Today, we’ll look at why we continue to like CSL Limited (ASX CSL).

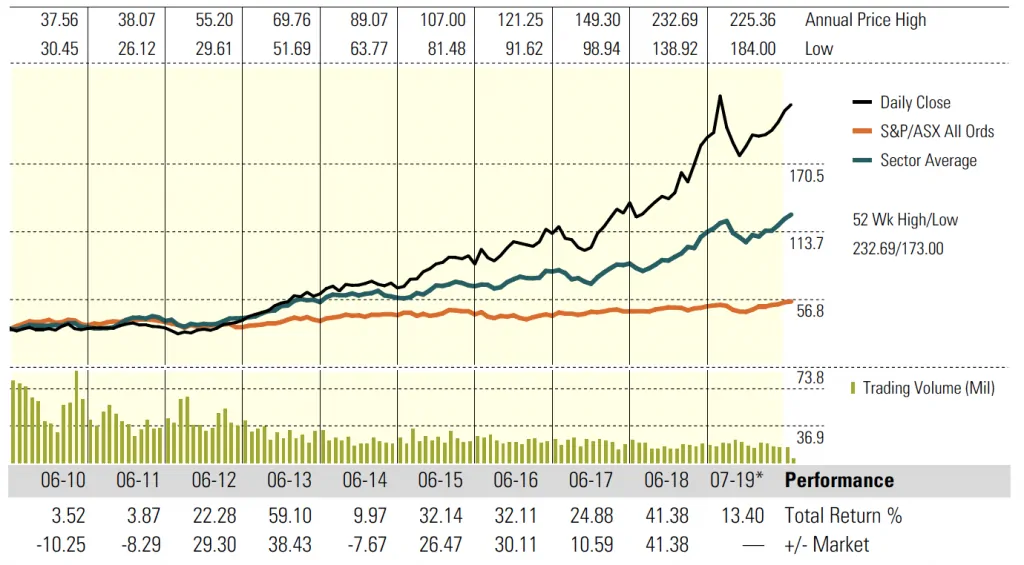

We first looked at this stock in July 2018, when the stock was trading at about $198.

We felt that the stock was a bit expensive then but still had good upside potential.

Since then, the CSL share price rallied to over $230 by September 2018, before pulling back to around $175, then rallying again back to its highs. The stock last traded at a touch over $230.

Since mid-2018, CSL has grown revenue and profits strongly and we think their business is strong and growth will continue.

Table of Contents

- 1 About CSL Limited (ASX CSL)

- 2 Strategic Overview

- 3 Biotechnology industry experiencing high growth

- 4 A potential future market in Primary Immunodeficiency (PI)

- 5 High barriers to market entry

- 6 Strong Product innovation

- 7 Blood plasma products supported by efficient donor management

- 8 High R&D costs required but well funded

- 9 Strong financial performance

- 10 Peer Comparison

- 11 CSL seems expensive but strong growth and quality revenue justify the price

About CSL Limited (ASX CSL)

CSL Limited (ASX CSL) develops, manufactures, researches and markets products to treat and prevent serious human medical conditions.

The company’s products include immunoglobulins, pediatric and adult vaccines, infection, pain medicine, skin disorder remedies, antivenoms and anticoagulants.

With over a century’s experience, CSL is a global biotechnology leader that delivers medicines in more than 60 countries.

They have invested heavily in R&D areas to launch more products, save lives, protect public health and help people with life-threatening medical conditions.

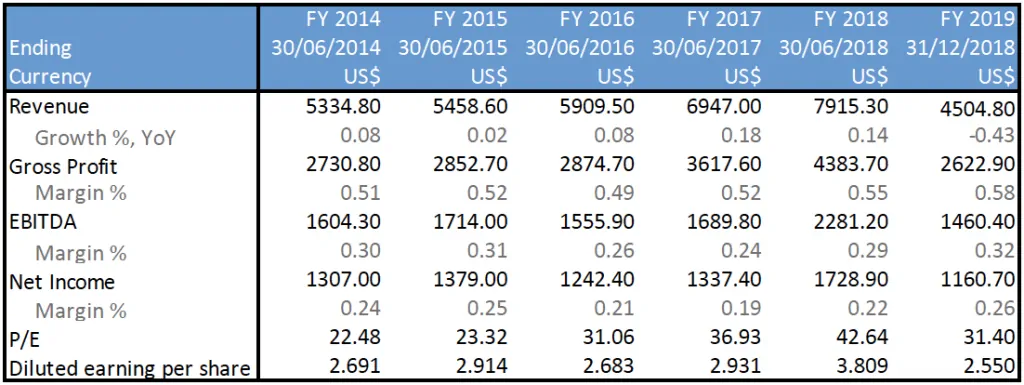

In FY18, CSL’s profit rose 29.27% from US$1337.4m to US$1728.9m. Its total comprehensive income increased by 10% from US$1510.4 to US$1661.6.

More impressively, its diluted earnings per share rose 30.9% from US$2.931 to US$3.809.

Currency in AUD$

Source: Morningstar

Source: CSL Limited Annual Report

HY19 looked strong and CSL is on target for FY19 to beat FY18.

Strategic Overview

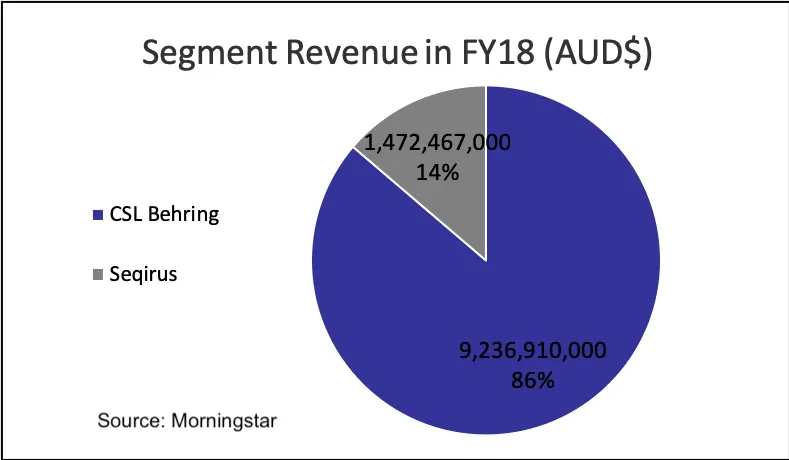

The company splits its products into two divisions.

- CSL Behring focuses on the research and development of immunoglobulin replacement therapy (IRT) and

- Seqirus is one of the largest influenza vaccine company’s in the world.

As illustrated, CSL Behring accounts for 86% of the revenue and Seqirus accounts for 14%. In addition, the georgical distribution of property, plant, equipment and intangible assets is shown below.

CSL operates across the world. The major markets of the company are

- The U.S. – 44%

- UK, Switzerland and China – 28%

- Germany – 10%

- Australia – 9%

- Rest of the world – 22%

Efficiency and Quality

It’s obvious that CSL Behring is CSL’s growth engine. Total sale in constant currency, grew 10% over the FY18 to US$6.6 million.

Its immunoglobulins sales rose by 11% in constant currency, especially Hizentra which increased by 12% at constant currency. Privigen has also performed well with sales up 13% in constant currency.

CSL Behring’s strategy is to be the most efficient, highest quality plasma player. The company has a deep understanding of what patients with rare and serious diseases need and the science to successfully innovate.

They also have the operational expertise to manufacture and commercialize high-quality therapies.

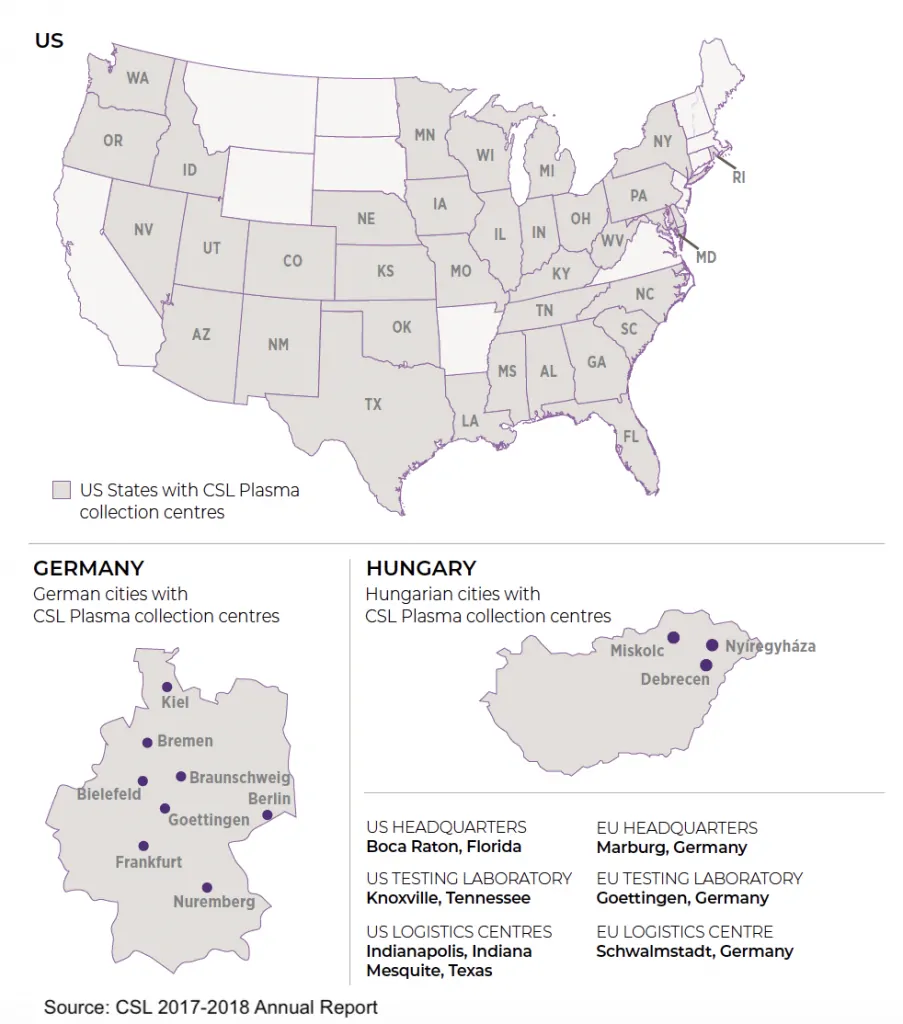

In the US, CSL Plasma opened 27 new collection centres during FY18, the growth of which outstrips the industry.

CSL also launched a new CSL Plasma donor management system as well, to build and manage the largest and most efficient plasma collection network in the US.

Egg-based and cell-based technologies

Seqirus is one of the world’s largest influenza vaccine companies and a major partner in the prevention and control of influenza globally.

The strategy of Seqirus is egg-based and cell-based manufacturing technologies.

The most differentiated product is cell-based quadrivalent and adjuvanted products, compared with other companies’ products.

There is strong scientific rationale to suggest that cell-based technology may potentially overcome the challenges of egg-based influenza virus mutations, leading to higher vaccine effectiveness.

R&D investment and innovation

There is an increasing trend of capital allocation into research and development (R&D) to expand CSL’s product efficiency and range.

Additionally, CSL’s strategy is also to achieve agreements and gain support with governments and exploring more markets. For example, CSL achieved regulatory approval for vaccine FLUAD in the UK.

For the Chinese market, CSL would transition to its own Good Supply Practice (GSP) in FY20, which means it could import albumin into China and distribute products by itself instead of a third party.

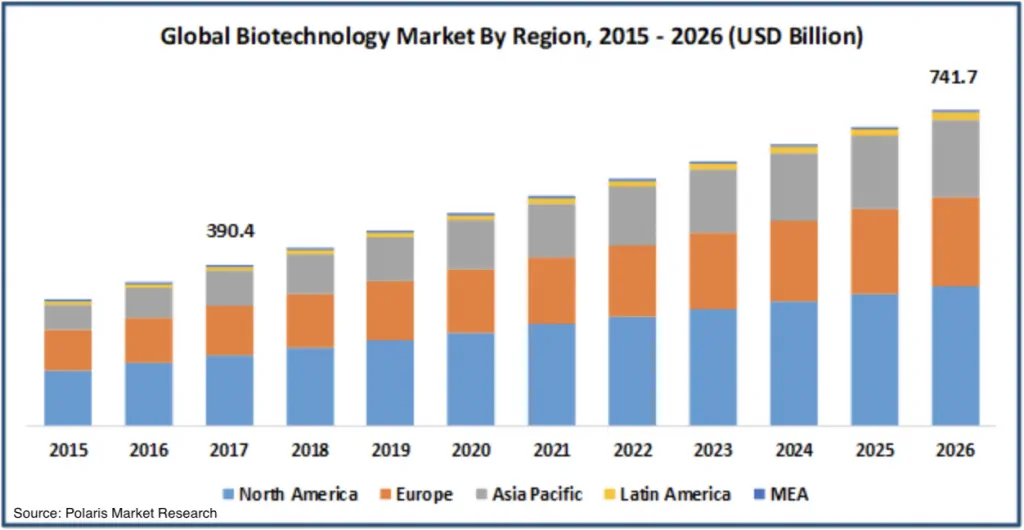

Biotechnology industry experiencing high growth

Biotechnology industry involves biotechnology research and development by using biological systems or living organisms, licensing, product manufacturing and product wholesaling.

According to the biotechnology market research report published in 2019, the biotechnology market is estimated to grow from US$390.4 billion in 2017 to US$741.7 billion by the end of 2026, with a forecast CAGR of 7.7%.

A potential future market in Primary Immunodeficiency (PI)

Rising incidence of persistent conditions globally such as primary immunodeficiency is expected to increase the need for biotechnology products in the future.

Primary Immunodeficiencies is a large group of disorders caused when the immune system misfires, leading to frequent or severe infections, swellings and autoimmune problems.

According to the data form World PI Week in April 2017, there are approximately six million people worldwide who have been diagnosed with primary immunodeficiency.

The paper “Changing the lives of people with primary immunodeficiencies (PI) with early testing and diagnosis” believes between 70% and 90% of people worldwide living with PI still remain undiagnosed.

This presents a large opportunity for CSL to produce methods to detect undiagnosed PI as well as technologies to better the lives of people living with PI.

High barriers to market entry

Strict requirements for safety and effectiveness of products, expert and professional human resources, millions in capital investment and long research and development cycles are all high barriers to market entry.

There is also no guarantee a product will make it to market as there is strong regulation as well as trials required to prove effectiveness.

Companies that are established in this industry, like CSL, have economies of scale to afford necessary research and investment, and it would be difficult for new companies to enter the market.

Strong Product innovation

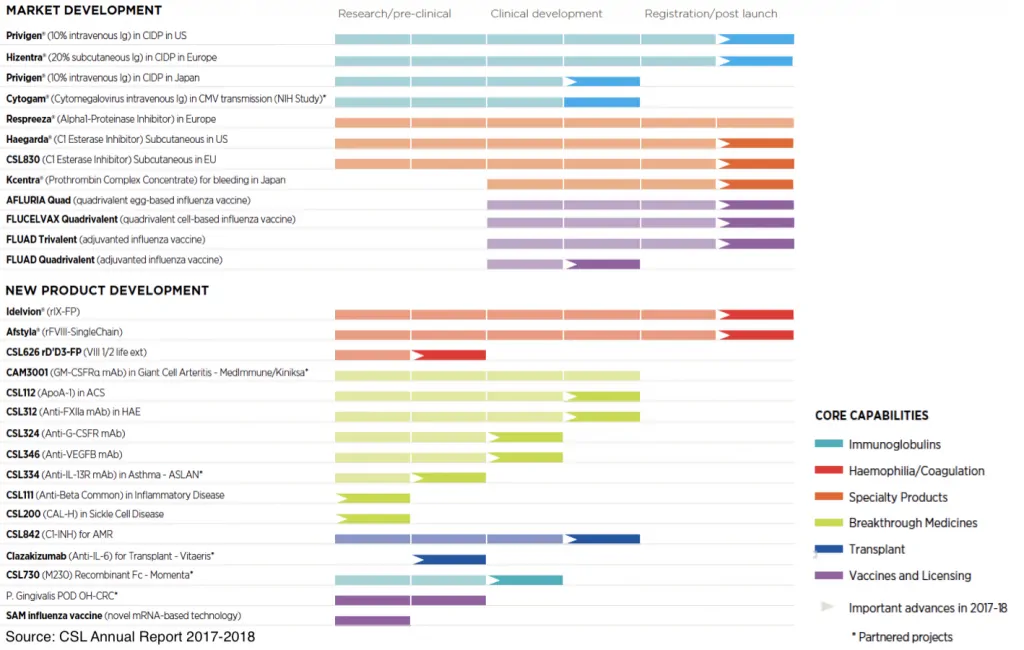

As the R&D investment showed, CSL has extensive R&D capacity.

From 2016-2018, CSL developed 5 major product launches in 24 months.

As the following table shows, there are differentiated products for different diseases.

CSL provides exhaustive products mix options for customers with different demands. For example, there are two therapies for PI, Hizentra and Privigen.

Privigen needs to be treated every 3 or 4 weeks and requires a hospital or clinic to operate by a doctor or nurse.

Hizentra is usually given one or more times a week, and can often be given at home by patients themselves.

CSL offers the option for patients to choose a safe and convenient product to help them lead a normal and healthy life.

Blood plasma products supported by efficient donor management

CSL is one of the world’s largest manufactures of blood plasma products. CSL offers the broadest range of quality plasma products and operates one of the world’s largest blood plasma collection networks, with more than 200 centres around the world.

A new CSL Plasma donor management computer system was launched to trace each plasma unit from the initial donation to laboratory test results, to logistics and on to the fractionation facilities.

CSL’s management system is the most efficient process and system available that focuses on donor and plasma safety.

High R&D costs required but well funded

To stay competitive, CSL needs to invest heavily in a large range of experiments. These experiments require highly skilled and expensive teams, as well as time.

There is, also no positive correlation between the amount of money invested and the outcome of the research, most of the R&D costs can be considered sunk costs.

However, CSL’s R&D is supported by their highly skilled in-house teams and strong free cash flow. This is evident in the relatively large amount of products introduced into the market recently and the strong pipeline of upcoming products in the works.

Strong financial performance

CSL has experienced high growth across all income metrics, including operating revenue, EBITDA, pretax profit, and net profit.

Specifically, FY10-18 operating revenue reached compound growth of 11.18%, EBITDA at 11.69%, pretax profit at 10.78% and net profit at 10.49%, respectively.

More impressively, FY 16-18 YoY compound growth, as depicted as the grey lines, reached 12.43%, 28.13%, 29.79% and 18.24% of operating revenue, EBITDA, pretax profit, net profit respectively.

However, after the establishment of Seqirus following the acquisition of the Novartis influenza vaccines business, CSL faced temporary obstacles in FY16. Having said that, CSL bounced back strongly in FY17 and FY18 after managing their expenses well.

Robust margin metrics

CSL’s EBITDA margin, pretax profit margin, net profit margin and operating expenses margin was very stable and predictable from FY10-15.

With the establishment of Seqirus in FY16, the operating expenses margin increased sharply to 15.83% which caused a dip in EBITDA margin, pretax profit margin and net profit margin.

CSL managed to bring expenses back to pre-acquisition levels in FY17, which is at about 70% of operating revenue in the following years.

CSL has achieved a healthy, stable and robust level of the EBITDA margin (35%), pretax profit margin (30%), net profit margin (22%) and operating expenses margin (70%) year on year.

Even if there would be a significant increase in operating expenses, CSL has shown they have the experience to manage expenses and to remain at a stable and robust profit margin.

Peer Comparison

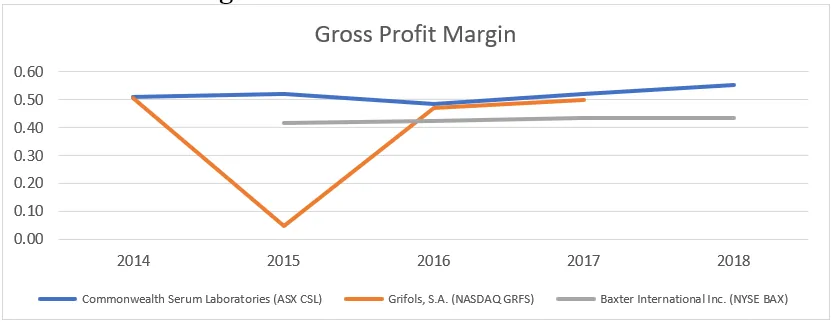

Grifols, S.A. (NASDAQ GRFS) and Baxter International Inc. (NYSE BAX) are two strong competitors of CSL Limited with similar business models.

Share Price History

The CSL share price has had much higher share price growth.

In 2010 to 2012, CSL had similar share price performance with GFRS and BAX. Since 2012, CSL growth accelerated and grew a remarkable 577.92% from 2010 to 2019, compared with 218.46% growth of GFRS and 169.75% growth of BAX.

Revenue

BAX and CSL both have stable growth of revenue from FY15-18, compared with the significant fluctuating revenue of GRFS.

However, CSL is growing revenue faster than BAX.

Gross Profit Margin

From FY14-18, CSL had the highest gross profit margin compared with the fluctuating margin of GFRS and the lower level of margin for BAX.

P/E Ratio

CSL has gotten more expensive over the years. CSL’s PE has risen from sub 30’s in 2017 to around 40 times in 2018.

However, even though CSL is more expensive, investors are marking the stock up likely because of the stocks higher growth rate and higher quality revenue lines.

In addition, its major competitor BAX has a similar PE ratio, indicating that the market is most likely fairly pricing CSL, if not slightly underpricing due to CSL’s stronger revenue growth.

CSL seems expensive but strong growth and quality revenue justify the price

CSL Limited (ASX CSL) is a global leader in manufacturing medical products and injections related to primary immunodeficiency, chronic inflammatory demyelinating polyneuropathy and other serious diseases.

The company aims to develop and provide more safe, effective and convenient products for patients to help lead a healthy and normal life and to prevent more potential diseases efficiently by offering injection service.

CSL has shown strong, stable growth and the ability to manage expenses when the time calls for it, such as after the acquisition.

Compared with other competitors, CSL has shown outstanding performance with stable and robust growth in the past both in revenue the share price.

Even though CSL at 40x PE seems expensive, CSL is in line with its major competitor BAX and continues to show promise and predictable upside.