Today, we will look at why we like Origin Shares (ASX:ORG) as a dividend play and some research on our origin share price forecast.

Origin Energy (ASX:ORG) is a leading integrated energy company and Australia’s largest energy retailer by revenue size and customer accounts.

With a new technology acquisition in play, Origin plans to improve its customer experience and reduce costs with a new highly automated platform called Kraken.

With this new platform and reduced costs, Origin shares could see growth in their EPS and dividends in the near future.

Even though growth in the ORG share price won’t be spectacular like a tech stock, as a utility, Origin is a good and steady dividend play with growth potential that can add a dependable ballast to a portfolio.

Table of Contents

- 1 About Origin Shares (ASX:ORG)

- 2 Insider Buying of Origin Shares (ASX:ORG)

- 3 Covid-19 Pandemic Impact on Origin Shares (ASX:ORG)

- 4 Origin Shares (ASX:ORG) Opportunities and Threats

- 5 Origin Shares (ASX:ORG) Financial Analysis

- 6 Origin Shares (ASX:ORG) Dividend

- 7 Origin Shares (ASX:ORG) Peer Analysis

- 8 Conclusion

Origin’s market capitalisation is ~$AUD7.72 billion.

The company was formed as a result of a demerger of Boral Limited in February 2000 to separate the energy business from the building and construction materials business.

After the merger, the South Australian Gas Company (SAGASCO) became part of Origin.

Origin’s main source of revenue comes from supplying gas and electricity to ~30% of the East Coast of Australia.

The company is the upstream operator for Australia Pacific LNG (APLNG) and responsible for the development of its CSG fields.

Origin owns a 37.5% interest in APLNG.

The company has natural gas basins in Queensland, Western Australia, and the Northern Territory.

It also has electricity power stations in all states in Australia, bar, Northern Territory, Tasmania, and ACT.

The diverse basins help hedge against any adverse weather events which could affect supply.

In addition, Origin has recently expanded into providing mobile phone and home internet products.

Recently, company non-executive directors, Michael McCormack and Steven Sargent (Non-Executive Deputy Chairman) made on-market purchases. McCormack purchased 100,000 Origin shares at an ORG share price of $4.97 on 18th December 2020.

Sargent purchased 10,000 Origin shares at an ORG share price of $4.86 on the 21st of December 2020.

Peter Lynch one of the greatest investors of all time sums up insider buying as, “insiders might sell their shares for any number of reasons, but they buy for only one, they think the price will rise”.

Buying from executives involved in the day-to-day running of the business is generally a strong indicator that they believe in the business.

Australian Super Pty Ltd has also increased its position from owning 8.39% of all Origin shares to 9.39%.

The Covid-19 pandemic caused a reduction in demand for energy, however, this is mitigated by the lack of competition in the gas market which accounts for ~45% of Origin shares’ revenue.

This means pricing isn’t competitive with international markets.

Thus, the price of gas remains higher on the East Coast (Gas Inquiry 2017-2025 Interim Report July 2020).

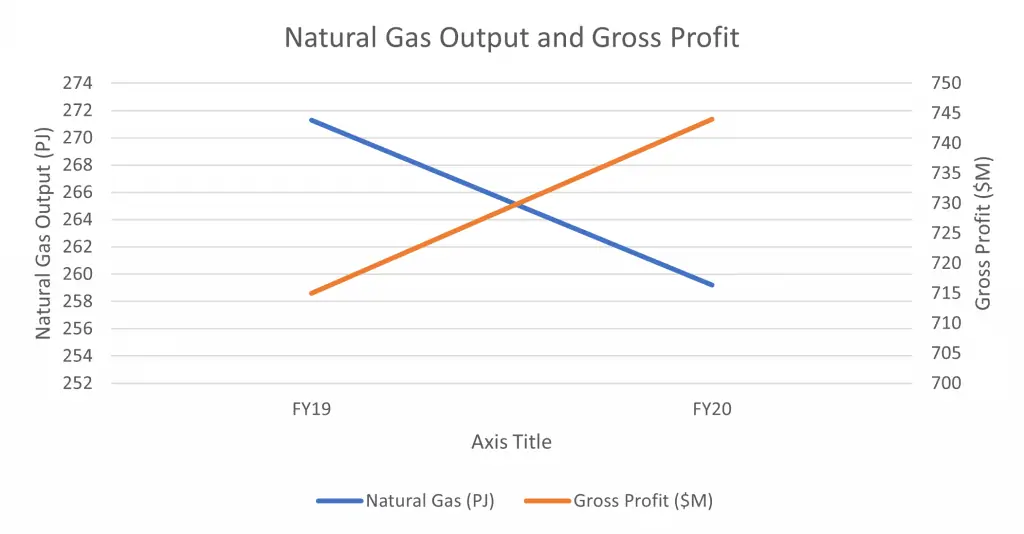

As a result, Origin was able to produce more profitable natural gas in 2020 (see figure 1).

Origin also has a strong capacity to increase production if there is an increase in demand for LNG.

Distribution breakeven is expected to be in the range of US$24-28/bbl. The forecasted price is above US$44/bbl in the near term.

Figure 1: Origin Natural Gas Output and Gross Profit

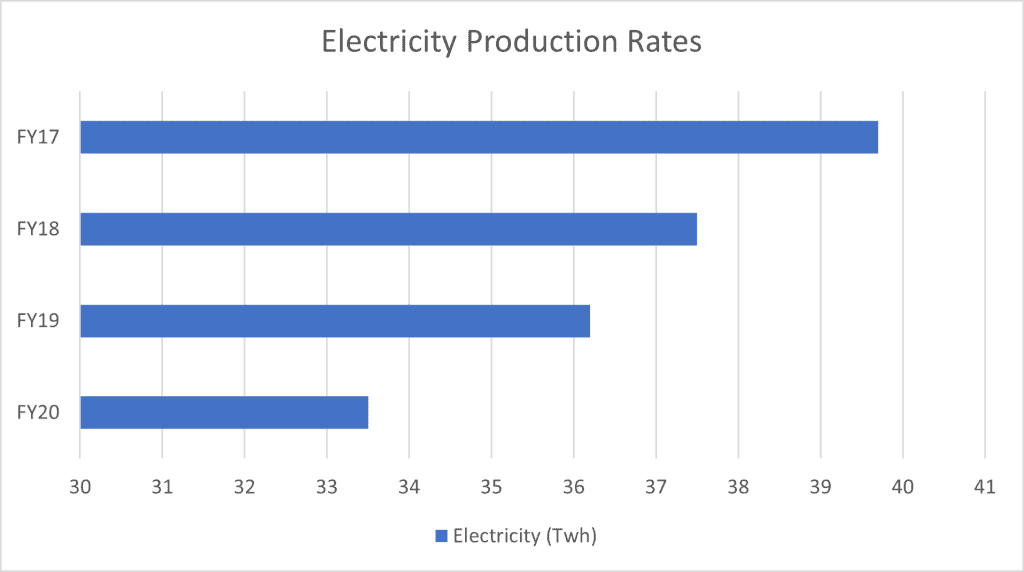

Although the trend with electricity production rates has been down, the impact of Covid-19 resulted in a sharp decline of ~7.5% (more than 2x the previous year’s decline) as shown below in figure 2.

Figure 2: Origin Electricity Production Rates

Source: Data sourced from Origin Annual Reports

Kraken Platform

Origin acquired the license for Kraken as well as a 20% stake from Octopus Energy who is based in the United Kingdom.

Karken manages the end-to-end process for customers and allows Origin to gain real-time analytics of customer needs, which assists in reducing customer churn.

Origin expects an immediate savings of A$70-80M in 2022 and for it to grow to as much as A$150M annually within the next 5 years.

Total capital expenditure for FY20 and FY19 was $500M and $341M.

Based on the above average, the Kraken platform will save as much as 20% in FY22 and potentially up to 36% within the next 5 years.

Potential Gas Shortfall

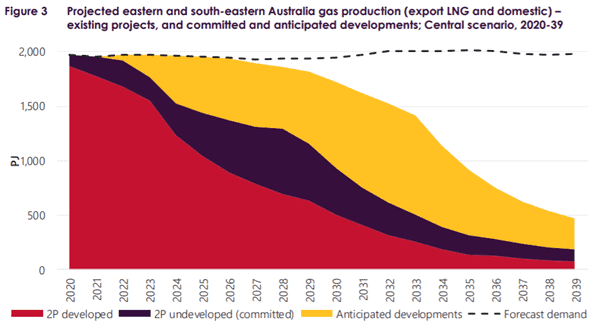

Governments are worried about a potential gas shortfall in the coming years.

The Victorian government lifted its moratoria on onshore conventional natural gas exploration and the Queensland government released more acreage for exploration.

This suggests that the domestic price of gas could increase in the coming years as new projects will take several years before coming online.

When the price of LNG increases, Origin’s capacity to increase supply will be beneficial.

Source: Australian Energy Market Operator, Gas Statement of Opportunities, March 2020.

Government Regulation

The introduction of the Treasury Laws Amendment (Prohibiting Energy Market Misconduct) Act 2019 creates uncertainty as we are unsure of how it will affect Origin or the industry.

The new legislation requires energy retailers to pass on savings to consumers where there is a sustained and substantial reduction in costs for the company.

It also prevents energy companies from distorting or manipulating wholesale electricity prices and stops them from withholding electricity financial contracts for anti-competitiveness reasons.

The Federal government has also established an ‘Energy Made Easy’ website which makes it easier for customers to compare the prices of energy providers.

This may allow smaller competitors to compete who weren’t previously able to, due to branding constraints.

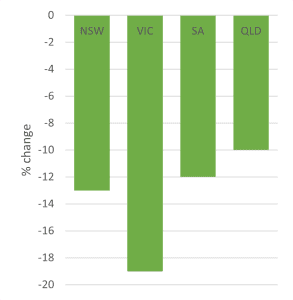

Additionally, the Australian Government has introduced price caps on retailers’ electricity standing offers from 1 July 2019.

Between this time and January 2020, standing offer prices for residential customers have fallen considerably (see figure 4).

However, electricity standing offer prices remain higher than what the market offers. Origin’s (ASX:ORG) wholesale costs are relatively fixed (see figure 5).

Thus, margins are leveraged to movements in wholesale market prices. This reduces Origin’s exposure to fluctuations with costs.

Figure 4: Change in residential standing offer prices since the introduction of price caps.

Source: Australian Energy Regulator, State of The Energy Market 2020.

Figure 5: Pricing and uses of gas

Source: Origin Annual Report 2020.

Shift Towards Lower Emissions

The electricity sector is the largest contributor to national carbon emissions, accounting for 34% of Australia’s total emissions.

Origin (ASX:ORG) has already invested in renewables in its quest to lower emissions.

1,400MW of their total 7,400MW generation portfolio is solar and wind energy.

Origin is collaborating with Jemena (Gas and electricity distributor on the East Coast) and the Australian Renewable Energy Agency, who are funding a A$15M program to explore green hydrogen production and a connection across gas and electricity grids.

Legal Dispute

Origin is currently involved in a long-standing dispute (since 2014) with Tri-Star Group, which is now in the Queensland Supreme Court.

The dispute is over whether a reversion trigger occurred when Origin entered a 50/50 joint venture agreement with ConocoPhillips to develop its CSG assets which included the interests transferred by Tri-Star.

If proven, APLNG would have no further use of the asset which produces more than 50% of their income and would be liable to back pay billions of dollars in royalty payments.

This also accounts for ~60% of Origin’s revenue. APLNG filed an amended defence and counterclaim in the reversion proceeding in May 2020 and defence and counterclaim in April 2020.

ORG Share Price

The ORG share price has fallen ~48% from pre-Covid 19 highs of $8.74.

The companies underlying energy market EBITDA was down 12% and integrated gas market EBITDA down 38% on the prior half-year results.

These were due to the impact of higher network costs due to Covid-19 impacts (one-off cost) and a fall in wholesale commodity prices due to the Covid-19 impacts.

Given Australia’s ability to handle the virus efficiently and the imminent rollout of vaccines, Origin’s current share price may be oversold.

A report suggests that 93% of jobs that were lost due to the pandemic have now been recovered.

However, it seems that the market is not favouring a return in the energy sector with the main peer AGL also struggling to attract investors also.

AGL’s share price is down ~50% since pre-Covid 19 highs.

At first glance the statutory profit falling from $1,211M FY19 to $13M HY21 is alarming.

However, the fall was due to a $1,215 accounting claim on non-cash APLNG impairment and also onerous contract provision charges, reflecting lower oil and LNG price assumptions in the near term due to the impacts of the Covid-19 pandemic.

Basic/statutory earnings per share dropping from 68.8cps in FY19 to 0.7cps in HY21 can also be explained mainly by the above fall in statutory profit, due to the Covid-19 pandemic and the shutdown of businesses due to lockdowns which impacted demand (as shown in figure 6).

Source: Origin Energy Quarterly Report December 2020

Further, basic earnings per share (EPS) seems to fluctuate drastically within Origin shares and its peers (refer to figure 7) which is why we are not too concerned by the change.

Figure 7: Earnings Per Share Peer Comparison

The HY2021 results display strong free cash flow despite the reduced profits. Origin shares has $655M free cash flow available in HY2021 compared to $680M in HY2020.

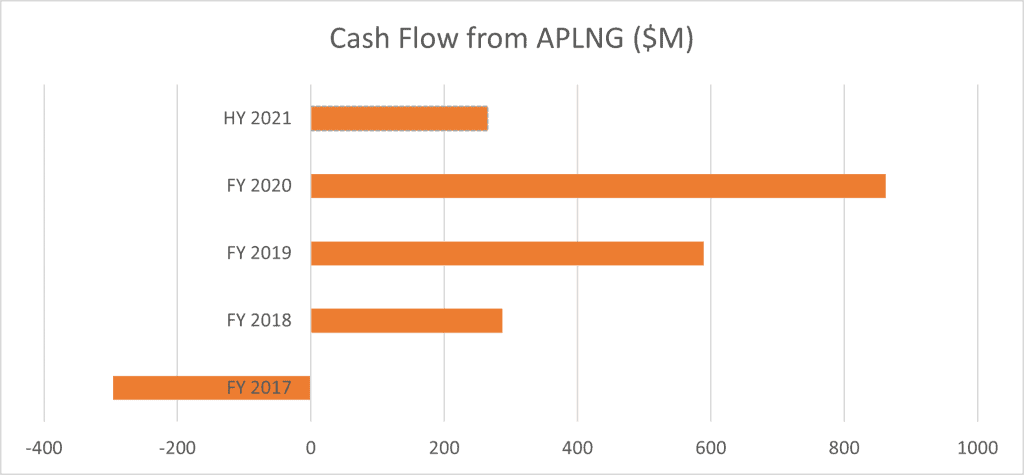

This remained strong due to the consistent cash distributions from APLNG (see Figure 8) as well as reductions in capital expenditure, interest, and tax payments.

Origin’s (ASX:ORG) benefits from their large 4.2M customer accounts as it makes the economics of their projects more attractive.

Their new Kraken platform will aim to grow on this.

Recently AGL (competitor) agreed to pay $A115M for 215,000 customers, which equates to $A535 per customer.

If we use that number, Origin’s customer base is valued at a minimum of $A2.247B.

Cash Flow from investing activities grew 46% from 589M in FY19 to 862M in FY20 due to a continued increase in cash distributions from APLNG (see figure 8).

Figure 8: Cash Flow from APLNG (Investment Activities)

Origin plans to pay out an unfranked interim dividend of 12.5 cents per Origin share, representing 34% of free cash flow.

At the current ORG share price, the grossed-up dividend yield is 3.87%.

The board will continue to target a payout ratio of 30 to 50% of free cash flow per annum in the future.

This interim dividend of 12.5 cps at first appears to be unsustainable when looking at the recent HY21 statutory EPS of 0.7 cps.

However, a bulk of Origin’s revenue comes from their APLNG investment which appears as revenue from investment activities (see figure 8).

As a result, these profits appear as underlying profits and not statutory profits.

Hence, a better indication when comparing the EPS to dividend payout would be underlying EPS which is 12.7 cps HY21.

Given the expected bounce back in commodity prices and the reopening of businesses, Origin should be able to maintain its dividend distribution.

Free cash flow is another important focus when seeing if dividends are attainable.

As you can see in the below chart (Figure 9), Origin’s free cash flow has been consistent and in excess of cash needed for a dividend distribution which is reassuring from a future dividend perspective.

Figure 9: Free Cash Flow and Cash Amount Needed for Dividend Distribution

EBITDA is an important measuring tool that shows earnings before, interest, taxes, depreciation, and amortization.

Origin shares have the largest earnings out of its peers. A reduction in EBITDA of 21-31% is predicted in the most recent company guidance.

This is based on regulatory changes and Covid-19 impacts.

Even with this reduction, it is likely that Origin shares will have the strongest earnings out of the peers, hence the largest market share.

Net profit margins have remained consistent with Origin even with the fall in oil and gas prices as they are hedged through fixed pricing which was discussed earlier.

Another reason is that their APLNG profit margins have increased this financial year, as they can produce more.

At the current ORG share price, return on equity has fallen for Origin shares this financial year primarily due to funds being invested into the new Kraken platform (Octopus).

Figure 10: Peer Comparison

From a dividend yield perspective, AGL has been outperforming Origin.

However, it is important to note that Origin is balancing rewarding shareholders with dividends whilst also reinvesting into the growth of the company.

While Financial Ratios are a good tool to see the profitability of a business.

When using this, it is important to view the company from a holistic point of view.

Origin’s payments for their strategic partnership with Octopus (Kraken platform) would have reduced their net profit margins, return on equity, earnings per share, and dividend yield in the short term.

However, in the long term, if Kraken is successful, these metrics will improve as a result along with the ORG share price. An example of this is Origin’s investment in APLNG.

The cash flow from this investment is displayed above in figure 8.

Figure 11: Dividend Yield Comparison

*Note Energy Australia not included, as they did not pay dividends during this period.

Conclusion

It is likely that as Covid-19 vaccines begin to roll out and businesses resume ‘normal’ trade, there will be an uptake in demand for energy.

However, it appears that international borders will still be closed for some time, thus, it would be unlikely that demand returns to pre-Covid 19 highs in the short term on the back of vaccines alone.

The record amount of government stimulus means it is likely that both private and public infrastructure spending will increase.

This would likely increase energy consumption.

Therefore, we cannot rule out that energy demand will not return to pre-Covid 19 levels.

With a long-term outlook, the Kraken platform could achieve large capital expenditure savings and a possible shortfall of gas could improve Origin’s margins.

Demand will always exist for energy and Origin (ASX:ORG) have the majority of the market share which provides stability in revenues even when there are fluctuations in commodity prices.

The main risks for Origin shares are the outcomes of the legal dispute and the effects of the new electricity regulations.

However, they may be displaced by the heavily reduced share price (48% cheaper than pre-Covid 19 highs) and the predicted dividend yield of over 6% with the current ORG share price in a low-interest environment.