.81%) brought up the rear.

The ASX200, ASX300, and ASX Ordinaries ended the week down 2.5%, 2.6%, and 2.7%.

Table of Contents

Last Week In ASX Stocks

The ASX Materials Index (ASX:XMJ)

The ASX Materials Index closed the week down 1.8%, outperforming the broader market buoyed by a strong performance from new energy and copper miners.

Sector majors BHP (ASX:BHP), Rio Tinto (ASX:RIO), South32 (ASX:S32), Fortescue Metals (ASX:FMG), and Mineral Resources (ASX:MIN) closed the week down 0.52%, 0.81%, 2.4%, 5.6% and 1.88%.

Fortescue Metals announced A$9.2 billion capex plans for its green energy push to achieve net zero carbon emissions by 2030.

New energy miners were a mixed bag with IGO (ASX:IGO) and Pilbara Minerals (ASX:PLS) ending up at 2.2% and 6.83% while Lynas Rare Earths (ASX:LYC) and Allkem (ASX:AKE) tanked 2% and 2.88%.

IGO saw investor interest on news of promising exploration results at a lithium project in WA’s Goldfields region, in which it holds a 25% stake.

OZ Minerals (ASX:OZL) shot up 4.74% after announcing a A$1.7 billion investment in their West Musgrave Copper-Nickel project while Lake Resources (ASX:LKE) rallied 6.6% after reporting that it is moving forward with its lithium project in Kachi, despite rumors of disputes with its partner surfacing earlier.

Bloomberg said that BHP may up its bid for OZ Minerals.

Gold miners Evolution Mining (ASX:EVN) and Northern Star Resources (ASX:NXT) fell 4.1% and 0.4% while Newcrest Mining (ASX:NCM) closed up 0.36%.

The ASX Energy Index (ASX:XEJ)

The ASX Energy Index tanked 3.03% for the week as hard landing narratives fed fears of demand destruction.

Sector heavyweights Woodside Energy (ASX:WDS), Beach Energy (ASX:BPT), and Santos (ASX:STO) ended the week lower by 3.81%, 5.97%, and 4.31%.

A Federal Court justice ordered Santos to halt drilling at its Barossa gas field northwest of Darwin; however, Santos plans to appeal.

Coal miners New Hope Corporation (ASX:NHC) and Whitehaven Coal (ASX:WHC) ended up 12.23% and 4.68% to close at all time highs, while Stanmore Resources (ASX:SMR) and Yan Coal (ASX:YAL) closed down 4.37% and 3.92%.

New Hope Corporation rallied after reporting its full-year profit after tax had risen more than 12-fold thanks to soaring coal prices.

New Hope will pay 86c a share in dividends for 2021/22, up from11c the prior year, after making $983m in profit.

Meanwhile, Viva Energy (ASX:VEA) ended down 0.18% after announcing that it will buy Coles’ convenience store and petrol network for A$300 million.

Viva chief executive Scott Wyatt said the deal will make the company Australia’s clear number two player in both the fuel and convenience sector.

The ASX Financials Index (ASX:XFJ)

The ASX Financials Index declined 2.61% for the week, in line with the broader market.

Big banks Commonwealth Bank of Australia (ASX:CBA), National Australia Bank (ASX:NAB), Australia and New Zealand Bank (ASX:ANZ), and Westpac (ASX:WBC) ended the week lower by 1.44%, 3.07%, 1.1%, and 1.06%.

Regional banks Bendigo Adelaide (ASX:BEN) and Bank of Queensland (ASX:BOQ) fared similarly at 4.22% and 1.17% down.

Insurance providers Suncorp (ASX:SUN), QBE Insurance (ASX:QBE), and Insurance Australia Group (ASX:IAG) also lost ground by 4.74%, 3.9%, and 3.71%.

Platinum Asset Management (ASX:PTM), Magellan Financial (ASX:MFG), and AMP (ASX:AMP) fell 0.3%, 10.34%, and 3.8%.

Magellan lost more than its peers primarily because its business performance is most dependent on AUM, the outlook on which is poor due to market conditions.

The ASX All Technology Index (ASX:XTX)

The ASX All Technology Index (ASX:XTX) had a forgettable week and closed 6.84% down as markets embraced ‘riskoff.’

Platform companies REA Group (ASX:REA), RedBubble (ASX:RBL), Domain Holdings (ASX:DHG), and Carsales.com (ASX:CAR) bled 7.35%, 13.16%, 7.58%, and 5.63%.

SaaS companies Xero (ASX:XRO), Appen (ASX:APX), Nuix (ASX:NXL), and WiseTech Global (ASX:WTC) fell off a cliff at 8.84%, 9.52%, 15.33%, and 5.63% down for the week.

BNPL vendors Block (ASX:SQ2), Sezzle (ASX:SZL), Zip Co. (ASX:Z1P), and MoneyMe (ASX:MME) took a bloodbath and gave up 17.3%, 18.93%, 12.07%, and 15.56% as rate hikes deal them the double whammy of higher costs and lower demand.

Semiconductor maker Altium (ASX:ALU) and data-center operator NextDC (ASX:NXT) fared better but broke 4.07% and 6.07%.

The ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX:XNJ) dipped 3.65% on fears of a weak outlook.

Industrial commodities producers Boral (ASX:BLD), ADBRI (ASX:ABC), and Brickworks (ASX:BKW) ended lower by 5.61%, 8.21%, and 0.14%.

Brickworks fared better as it announced full-year earnings growth of 257% to $854 million for FY22.

Industrial majors Amcor CDI (ASX:AMC), Reece (ASX:REH), Brambles (ASX:BXB), and Reliance Worldwide (ASX:RWC) shed 4.06%, 3.54%, 3.24%, and 7.24%.

Infrastructure companies Transurban Group (ASX:TCL) and Qube Holdings (ASX:QUB) fell 2.6% and 6.56% for the week.

Airlines Qantas (ASX:QAN) and Air New Zealand (ASX:AIZ) lost 4.31% and gained 5%, respectively.

The ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) tanked 5.5% on fears of poor demand on higher recession probability.

Hospitality providers Skycity Entertainment (ASX:SKC) and Star Entertainment (ASX:SGR) ended the week lower by 1.96% and 4.61%.

Travel companies Webjet (ASX:WEB), Flight Centre (ASX:FLT), and Corporate Travel Management (ASX:CTD) closed down by 3.87%, 6.72%, and 8.22%.

Retailers Harvey Norman (ASX:HVN), Temple and Webster (ASX:TPW), Kogan (ASX:KGN), Nick Scali (ASX:NCK), and JB Hi-Fi (ASX:JBH) cratered 4.22%, 13.88%, 9.07%, 15.73%, and 7.27%.

However, sports clothing company KMD Brands (ASX:KMD) gained 3.95% after reporting that Kathmandu clocked its highest-ever sales in the three months to July 31.

Food brands Dominos Pizza (ASX:DMP) and Collins Foods (ASX:CKF) took a beating and slumped 14.19% and 7.26%.

Dominos tanked as its global parent reported poor earnings despite strong revenues owing to inflationary pressures leading investors to fear the same outcome at local subsidiaries and franchise holders.

The ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) performed largely in line with the broader market at 2.87% down for the week.

Sector majors Coles Group (ASX:COL), Woolworths (ASX:WOW), and Wesfarmers (ASX:WES) ended down 1.68%, 5.37%, and 2.85%, respectively.

Food producers Bega Cheese (ASX:BGA), Costa Group Holdings (ASX:CGC), Tassal Group (ASX:TGR), and GrainCorp (ASX:GNC) ended lower by 6.1%, 0.20%, 0.19%, and 0.95%.

Baby food makers a2M Milk (ASX:A2M) and Bubs Australia (ASX:BUB) closed down 4.1% and 0.98%.

The ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) closed 3.91% lower for the week. Healthcare providers Healius (ASX:HLS), Fisher and Paykel (ASX:FPH), and Ramsay Healthcare (ASX:RHC) gave up 2.89%, 4.76%, and 3.88%.

Equipment makers Cochlear (ASX:COH), CSL Ltd. (ASX:CSL), Resmed CDI (ASX:RMD), and Sonic Healthcare (ASX:SHL) slumped 7.68%, 3.46%, 4.71%, and 6.18%, respectively.

Biotech firms Imugene (ASX:IMU) and Mesoblast (ASX:MSB) ended down 13.64% and 9.14%.

However, Polynovo (ASX:PNV) closed the week up 3.7% after announcing FDA approval of its Novosorb drug, a new skin substitute product.

The ASX Real Estate Index (ASX:XPJ)

The ASX Real Estate Index (ASX:XPJ) fell hard by 5.53% because high rates substantially hurt valuations, costs, and demand.

All major players across segments Goodman Group (ASX:GMG), Charter Hall Group (ASX:CHC), Mirvac Group (ASX:MGR), Vicinity Centers (ASX:VCX), and Dexus Group (ASX:DXS) ended in the red between 4%-7%.

The ASX Utilities Index (ASX:XUJ)

The ASX Utilities Index (ASX: XUJ) also caved in by 4.83%.

Sector heavyweights APA Group (ASX:APA), AGL Energy (ASX:AGL), and Origin Energy (ASX:ORG) closed lower by 6.05%, 5.81%, and 3.55%.

Origin Energy announced a divestment of its Betaloo Basin oil assets for A$60 million and plans to dispose of other upstream assets.

The company expects to record a non-cash loss of $70 million – $90 million related to the Betaloo sale.

ASX Telecom Index (ASX:XTJ)

Lastly, the ASX Telecom Index (ASX:XTJ) was down 3.38%.

Sector players Telstra (ASX:TLS) and TPG Telecom (ASX:TPG) fell 1.69% and 2.51% while smaller peers Chorus (ASX:CNU) and Aussie Broadband (ASX:ABB) declined 1.48% and 1.71%.

This Week In ASX Stocks

New ASX Listings

| Name | Date | Ticker | Business | Amount Raised | Price/Share |

|---|---|---|---|---|---|

| Atlantic Lithium | 26th September | ASX: A11 | Lithium Exploration and Development | A$13.253 | A$0.58 |

| Basin Energy Limited | 29th September | ASX: BSN | Energy Assets Exploration and Development | A$9M | A$0.20 |

| Critical Minerals Group | 27th September | ASX: CMG | Minerals Exploration and Development | A$5M | A$0.20 |

Market and Economic Outlook

Last Week’s Print

The week started off on a cautiously optimistic note after the sell-off that followed the US’ worse-than-expected inflation print.

On Monday, the RBA put out its MPC meeting minutes.

For starters, it highlighted an open-minded stance from the bank in terms of hikes and paved the possibility of slowing the pace of hikes should the economy show weakness.

Secondly, it stated that the RBA’s bond-buying program during the pandemic had cost it dearly and will probably put it in a negative equity position, preventing the bank from paying the government a dividend for the next few years.

Later in the day, China surprised markets with a 0.1% repo rate cut to stimulate its economy.

On Thursday, the US delivered its much expected 75 basis point hike, taking rates to 3% – 3.25%.

After a very brief short covering, the markets fell sharply sending volatility soaring, and global markets followed suit.

The week ended with the dollar index up 17% YTD, which is ominous for equities worldwide.

Initial Jobless Claims rose to 213k, breaking their 5-week-long streaks of dropping.

Lastly, on Friday, Fed Chair Powell addressed the press and painted a grim picture of the near future.

He explicitly mentioned that a painful few months are ahead with odds of a soft landing diminishing, paving the possibility of a rise in unemployment and recession.

This Week

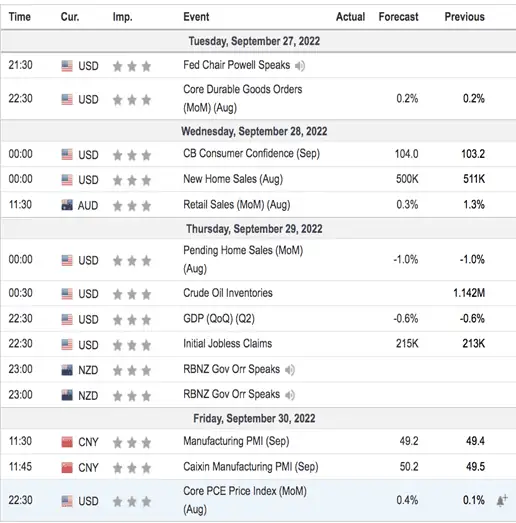

Important data events for next week are as follows:

Forex Outlook

AUD/USD

AUD/USD closed at 0.65279, well below the previous weekly close of 0.67186 after violating the key support zone at 0.67000, plumbing depths of 0.65151, and near two-year lows.

The almighty US Dollar received a huge boost from a hawkish Fed and a third rate hike of 0.75%, as well as a fresh escalation in the Ukraine conflict.

The US Dollar Index signed off the week at 113.023, near 20-year highs.

Powell will speak again on Tuesday, September 27, and likely continue in the same hawkish vein.

Again next week, data on US Durable Goods Orders (August) and Chinese Manufacturing PMI (September) will also shine a light on slowdowns, if any.

While the dollar towered, stocks cowered, and a risk-off mentality led the ASX to clock a weekly

loss of 2.5% with all sectors ending negatively.

The same sentiment also affected the Aussie, a typically risk-on currency, which is also facing headwinds from a lack luster Chinese economy.

What’s next for AUD/USD now that the 0.67000 level has been left in the dust?

Likely, new lows, but there may be a corrective relief bounce from the last week’s selloff, which may not last.

AUD/NZD

AUD/NZD ended the week at 1.13587, well above the previous week’s close of 1.12057.

Technically, the pair has broken out of a sideways rectangle pattern, and a sharp ascending triangle, lending further credence to our view last week that it remains in an uptrend.

Meanwhile, the NZD/USD continues to underperform AUD/USD, leading to potentially higher levels for AUD/NZD.