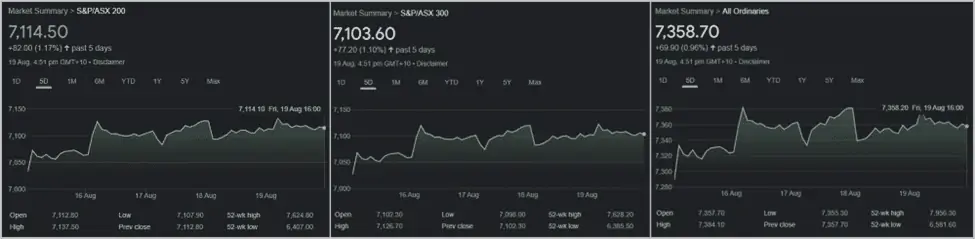

The Australian share market ended in positive territory for a fifth week in a row, receiving a boost from energy stocks.

The local bourse also received a tailwind from better-than-expected earnings from Walmart, which raised hopes that a recession in the US may be avoided after all.

Furthermore, China is expected to announce stimulus measures after recently reporting downbeat economic data.

These factors were tempered somewhat by a hawkish FOMC minute that said inflation was not showing signs of subsiding and that more rate action was necessary; however, some analysts speculated that a September rate hike may turn out at 0.50% as opposed to 0.75%.

Meanwhile, a lower-than-expected wages growth at home made the case for a smaller than 50-basis-point hike in the range of either 40 basis points or 25 basis points.

Also, gains in the domestic Materials and Energy sectors, primarily due to robust earnings reports, such as from BHP, bolstered ASX stocks.

The ASX200, ASX300, and Ordinaries ended the week with gains of 1.17%, 1.10%, and 0.96% respectively.

Table of Contents

Last Week In ASX Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) gained this week by a solid 2.54%, driven by a thumping earnings report from BHP, though sector majors presented a mixed performance.

BHP (ASX:BHP), Rio Tinto (ASX:RIO), South32 (ASX:S32), and Fortescue Metals (ASX:FMG) clocked gains of 6.07%, 2.33%, 2.95%, and 0.37% respectively.

BHP reported its second-biggest profit ever, driven by surging commodity prices and record iron ore sales, and wrong-footing the market which had been bracing for disappointing numbers following Rio’s recent underwhelming earnings report.

However, Mineral Resources (ASX:MIN) closed minorly in the red.

Amidst new energy miners, while IGO (ASX:IGO) gained 1.23%, Lynas Rare Earths (ASX:LYC), Allkem (ASX:AKE), and Pilbara Minerals (ASX:PLS) corrected somewhat and gave up 0.51%, 3.45%, and 3.62% respectively.

Amidst gold producers, Northern Star Resources (ASX:NST) and Evolution Mining (ASX:EVN) lost more than 7% each, while Newcrest Mining (ASX:NCM) nudged up 0.05% after it announced a bigger-than-expected dividend payout following a strong finish to the fiscal year.

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) turned in another stellar performance, shooting up 3.50%.

Heavyweights Woodside Energy (ASX:WDS), Santos (ASX:STO), and Beach Energy (ASX:BPT) built on the previous week’s winnings by adding another 2.42%, 5.11%, and 2.73% respectively.

Santos reported a record set of full-year earnings but warned of a cost overrun at its Pikka oil project in Alaska.

On the other hand, Beach Energy missed its full-year profit estimates due to higher expenses.

Coal majors kept up their massive momentum this week too.

New Hope Corporation (ASX:NHC), Whitehaven Coal (ASX:WHC), YanCoal (ASX:YAL), and Coronado Global (ASX:CRN) gained 12.10%, 12.21%, 9.63%, and 4.26% respectively.

ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX:XNJ) gained decently by 1.22%.

Industrial commodities makers Brickworks (ASX: BKW), ADBRI (ASX: ABC), and Boral (ASX: BLD) put on 3.14%, 1.53%, and 2.69% respectively.

Industrial majors Reece (ASX: REH) and Brambles (ASX: BXB) were up 3.83% and 11.73% respectively; Brambles, a global pallet maker, said full-year profit after tax rose 14% to $US593.3 million.

Amcor CDI (ASX: AMC) and Reliance Worldwide (ASX: RWC) were both up around 1.50%.

Among infrastructure players Transurban Group (ASX: TCL) was down 2.79% and Qube Holdings (ASX: QUB) fell 2.21%.

Transurban’s 2022/23 distribution to shareholders was below consensus expectations.

Airlines Qantas (ASX: QAN) and Air New Zealand (ASX: AIZ) ended mostly flat.

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) was a market contrarian, however, and ended down by 1%.

Banking heavyweights Commonwealth Bank of Australia (ASX:CBA), Australia New Zealand Bank (ASX:ANZ), Westpac (ASX:WBC), and National Australia Bank (ASX:NAB) gave up 1.08%, 4.26%, 1.46%, and 0.16%.

Regional banks Bank Of Queensland (ASX:BOQ) and Bendigo Adelaide (ASX:BEN) also slipped and were down 2.78% and 6.61% after BEN’s net profit after tax fell 6.9% to $488.1 million in the 12 months to June.

Wealth managers again put up a mixed show: While Magellan (ASX:MFG) and Platinum Asset Management (ASX:PTM) lost 4.24% and 0.27%, Pendal Group (ASX:PDL) and AMP (ASX:AMP) gained over 2% each.

Insurers too sulked and ended in the red: Suncorp (ASX:SUN), QBE Insurance (ASX:QBE), and Insurance Australia Group (ASX:IAG) all lost less than 1%.

Diversified financial services majors Macquarie Group (ASX:MQG) was up 1.36%.

ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) was up 0.93% this week.

Amongst hospitality companies Star Entertainment (ASX:SGR) and Skycity Entertainment (ASX:SKC) fell 0.68% and ended flat respectively.

Travel companies Webjet (ASX:WEB), Corporate Travel Management (ASX:CTD), and Flight Centre (ASX:FLT) headed lower by 2.1%, 4.60%, and 2.48% respectively.

Volatility in Temple and Webster (ASX:TPW) and Kogan (ASX:KGN) continued – while KGN lost 10.33%, TPW shot up 10.43%, after it was announced full-year revenue was up 31 % to $426.3 million, and upgraded its margin guidance for 2022/2023.

Peers Nick Scali (ASX:NCK), Harvey Norman (ASX:HVN), and JB Hi-Fi (ASX:JBH) were also in the loser’s corner and ended down by 3.21%, 1.89%, and 2.38% respectively.

JBH reported better than expected numbers for the 12 months to June 30, with sales up 3.5% to $9.2 billion.

Appliance maker Breville (ASX:BRG) corrected for a change and fell 4.25%; food brands continued on their declines and Dominos (ASX:DMP) and Collins Foods (ASX:CKF) fell 0.69% and 1.58% respectively.

ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) pushed higher again this week with a solid gain of 3.30%.

Sector heavyweights Coles Group (ASX:COL), Woolworths (ASX:WOW), and Wesfarmers (ASX:WES) surged higher by nearly 3% or more, charged up after Walmart’s earnings beat.

Food producers Bega Cheese (ASX:BGA), and Costa Group Holdings (ASX:CGC) ended flat.

GrainCorp (ASX:GNC) and Tassal Group (ASX:TGR) were up 6.48% and 5.09%.

Tassal, a Tasmanian salmon farming group, accepted a sweetened $1.1 billion takeover bid from Canadian aquaculture company Cooke at $5.23 per share, after three unsuccessful previous bids.

Amongst processed food makers, Bubs Australia (ASX: BUB) tanked 4.80% but A2 Milk rose 0.61%.

ASX All Technology Index (ASX:XTX)

The ASX All Technology Index (ASX:XTX) was a big loser this week, falling 3.33%.

Amongst platform companies REA Group (ASX: REA) and RedBubble (ASX:RBL) fell by 3.43% and 34.86%; RedBubble was punished by investors after it posted a $24.6 million full-year loss, compared to a $31.2 million net profit the year before.

“We are not at all satisfied with our result for the year,” Redbubble CEO Michael Ilczynski told analysts.

Carsales (ASX:CAR) and Domain Holdings (ASX:DHG) also declined 1.96% and 7.86% respectively.

Investors sold into a pop in the shares of CAR after it reported that full-year net profit after tax had risen 23 % to $161 million, and predicted “very strong” revenue and profit growth and margin expansion in 2022/23.

Saas players Xero (ASX:XRO) and WiseTech Global (ASX:WTC) clocked gains of 9.14% and 0.27% respectively.

This despite Xero board chairman David Thodey telling its annual general meeting that net subscriber growth in the United Kingdom had been “more subdued than we would like”.

Appen (ASX:APX) and Nuix (ASX:NXL) slumped over 8% each.

BNPL had another losing week: while Block (ASX:SQ2), Sezzle (ASX:SZL), Zip Co (ASX:Z1P) crashed 6.81%, 9.55%, and 17.20%,

MoneyMe (ASX:MME) went up 1.43%.

Link Administration (ASX:LNK) was down 0.11%.

In semiconductor and data center companies Altium (ASX:ALU) was up 0.95% and NextDC (ASX:NXT) gave up 1.47% each.

Thoma Bravo, a US PE firm, made an offer of $2.10 per share of Nearmap (ASX:NEA), the Sydney-based aerial mapping company.

ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) ended marginally in the green by 0.14%.

Healthcare providers Ramsay Healthcare (ASX: RHC) and Healius (ASX:HLS) shot up 2.64% and 1.33% respectively while Fisher and Paykel (ASX:FPH) crashed 6.17%.

Healthcare equipment makers ended mixed for the week – while Sonic Healthcare (ASX: SHL), CSL Ltd. (ASX:CSL) and Cochlear (ASX:COH) rose 1.42%, 0.32% and 0.28% respectively, Resmed CDI (ASX:RMD) lost 2.48%.

Cochlear posted a rise in underlying full-year earnings and looked to a stronger 2022/23 with the launch of a new sound processor.

CSL shrugged off a 6% drop in full-year net profit to $US2.26 billion after it faced higher costs to induce Americans to donate plasma.

However, biotech firms Imugene (ASX:IMU) and Mesoblast (ASX:MSB) corrected this week and were down 10.27% and 4.44% respectively.

ASX Real Estate (A-REIT) Index (ASX:XPJ)

The ASX Real Estate (A-REIT) Index (ASX:XPJ) fell 1.40%.

Among sector majors, Mirvac Group (ASX:MGR) gained 1.84% but Scentre (ASX:SCG) and Stockland Group (ASX:SGP) slumped 2.46% and 2.86% respectively.

Investors appeared to be unimpressed that Stockland reported a full-year profit that was up 25 percent to $1.38 billion.

While Vicinity Centres (ASX:VCX) fell 6.27% Goodman Group (ASX:GMG) ended flat.

Goodman reported it had lifted its full-year operating profit by 25 percent to $1.53 billion and had expanded its assets under management.

ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) was down 0.50% for the week.

Sector companies were a mixed lot; while Telstra (ASX:TLS) and Chorus (ASX:CNU) went up 2.48% and 0.51%, TPG Telecom (ASX:TPG) crashed 13.23% after reporting its half-year earnings before interest, tax, deprecation and amortisation (EBITDA) fell 5.3 per cent to $837 million;

Meanwhile, Megaport (ASX:MP1), also a big loser, fell over 7%.

ASX Utilities Index (ASX: XUJ)

Lastly, the ASX Utilities Index (ASX: XUJ) heavily underperformed the broad market, slipping over 2%.

Among sector majors AGL Energy (ASX: AGL) was a big loser at 7.76%, while Origin Energy (ASX:ORG) and APA Group (ASX: APA) fell just over 1% each.

AGL posted an greater-than-expected 58 per cent drop in net profit after tax amid “unprecedented” market volatility.

Origin reported a statutory loss of $1.4 billion for the year ended June 30, after writing off $2.2 billion associated with the hedging of high wholesale prices.

It also failed to provide profit guidance for the year ahead.

This Week In ASX Stocks

| AUGUST 2022 | 22 | 23 | 24 | 25 | 26 |

|---|---|---|---|---|---|

| ANNUAL REPORT | CHL, CNU, FLX, IHR, LBL, MEA, MPR, NHF, PGL, PIA, PL8, POW, PSI, PTL, RWC, SOR, WMI | ALC, AMA, AMX, ANN, ASB, BRI, CBR, CXL, CXZ, DET, EDC, EHE, GNG, HUB, IFM, ISU, JAN, JLG, KME, MAD, MMS, MOT, MXT, NAN, ONT, PCI, PRN, PRX, RDY, REH, RMY, RUL, SEC, SHH, SRG, SYM, TGF, UWL, WAX, WLD, XRF, NAN | 3PL, AKE, AMC, AMH, ANG, AP2, APA, APT, BMH, BVS, CAF, CGS, CIW, COS, CTE, CVW, FRI, GDA, GDC, GOZ, HMC, IDT, IPD, JCS, LAU, LYL, MAH, MSL, MSV, NSR, NST, PAB, PFP, PPG, RFF, RFG, RZI, SDG, SKC, SKT, SVW, SXE, TGG, TRJ, UNI, WAA, WOR | 4DS, A2M, AASF, AIM, AMT, AR9, AUB, BGT, BIS, BKL, BOL, BOND, CAJ, CBL, CCG, CL8, CUP, CWP, DJRE, DJW, DTC, DVL, DVR, EGG, EGL, EXP, FCL, FLT, FWD, G1A, GDG, GNE, GOVT, GTN, HT8, HUO, HZN, ID8, ILA, ITG, JIN, KZA, LGL, LVE, LVT, MHG, MHH, MHHT, MICH, NOX, NSX, NVX, OPY, PPE, PPL, PRT, QFE, QHL, QIP, QMIX, QUB, RAC, RFG, RVR, SFY, SLF, SLH, SLX, SNC, SOP, SPL, SPN, SRV, STW, TGP, TIP, TYR, WDIV, WEMG, WHC, WLE, WLS, WOO, WOW, WXHG, WXOZ, ZNO | 1AD, A3D, ACQ, ADR, AFG, AFW, AGN, AHC, AJL, AJX, AVH, AVJ, BEL, BEX, BGA, BIT, BMT, BOT, BRL, BWX, CDD, CM8, CYG, DDH, DMC, EAI, EDU, EVZ, FFC, FGL, FOS, FRM, GNX, HGV, HXL, HZR, IDX, IOD, IQ3, IXC, IXU, LPE, MAI, MCL, MFF, MIR, NSB, NXT, OCC, OEC, OEQ, OPL, PAR, PDN, PGC, PLY, PTB, PWR, PYR, QUE, RAC, RAP, RFX, RPG, RSH, SB2, SEN, SER, SES, SHJ, SKF, SND, TLS, TPC, TSI, TTB, TTI, VBC, WBT, WES, WMA, YOW |

| INTERIM REPORT | ALD, GEM, OML, WDS, ALD, OML | ATS, AVE, AWC, DSE, NTO, NZM, OSH, PPM, RBD, RPL, SCA, SCG, SCW, SKI, SNZ, VEA, AWC, SCG | ABC, BRN, CAA, DBI, FDV, GRR, ILU, NCL, NEU, RVS, TML, ZOR, GEM, ILU | ALX, APE, APX, AVR, BLY, CGC, DDR, ECG, EVO, IMR, MGL, NIC, TIG, UUV, APE, VEA | AGD, CLB, ELS, HCT, HGO, HMD, KSL, LME, MGG, NCL, OMH, PVS, RSG, SIS, SMX, TFL, TYM, UOS, VGL, WPR, CGC, SIQ |

| PRELIMINARY REPORT | AD8, BOD, CAN, CHC, CHL, CNU, COE, DDT, DGH, ECF, ENN, EOL, ERF, EVT, FLX, GDI, IHR, IPC, LBL, LCE, M7T, MEA, MHJ, MLD, MPR, NHF, PGL, PIA, PL8, PSI, PTL, RMS, RWC, SHL, SPZ, UBN, VRT, WMI, YFZ, CNU, EML, LLC, NHF, NSR, SXL | 4DX, ALC, AMA, AMX, ANN, ANR, ASB, ATL, BLD, BLG, BRI, CBR, CGO, CXL, CXZ, DET, EDC, EHE, GAP, GNG, HGH, HSN, HUB, IFM, ISU, JAN, JLG, KGN, KME, MAD, MMS, MND, MOT, MVF, MXT, NAN, ONT, PCI, PRN, REH, RMY, RUL, SEC, SIV, SLC, SOM, SRG, SYM, TGF, UWL, WAX, WLD, WSA, XRF, YFZ, ANN, ARB, BLD, BRG, CQR, EDV, MND, NAN | 3PL, ACF, ACR, AKE, AL3, AMI, ANG, ANP, AOF, AP2, APA, APT, AVG, BMH, BNO, BVS, CAF, CGS, CIW, CLT, COS, CTE, CU6, CVC, CVW, DXN, EMB, ENA, EOL, FRI, GDA, GDC, GNG, GSS, HMC, IBC, IDT, IEL, IGL, INV, IPD, JCS, KIL, KLS, KME, KSC, LAU, LOV, LSF, LYL, MAH, MAQ, MEZ, MGX, MLG, MSL, MSV, MVP, MYD, NEC, NSR, NST, NZO, PAB, PBP, PFP, PPG, PTM, PXA, RFF, RFG, RIC, RZI, S66, SIO, SKC, SKT, SLA, SVW, SXE, TRJ, UNI, VEE, WAA, WGN, WOR, WTC, ZIP, ZOR, APA, AUB, COL, DMP, EBO, FCL, MEZ, NWL, PTM, PXA, SHL, SPK, SVW, TAH, WOR, WTC | 4DS, 5GG, A2B, A2M, ACF, AEF, AGI, AIM, AIS, AIZ, AKG, ALG, ALX, AMO, AR9, AUB, BIS, BOL, BST, BTH, CAJ, CBL, CBO, CCE, CCG, CCR, CCX, CL8, CMP, CMW, COG, COS, CUP, CUV, CWP, DTC, DVL, ECP, EDV, EGL, EPY, EXP, FCL, FLT, FWD, GDG, GFL, GTN, HPG, HT8, HUO, HZN, ID8, IFL, ILA, ITG, JAY, JIN, KNO, KZA, LBT, LGL, LNK, LVE, LVT, MHH, MHHT, MWY, NOX, NSX, NVX, OCL, OPY, PFT, PLS, PNV, PPC, PPE, PPL, PRT, PRU, QAN, QFE, QHL, QIP, QUB, RAC, RFG, RHC, RMS, RNO, RVR, SBM, SFY, SLF, SLH, SLX, SNC, SOP, SPL, SPN, SRV, SSM, STW, SWP, TGP, TIP, TYR, WAT, WHC, WLS, WOO, WOW, WZR, X64, ZER, ZNO, AIR, ALG, CMW, EVT, FLT, HUM, IEL, IFL, NEC, PPT, QAN, QUB, S32, SGR, SKC, SKT, WHC, WOW | 1AD, A3D, ABA, ACQ, ADR, AFG, AFW, AGN, AHC, AJL, AJX, AVH, BBC, BEL, BEX, BFC, BGA, BIT, BMT, BOT, BRL, BTN, BWX, CAU, CDD, CLH, CM8, CSS, CSX, CUP, CUV, CVL, CYG, DCL, DDH, DMC, DSK, EAI, ECT, EDU, EPX, EVZ, FCT, FFC, FGL, FOS, FRM, GNX, HGV, HT8, HXL, HZR, ICE, IDX, IOD, IQ3, IXC, IXU, KAT, LPE, LYC, MAI, MCL, MPA, MYX, NSB, NXT, OCC, OEC, OEQ, OPL, PAR, PDN, PGC, PLY, PTB, PWR, PYR, RAP, RDH, RFX, RNT, RPG, RSH, SB2, SEN, SES, SGH, SHJ, SKF, SND, SNL, TGH, TPC, TSI, TTB, TTI, VBC, VYS, WBT, WES, WMA, WPR, YBR, YOW, BGA, NXT, RHC, WES |

| QUARTERLY REPORT | HAV |

New ASX Listings

| Date | Company | Website Link | Ticker | Business | Type of Sh | Per Share | Issue Amount |

| 24-08-2022 | Heavy Rare Earths Limited | https://hreltd.com.au/ | ASX: HRE | Mining exploration in Australia | Ordinary Fully Paid Shares | A$0.20 | A$6 million |

Economic and Market Outlook

Last week’s data prints

China’s Industrial Production in July rose by 3.8% year on year, according to the National Bureau of Statistics (NBS).

It was down slightly from 3.9 per cent growth in June.

China cut its key policy interest rate last week for the first time since January as major economic growth indicators slowed.

The People’s Bank of China (PBOC) unexpectedly lowered the rate of one-year medium-term lending facilities to 2.75 per cent from 2.85 per cent when selling 400 billion yuan (US$59.3 billion) of the tool on last Monday.

Minutes of the the RBA’s August 2 meeting showed the bank was committed to further interest rate hikes in the future, though the action would be guided by incoming economic data and the inflation outlook.

“The board expects to take further steps in the process of normalizing monetary conditions over the months ahead, but it is not on a pre-set path,” the minutes read.

“It is seeking to do this in a way that keeps the economy on an even keel.

The path to achieve this balance is a narrow one and subject to considerable uncertainty.”

At its 17 August meeting, the Reserve Bank of New Zealand (RBNZ) hiked the official cash rate to 3.00% from 2.50%, marking the seventh consecutive increase.

The Bank’s decision was aimed at keeping inflation expectations anchored following recent increases in price pressures.

U.S. retail sales were unexpectedly unchanged in July compared to a month ago as falling gasoline prices weighed on receipts at service stations, but consumer spending appeared to pick up at the start of the third quarter.

The data allayed fears that the economy was in a recession.

Australia’s headline Employment Change dropped to -40.9K versus 25K expected and 88.4K prior while Unemployment Rate eased to 3.4% compared to 3.5% consensus and prior.

Also, the Participation Rate declined to 66.4% versus 66.8% market forecasts and previous readings.

FOMC minutes said inflation was not showing signs of subsiding and that more rate action was necessary.

“Participants agreed that there was little evidence to date that inflation pressures were subsiding,” the minutes said.

US Existing-home sales in July fell for the sixth consecutive month to a seasonally adjusted annual rate of 4.81 million.

Sales were down 5.9% from June and 20.2% from one year ago.

“The ongoing sales decline reflects the impact of the mortgage rate peak of 6% in early June,” said NAR Chief Economist Lawrence Yun.

“Home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers.”

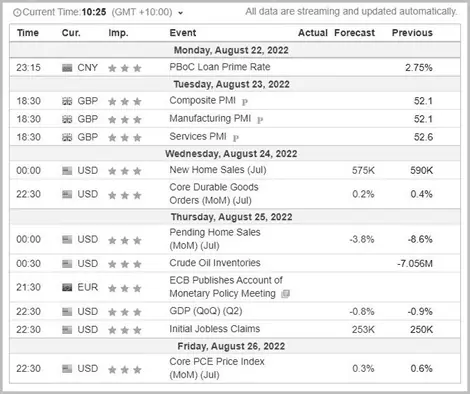

Next Week

Important data events next week are as follows

Most crucially, however, Federal Reserve Chair Jerome Powell will address the annual global central banking conference in Jackson Hole, Wyoming, on Friday, Aug. 26, at 10 a.m EDT (1400 GMT).

This highly anticipated speech could signal how high U.S. borrowing costs may go and how long they will need to stay there to bring down soaring inflation.

Forex Outlook

AUD/USD

AUD/USD closed at 0.68746, sharply below the previous weekly close of 0.71213, and positioned at the crucial support zone of 0.69000.

The pair was impacted severely at the start of last week on a disappointing raft of economic data out of China which forced the country to implement, out of the blue, a 10bps cut in its one-year lending facility.

This cut at the root of the outlook for commodities, and dimmed the prospects of ‘risk-on,’ resource-based commodities such as the AUD/USD.

Also, the US Dollar came out of its correction and zoomed higher after a low of 104.69, closing the week at 108.103.

Meanwhile, a ‘softer’ Australian jobs report showed a record low unemployment rate but also a decline in the jobs number, the first after a stellar run.

Troubles for AUD/USD were compounded by a hawkish FOMC minutes that continued to harp on the inflation tune.

The fortunes of the pair next week will be determined by whether the 0.69000 support line holds, and the Jackson Hole speech by Fed Chair Jerome Powell.

However, the most recent short term uptrend channel has clearly been rejected.

AUD/NZD

AUD/NZD ended the week at 1.11304, and above the previous week’s close of 1.10299.

The RBNZ duly hiked rates by 0.50% but sounded a sombre warning on inflation, which it said would only decline below 3% in two years.

That could indicate a hawkish stance by the bank on rate action for longer.

Meanwhile, the Australian dollar suffered from the twin effects of poor economic data out of China, and a softer employment print.

The latter could likely blunt the edge of a forthcoming rate hike by the RBA, and it might not be some basis points lower than 0.50%.

At the start of the week, the AUD/NZD was near to testing the lower support line of the rectangle sideways pattern it has been moving inside.

However, midweek it rebounded off the lower channel line of the long-term upslanting channel in green.

The outlook for the pair is still sideways. However, on the upside, it has to contend with resistance at 1.11700.