The Australian stock market suffered at the hands of investors last week who headed for the exits after multiple sources of data (worse-than-expected inflation, better-than-anticipated retail sales) showed the US Fed would remain hawkish in its interest decision next week.

This only reinforced expectations of a global trend of further rate hikes.

The ASX ended in the red for the third time in four weeks.

In Australia, a strong jobs report (though slightly under expectations) and comments from Governor Philip Lowe echoed much of the same sentiment.

There were also rumblings about the potentially torrential rainfall due to La Nina (the third year on the trot), its adverse impact on crops and, therefore, inflation.

After a long time, all 11 ASX sectors closed in the red for the week.

The biggest three losers were Real Estate, Technology, and Industrials.

However, Utilities, Financials and Energy lost the least.

The ASX200, ASX300, and Ordinaries closed the week lower by 2.25%, 2.26%, and 2.29%, respectively.

Table of Contents

Last Week In ASX Stocks

The ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) closed the week down a painful 2.89% after fears of aggressive hikes inducing a recession took hold.

Sector majors BHP (ASX:BHP), Rio Tinto (ASX:RIO), South32 (ASX:S32), Fortescue Metals (ASX:FMG), and Mineral Resources (ASX:MIN) tanked 2.76%, 3.34%, 8.61%, 3.23%, and 7.49%.

Rio Tinto and its biggest customer, China Baowu Steel Group Co. Ltd, have agreed to enter into a joint venture with respect to the Western Range iron ore project in the Pilbara, Western Australia, investing $2 billion to develop the mine.

New energy miners Pilbara Minerals (ASX:PLS), Vulcan Energy Resources (ASX:VUL), Allkem (ASX:AKE), Lynas Rare Earths (ASX:LYC), and IGO (ASX:IGO) crashed 2.13%, 2.58%, 5.1%, 5.1%, and 4.58%.

Gold miners tumbled after gold prices crashed to a more than two-year low of US$1,661; Newcrest Mining (ASX:NCM), Northern Star Resources (ASX:NST), and Evolution Mining (ASX:EVN) slumped 6.47%, 6.13%, and 12.93%, respectively.

Uranium miners Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) also tanked after a stellar performance in the previous weeks and lost 6.72% and 5.59%.

The ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) cracked 1.49% on recessionary fears.

Heavyweights Woodside Energy (ASX:WDS), Santos (ASX:STO), and Beach Energy (ASX:BPT) ended down 1.36%, 0.39%, and 2.39%.

Coal miners finally broke their monster winning streak with Whitehaven Coal (ASX:WHC), Stanmore Resources (ASX:SMR), and Yan Coal (ASX:YAL) ending down 2.69%, 6.20%, and 11.30% while New Hope Coal (ASX:NHC) and Coronado Global (ASX:CRN) closed higher by 0.18% and 6.02%.

Yan Coal slumped on termination of its acquisition talks.

The ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) also fared poorly losing 1.29%.

Major banks Commonwealth Bank (ASX:CBA), National Australia Bank (ASX:NAB), and Macquarie Group (ASX:MQG) tanked 1.84%, 0.40%, and 4.58% while Australia New Zealand Banking Corp (ASX:ANZ) and Westpac (ASX:WBC) rose 1.03% and 0.68%.

Westpac joined ANZ and NAB to announce that it will pass on rate hikes in full to loan and mortgage holders.

Wealth managers AMP Ltd. (ASX:AMP) and Platinum Asset Managers (ASX:PTM) shot up 4.62% and 1.80% while Magellan Financial (ASX:MFG) fell 2.29%.

Insurers IAG (ASX:IAG), QBE (ASX:QBE), and Suncorp (ASX:SUN) too had a poor week and closed down by 3.33%, 2.9%, and 5.75%, respectively.

The ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX:XNJ) was amongst the bigger sector losers, down 3.95%.

Industrials commodities makers Boral (ASX:BLD), ADBRI (ASX:ABC), and Brickworks (ASX:BKW) fell 2.48%, 4.47%, and 2.13%.

Heavyweights Amcor (ASX:AMC) and Reece (ASX:REH) declined 1.48% and 5.47% while Brambles (ASX:BXB) inched up 2.12%.

Infrastructure players Transurban Group (ASX:TCL) and Qube Holdings (ASX:QUB) crashed 5.81% and 3.45% while toll operator Atlas Arteria (ASX:ALX) tanked 11.07% after announcing a $2B US acquisition that was resisted by a significant institutional shareholder.

Airlines Qantas (ASX:QAN) and Air New Zealand (ASX:AIZ) closed 0.47% and 1.65% in the green.

The ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) lost openly 2.8% for the week.

Travel companies Webjet (ASX:WEB), Corporate Travel Management (ASX:CTD), and Flight Center (ASX:FLT) gave up 2.05%, 3.8%, and 5.92%.

Entertainment and hospitality companies Star Entertainment (ASX: SGR) and SkyCity Entertainment (ASX: SKC) shot up 4.69% and 0.79%.

Star Entertainment was bid up heavily after the regulators made it clear that a suspension of the company’s license over governance issues was off the table.

Still, changes need to be made to operating practices to avoid problems such as money laundering.

Retailers Kogan (ASX:KGN), Temple and Webster (ASX:TPW), JB Hi-Fi (ASX:JBH), and Harvey Norman (ASX:HVN) ended lower by 3.22%, 2.84%, 1.55%, and 1.27% respectively.

Appliance maker Breville (ASX:BRG) tanked 2.58% due to murky conditions in China, which is a major market for the company.

Food brands Dominos (ASX:DMP) and Collins Foods (ASX:CKF) also ended 3.25% and 1.81% lower.

The ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) too had a poor week and slumped 3.39%.

Heavyweights Wesfarmers (ASX:WES), Woolworths (ASX:WOW), and Coles Group (ASX:COL) ended lower by 5%, 3.21%, and 3.88%.

Staple producers GrainCorp (ASX:GNC), Elders (ASX:ELD), Costa Group Holdings (ASX:CGC), and Bega Cheese (ASX:BGA) crashed by 4.19%, 1.67%, 3.05%, and 3.92% respectively.

Processed food makers a2M Milk (ASX:A2M) and Bubs Australia (ASX:BUB) also ended 4.4% and 0.96% in the red.

However, A2M partner Synlait Milk received continued permission to sell its infant milk formula product in China.

The ASX All Technology Index (ASX:XTX)

The ASX All Technology Index (ASX:XTX) gave back all gains from recent sessions to end 4.08% in the negative.

Platform companies REA Group (ASX:REA), Domain Holdings (ASX:DHG), RedBubble (ASX:RBL), and Carsales.com (ASX:CAR) ended lower by 1.25%, 1.19%, 8.93%, and 5.12%.

Saas players Xero (ASX:XRO), Nuix (ASX:NXL), Wisetech Global (ASX:WTC), and Appen (ASX:APX) took a beating and fell by 6.37%, 7.36%, 7.62%, and 8.02%.

Datacenter and semiconductor players NextDC (ASX:NXT) and Altium (ASX:ALU) also ended 3.04% and 7.55% in the red.

BNPL players Block (ASX:SQ2), Sezzle (ASX:SZL), MoneyMe (ASX:MME), and Zip Co. (ASX:Z1P) tanked big time at 6.88%, 13.43%, 5.62%, and 8.62% as rising rates will deal them a double blow of lower margins/higher costs and lower demand.

Fintech PushPay (ASX: PPH) crashed 9.29% for the week after its deal to get acquired by PE firm BGH fell through.

The ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) also took a beating at 3.86% down for the week.

Healthcare providers Ramsay Healthcare (ASX:RHC), Healius (ASX:HLS), and Fisher Paykel (ASX:FPH) tanked 9.16%, 4.93%, and 3.6%.

In major news from the sector, private equity major KKR walked away from its A$30 billion deal to acquire Ramsay Healthcare.

Equipment makers Cochlear (ASX:COH), Sonic Healthcare (ASX:SHL), Resmed (ASX:RMD), and CSL Ltd. (ASX:CSL) ended 1.08%, 4.49%, 1.87%, and 3.79%.

Imugene (ASX:IMU) and peer Mesoblast (ASX:MSB) closed flat and up by 4.62%, respectively.

Imugene announced an equity raise of A$80 million at an 11% discount.

The ASX Real Estate Index (ASX:XPJ)

The ASX Real Estate Index (ASX:XPJ) cracked 5.5% as rate hikes took center stage, severely hurting the highly leveraged sector’s prospects.

Sector majors across all categories such as Goodman Group (ASX:GMG), Mirvac Group (ASX:MGR), Scentre Group (ASX:SCG), Charter Hall Group (ASX:CHC), and Dexus (ASX:DXS) all ended significantly in the red between 3% – 7.5%.

The ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) fell by 3.40% thereby underperforming the market.

Sector majors Telstra (ASX:TLS) and TPG Telecom (ASX:TPG) dumped 3.54% and 5.17% while smaller peers Aussie Broadband (ASX:ABB) and Chorus (ASX:CNU) closed lower by 6.37% and 3.17%.

Lastly, the ASX Utilities Index (ASX:XUJ) outperformed, but still closed 1.33% in the red.

Major players APA Group (ASX:APA) and Origin Energy (ASX:ORG) closed down 1.82% and 2.52% while AGL Energy (ASX:AGL) inched up 1.14%.

This Week In ASX Stocks

| Sep-22 | 19th | 20th | 21at | 22nd | 23rd |

|---|---|---|---|---|---|

| ANNUAL REPORT | AML, ARR, BAP, BCK, CBO, CEL, DEG, HXG, IEL, JHC, MYL, ODE, ORR, PTR, REA | ARO, BHP, BSL, CLT, CLV, CNR, COF, CPU, CTP, CXO, CYG, ECP, GSN, MRR, MWY, NHC, OZM, PAI, PFE, PMC, SNS, SRZ, TOU | AAR, AEV, AOA, AQD, AR3, BLZ, BML, CDA, CWX, EEL, ENA, GRL, LSA, MDR, MM8, NEC, NSX, PGO, PYC, SHL, VRS | 4DX, A4N, AIV, AMD, AOU, ASQ, AUZ, AVL, AXE, AYU, AZS, BGL, BKW, BMN, CHN, CZR, DUG, EGR, EPY, ERM, ESR, FSF, GAL, HRN, HXG, JNO, KIL, KNM, KYK, KZR, MPA, MVP, MYL, NCK, ODA, OOK, ORN, POS, QPM, RDH, RDN, REG, STA, SUV, SXY, SYN, TMX, WC8 | AEF, AHK, ARL, ATL, BCB, BCN, BPM, BRI, CAD, CAN, CAV, CDT, CMW, CNB, CNJ, CUL, CZN, DAF, DEX, DGH, DKM, DYL, E2M, ECL, EFE, EQX, ERW, ESS, FYI, FZO, G50, GCY, GLE, HNR, HVM, KLS, KRR, LMG, LNK, M24, MAET, MHJ, MKR, NGY, NSM, PFT, PMGOLD, PNR, PNX, PRM, PVW, QEM, QVE, RCW, RDM, S2R, SEG, SGR, SIO, SNL, SVL, TAM, TDO, TGR, TLM, TMK, TMR, TRT, TSO, UBN, WAT, WGN, WHC, WMG, YBR, YRL, ZER, ZMI, ZOR |

| INTERIM REPORT | SIG | NZK | |||

| PRELIMINARY REPORT | KMD, NHC | BKW, FSF, PMV, SOL | |||

| QUARTERLY REPORT | – | – | – | – | – |

New Listings

| Name | Ticker | Date | Business | Amount Raised | Price/Share |

|---|---|---|---|---|---|

| Australia Sunny Glass Group | ASX: AG1 | 21st September | Glass production and supply for architectural purposes | A$7.5M | A$0.35/share |

Market and Economic Outlook

Last Week’s Print

The week kicked off with the much-awaited US CPI data for August on Tuesday which came in higher (versus expectations of a decline) given that energy prices deflated.

MoM and YoY CPI for August were reported at 0.1% and 8.3% while MoM and YoY Core CPI were 0.6% and 6.3%, respectively.

The following day, the US reported its Producer Price Index at -0.1%.

On Thursday, New Zealand reported its Q2 QoQ GDP at 1.7% while Australia’s job report showed 33.5k new jobs were added in August, against expectations of 35k.

US Retail Sales for August grew 0.3%, empowering the Fed to hike aggressively at the next meet.

Initial Jobless Claims came in at a better than expected 213k.

Australian employment data showed the labor market added 58,800 full-time jobs with an aggregate increase in employment of 33,500, close to consensus expectations of 35,000.

Lastly, on Friday, Chinese Industrial Production surprised to the upside with 4.2% growth YoY, against the consensus of 3.8%.

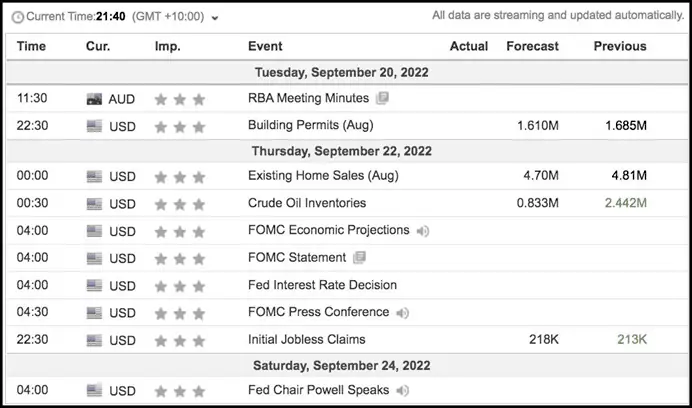

Next Week

Important data events for next week are as follows:

Forex Outlook

AUD/USD

AUD/USD closed at 0.67186, well below the previous weekly close of 0.68419 after violating the key support zone at 0.67000, and plumbing depths of 0.66700.

The AUD/USD started the week on an optimistic note, carrying over the momentum from the equity-fuelled rally on Wall Street the previous Friday.

Unfortunately, the pair was pummelled down near to the key support zone of 0.67000 after US CPI data ran hotter than expectations.

US retail sales also saw a surprise bounce, rising 0.3% and better than consensus.

This only served to further fan fears of malevolent interest rate action by the Fed next week (September 22).

As a result, investors caved in to ‘risk-off,’ reflected by negative action on the ASX, with all sectoral indices ending in the red in the weekly result.

The usual ‘rate-driven’ suspects, namely Real Estate and Technology, were the biggest losers.

Even defensive, consumer-oriented sectors posted sizable losses as the ‘R-word loomed large in the media and investors’ mindset, with a solid Australian jobs report failing to lift.

This sentiment was also visible in the technical action on AUD/USD, which on Friday convincingly violated the 0.67000 line, before recouping some losses after the release of better-than-expected Chinese numbers on industrial production and retail sales.

Post-CPI, the dollar index printed a power white candle, and subsequent sideways action shows it is perhaps only marking time near the highs of this candle, and may move higher on the smallest pretext.

The outlook for AUD/USD continues to be gloomy.

AUD/NZD

AUD/NZD ended the week at 1.12057, marginally above the previous week’s close of 1.12034.

The pair has now consolidated its breakout of the sideways rectangle, though it has met with strong resistance at 1.12600, from which zone it has retraced its steps on five recent occasions.

However, AUD/NZD has not retested the 1.18000 level, the upper line of the rectangle, despite the drumbeat around risk-off, recession, and rate hikes.

This, despite the solid, better-than-expected GDP growth of 1.7% in the June quarter, that put paid to fears of a recession in New Zealand, at least for now.

Also, the solid print on manufacturing PMI of 54.9, which roundly beat the consensus of 52.5, marked the highest level since July 2021, and ran counter to the global manufacturing trend.

That means the uptrend in AUD/NZD is likely still in place.