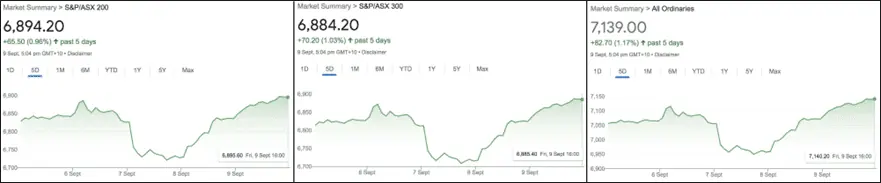

The Australian markets broke their multi-week losing streak by inching into the green as commodity prices bounced in the later half of the week, leading to a solid rebound in the materials sector.

Markets were weak in the first half of the week as major central banks such as Canada, the ECB, and the RBA hiked rates in tandem, taking commodities down with them.

However, energy and miners snapped higher on Friday on strong demand prospects, better-than-expected GDP figures, and comments from the RBA Governor about a potential slowing of the pace of rate hikes going forward.

The Materials and Technology sectors were the top gainers.

However, Energy, Consumer Staples, and Utilities ended with losses.The ASX200, ASX300, and ASX Ordinaries closed the week up 0.96%, 1.03%, and 1.17%, respectively.

Table of Contents

Last Week ASX In Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) had a stellar week gaining 5.13% after getting bludgeoned last week.

Electric-related miners and ore miners got a shot in the arm after some real estate projects in China were restarted and a report from the Federal Chamber of Automotive Industries reported breakneck EV demand.

Major mining players BHP (ASX:BHP), Rio Tinto (ASX:RIO), South32 (ASX:S32), and Fortescue Metals (ASX:FMG) shot up 2.78%, 3.06%, 4.79%, and 9.09% respectively.

Mineral Resources (ASX:MIN) rocketed higher by 21.62% after rumors surfaced that the company was spinning off its lithium business.

New energy players therefore got a shot in the arm and IGO (ASX:IGO), Lynas Rare Earths (ASX:LYC), Allkem (ASX:AKE), and Pilbara Minerals (ASX:MIN) clocked impressive gains of 13.62%, 5.76%, 19.31%, and 24.44%.

A spark in gold prices sent Newcrest Mining (ASX:NCM), Evolution Mining (ASX:EVN), and Northern Star Resources (ASX:NST) higher by 3.22%, 2.46%, and 3.34%.

Turmoil in energy security and climate awareness pushed uranium producers Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) northwards by 16.35% and 12.79%.

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) closed the week negatively by 2.6% as simultaneous rate hikes spooked recession fears and sent oil tumbling; however, losses were recouped to a large extent.

Sector majors Woodside Energy (ASX:WDS), Beach Energy (ASX:BPT), and Santos (ASX:STO) tanked 5.88%, 1.79%, and 0.70%.

However, coal remained strong as Russia halted natural gas supplies to the EU leading to jitters around the upcoming winter.

Coal players New Hope Corporation (ASX:NHC), Stanmore Resources (ASX:SMR), Whitehaven Coal (ASX:WHC), and Yan Coal (ASX:YAL) shot 4.33%, 0.88%, 4.8%, and 2.67%.

Yancoal’s majority shareholder, China-based Yankuang Energy, terminated its takeover bid.

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) had a rather uneventful week closing nearly flat with a minor gain of 0.70%.

Big banks Commonwealth Bank of Australia (ASX:CBA), National Australia Bank (ASX:NAB), and Westpac (ASX:WBC) dipped 1.02%, 2.04%, and 0.75% while Australia New Zealand Bank (ASX:ANZ) closed higher by 2%.

Smaller banks Bendigo Adelaide (ASX:BEN) and Bank of Queensland (ASX:BOQ) slumped 3.06% and 2.99%.

Insurers Suncorp (ASX:SUN), QBE Insurance (ASX: QBE), and Insurance Australia Group (ASX:IAG) inched up by 1.21%, 3.45%, and 0.22%.

Wealth Managers Platinum Asset Management (ASX:PTM), and Magellan (ASX: MFG) were in the green by 0.61% and 0.97% while AMP (ASX:AMP) ended down 1.31%.

Magellan reported a further drop of A$1.3 billion in AUM.

ANZ and NAB promptly raised home loan rates by 0.50% to pass on the RBA hike.

With rate hikes done with (as of now), the ASX All Technology Index (ASX:XTX) also received a tailwind from good economic data and shot up 3.77%.

Platform companies REA Group (ASX:REA), and RedBubble (ASX:RBL) went up by 0.49% and 2.52% while Domain Holdings (ASX:DHG) and Carsales.com (ASX:CAR) dumped 0.36% and 1.2%.

SaaS players Xero (ASX:XRO), Appen (ASX:APX), Nuix (ASX:NXL), and WiseTech Global (ASX:WTC) posted solid gains of 7.2%, 8.1%, 37.1% and 6.2% respectively.

Nuix was chased up by investors on rumors that it received a takeover bid from US-based business intelligence software company Reveal, resulting in a trading halt of the stock.

BNPL companies Block (ASX:SQ2), Sezzle (ASX: SZL), and Zip Co. (ASX:Z1P) shot up 6.61%, 6.71%, and 2.92% while MoneyMe (ASX:MME) continued to tank 5.56% after last week’s discounted issue of stock.

Semiconductor maker Altium (ASX:ALU) and data-center operator NextDC (ASX:NXT) ended up 8.49% up and 3.72% down, respectively.

POS and payments firm Tyro Payments (ASX:TYR) shot up 43.98% after rejecting a buyout offer.

ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX:XNJ) ended nearly unmoved and was down 0.32%.

Industrial commodities makers Boral (ASX:BLD) and ADBRI (ASX:ABC) closed lower by 1.06% and 1.66% while Brickworks (ASX:BKW) ended in the green by 2.67%.

Heavyweights Amcor CDI (ASX:AMC) and Reece (ASX:REH), gained 0.73% and 1.58% while Brambles (ASX:BXB) and Reliance Worldwide (ASX:RWC) floundered by 3.42% and 1.62%.

Infrastructure companies Transurban Group (ASX:TCL) and Qube Holdings (ASX:QUB) were up 0.36% and down 2.24%.

Airlines Qantas (ASX:QAN) and Air New Zealand (ASX:AIZ) gained 1.45% and lost 0.83% respectively.

Qantas was embroiled in a minor controversy over executive pay.

Consumer Discretionary Index (ASX:XDJ)

The Consumer Discretionary Index (ASX:XDJ) inched up 0.70%.

Entertainment and Hospitality companies Skycity Entertainment (ASX:SKC) and Star Entertainment (ASX:SGR) closed lower by 0.4% and 0.37%. Travel companies Webjet (ASX:WEB) and Flight Centre (ASX:FLT) lost1.22% and 0.99% while Corporate Travel Management (ASX:CTD) inched up 1.96%.

Retailers Harvey Norman (ASX:HVN), Temple and Webster (ASX:TPW), Kogan (ASX:KGN), Nick Scali (ASX:NCK), and JB Hi-Fi (ASX:JBH) all took to bullish ways and shot up 3.12%, 14.87%, 5.07%, 4.50%, and 3.03% respectively.

While TPW soared on bullish broker reports, Appliance maker Breville (ASX:BRG) slipped 7.1% on broker downgrades.

Food brands Dominos Pizza (ASX:DMP) and Collins Foods (ASX:CKF) inched up 0.93% and 0.52%.

Consumer Staples Index (ASX:XSJ)

The Consumer Staples Index (ASX:XSJ) closed the week down 1.49% after a strong performance last week.

Majors Coles Group (ASX:COL) and Woolworths (ASX:WOW) ended down 1.77% and 2.11% while Wesfarmers (ASX:WES) closed 1.69% up.

In other news, shareholders approved Woolworth’s acquisition of MyDeal.com A$243 million.

Food producers Bega Cheese (ASX:BGA) and Costa Group Holdings (ASX:CGC) went down 3.57% and 1.52% over the week while Tassal Group (ASX:TGR) and GrainCorp (ASX:GNC) closed nearly flat and up 1.60%.

Baby brands a2M Milk (ASX:A2M) and Bubs Australia (ASX:BUB) tanked 4.79% and 8.93%.

ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) was up a lukewarm 0.78% up for the week. Healthcare providers Healius (ASX:HLS) and Fisher and Paykel (ASX:FPH) ended up at 1.94% and 3.97% while Ramsay Healthcare (ASX:RHC) gave up 1.58%.

Healthcare equipment makers Cochlear (ASX:COH), CSL Ltd. (ASX:CSL), and Resmed CDI (ASX:RMD) gained by 1.81%, 8.38%, and 1.38% while Sonic Healthcare (ASX:SHL) lost 2.92%.

Biotech firms Imugene (ASX:IMU) and Mesoblast (ASX:MSB) ended down 2.16% and flat, respectively.

After the painful loss in the past week, the Real Estate Index (ASX:XPJ) this time inched into the green by 0.65%.

Industrial-focused players Goodman Group (ASX:GMG) and Charter Hall Group (ASX:CHC) closed up 0.32% and 1.72%.

Retail players Mirvac Group (ASX:MGR), Vicinity Centers (ASX:VCX), and Dexus Group (ASX:DXS) ended higher by 1.92%, 3.77%, and 0.12%.

ASX Utilities Index (ASX:XUJ)

The ASX Utilities Index (ASX:XUJ) fell by 2.20%.

Sector players AGL Energy (ASX:AGL) and Origin Energy (ASX:ORG) ended down 3.77% and 3.47% while APA Group (ASX:APA) closed up 0.38%.

ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) ended the week nearly flat with a minor loss of 0.25%.

Sector players Telstra (ASX:TLS) and TPG Telecom (ASX:TPG) tanked 0.51% and 1.24% while Chorus (ASX:CNU) ended up by 0.78%.

Other players Spark Infrastructure (ASX:SPK) and Aussie Broadband (ASX:ABB) ended flat and 3.53%.

This Week In ASX Stocks

| Sep-22 | 12th | 13th | 14th | 15th | 16th |

|---|---|---|---|---|---|

| ANNUAL REPORT | AUH, AUI, BEM, BTI, DUI, FIN, GWA, IVR, KNI, PAN, RAG, RMX, VAF, VAS, VMIN | BCC, BEN, BHP, CGN, HIT, HLS, RFX, SVY, WCG | ALY, AMX, AZY, FEX, GFL, INR, LOV, M2R, PTB, TMG, WML | AOP, CAI, EUR, FIJ, GSR, HMI, LT2, LT4, LTF, OPN, POL, PPT, PTM, SSM | 5GN, ABR, AD8, AKG, ARU, BOA, CCJ, CCX, COL, CWY, DGL, EQT, EVT, FRI, GLB, GTE, JBH, KFM, KSN, LT3, LT5, LT6, MPL, MYS, NML, ORG, PNN, QAN, RND, SBM, SFC, SOV, STX, TNG, X64 |

| INTERIM REPORT | SMG | BGP | – | – | – |

| PRELIMINARY REPORT | – | – | – | MYR | – |

| QUARTERLY REPORT | – | – | – | – | – |

New ASX Listings

| Name | Date | Business | Amount Raised | Price/Share |

|---|---|---|---|---|

| Octava Minerals | 14th September | Minerals Exploration and Development | A$6M | A$0.20 |

Market and Economic Outlook

Last Week’s Print

On Monday, Australia reported its MoM Retail Sales for August, which came in at an expected 1.3%.

This was followed by the RBA Interest Rate Decision on Tuesday, which culminated in another 50 basis point hike, taking the cash rate to 2.35%.

After a dull Wednesday, RBA Governor Lowe’s comments about possibly slowing the pace of hikes moving forwards gave a positive impetus to the market, especially the technology sector.

On Wednesday, Australia reported its Q2 GDP at 0.9% QoQ and 3.6% YoY.

While the economy looks strong with worker supply shortages continuing to persist, real wages are still negative and have not adjusted to the same extent as prevailing inflation.

What’s worrying global markets are massive rate 75 bps hikes from Canada and the ECB, and an upcoming one from the US Fed later this month, with an expected 50-75 bps hike.

On Thursday, Fed Chair Powell continued his iteration of the Fed’s commitment to reign in inflation at all costs.

However, the US appeared to have discounted this hawkish stance and staged a solid rally on Friday.

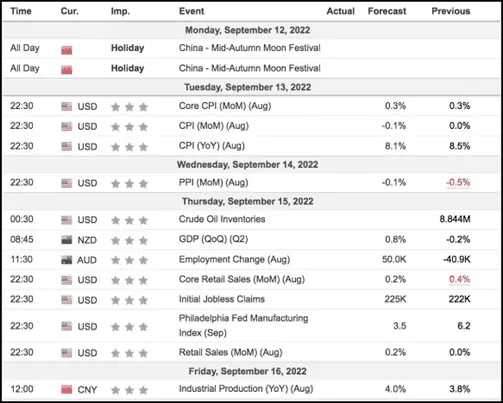

This Week

Important data events for next week are as follows :

Forex Outlook

AUD/USD

AUD/USD closed at 0.68419, well above the previous weekly close of 0.68059 after testing the key support zone at 0.67000 despite a 50bps rate hike by the RBA on Tuesday.

On Friday, the pair rebounded smartly, opening at 0.67500 and ending the day at 0.68419.

Friday’s action on AUD/USD, also likely to have been triggered by short-covering, was in line with a general tilt towards “risk-on,” as reflected by a decent rally on Wall Street.

The resource sector on the ASX last week ended over 5% higher amidst a robust print for the Australia’s current account, which increased to $18.3 billion for the June Quarter – driven by strong export prices and the 13th consecutive surplus reported – the longest such period on record.

The reversal in the pair is significant given the hint on Thursday from RBA Gov Philip Lowe that the bank could take its foot off the pedal of rate hikes.

However, a crucial fact that played a role in Friday’s rally may have been the sharp erosion in dollar strength as evidenced by the decline in the Dollar Index on the last three days of the week.

Will the rally last? That depends on next week’s crucial data, which is US CPI/PPI and Retail and Australian Employment data.

AUD/NZD

AUD/NZD ended the week at 1.12034, well above the previous week’s close of 1.11360.

As expected last week, the pair has resumed its upward trajectory and penetrated, again, the upper line of the sideways rectangle plotted in blue lines, the breakout marked in the ellipse.

On technical appearances, AUD/NZD has embarked on an uptrend and is likely to breakout of the rectangle.