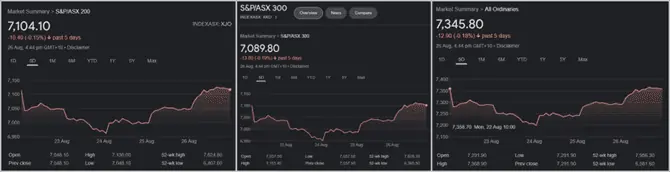

The Australian share market broke its 5-week winning streak, and ended last week just a whisker in the red, though it had a positive close on each of the last three days.

The Materials, Energy, and Real Estate sectors propped up the market, while Technology, Consumer Staples and Telecom were a drag.

However, on Friday, Fed Chair Jerome Powell made a short but hawkish speech at the Jackson Hole conference.

His words triggered a sharp sell off on Wall Street that will manifest itself across the globe, including ASX, on Monday.

The ASX200, ASX300, and Ordinaries ended the week basically flat with minor losses of 0.15%, 0.19%, and 0.18% respectively.

Table of Contents

Last Week In ASX Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) turned in another solid week, closing higher by 3.66%.

BHP (ASX:BHP), Rio Tinto (ASX:RIO), South32 (ASX:S32), and Fortescue Metals (ASX:FMG) posted impressive gains of 4.23%, 2.55%, 3.03%, and 6.21% respectively.

South32 announced it was scrapping its $1 billion plan to extend the mine life of its Dendrobium coal operation west of Wollongong in NSW.

Mineral Resources (ASX:MIN) outshone by rising over 9%.

Amidst new energy miners, while Lynas Rare Earths (ASX:LYC) fell 2.37%, IGO (ASX:IGO), Allkem (ASX:AKE), and Pilbara Minerals (ASX:PLS) resumed their uptrends and gained massively by 8.22%, 15.85% and 18.70% respectively.

Pilbara Minerals announced its maiden profit of $561.8 million in the12 months to June 30, compared to a $51.4 million loss the year before.

Amidst gold producers, Northern Star Resources (ASX:NST) went up a trifling 0.93%, though Evolution Mining (ASX:EVN) and Newcrest Mining (ASX:NCM) fell 0.20% and 2.11% respectively.

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) was a market favorite this week too, rocketing up by nearly 7%.

Heavyweights Woodside Energy (ASX: WDS), Santos (ASX:STO), and Beach Energy (ASX: BPT) built on the previous weeks’ gains by adding another 7.46%, 6.43%, and 5.37% respectively.

Saudi Arabia warned that OPEC could cut output to correct a recent drop in oil prices, triggering a surge in prices of natural gas and sending Brent crude above $100.

Coal majors kept up their bullish ways this week too.

New Hope Corporation (ASX:NHC), Whitehaven Coal (ASX:WHC), YanCoal (ASX:YAL), and Coronado Global (ASX:CRN) gained 6.44%, 8.46%, 1.03%, and 2.51% respectively.

ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX: XNJ) closed flat, gaining just 0.33%.

Among industrial commodities makers, while Brickworks (ASX:BKW) and ADBRI (ASX:ABC) fell 1.71% and 3.56% respectively, Boral (ASX:BLD) put on 3.05%.

ADBRI reported a first-half profit of $48.1 million, well under consensus expectations of $61 million, and said it was difficult to provide quantitative guidance given the uncertain economic and operating environment.

In industrial majors Reece (ASX:REH) gained over 2% but Brambles (ASX:BXB) fell 2.02%.

Amcor CDI (ASX:AMC) and Reliance Worldwide (ASX:RWC) also ended divergently – gaining 2.77% and losing 4.88% respectively.

Among infrastructure players Transurban Group (ASX:TCL) fell 1.59% but Qube Holdings (ASX:QUB) clocked a solid 6.85% rise.

In airlines Qantas (ASX: QAN) shot up 11.45% after it surprised shareholders with a $400 million share buyback; however, Air New Zealand (ASX:AIZ) slid 1.32%.

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX: XFJ) underperformed the market and ended down by 0.55%.

Banking heavyweights Commonwealth Bank of Australia (ASX:CBA), Westpac (ASX:WBC), and National Australia Bank (ASX:NAB) lost 0.92%, 1.14%, and 0.03%; however, Australia New Zealand Bank (ASX:ANZ) gained a marginal 0.39%.

Regional banks Bank Of Queensland (ASX:BOQ) and Bendigo Adelaide (ASX:BEN) also slipped and were down 0.98% and 4.95% respectively.

Wealth managers were all bid up by investors: Magellan (ASX:MFG), Platinum Asset Management (ASX:PTM), Pendal Group (ASX:PDL) and AMP (ASX:AMP) gained 1.88%, 1.08%, 10.29%, and 1.35%.

Pendal is to be acquired by Perpetual (ASX:PPT) in a $2.5 billion merger that will create an Australian asset manager, with $201 billion in assets under management.

Insurers were mixed: while QBE Insurance (ASX:QBE), and Insurance Australia Group (ASX:IAG) put on 3% and 1.55%, Suncorp (ASX:SUN) fell 0.46%.

Diversified financial services majors Macquarie Group (ASX:MQG) was down 0.67%.

ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) sat out the party and closed 0.22% in the red.

Amongst hospitality companies Star Entertainment (ASX:SGR) and Skycity Entertainment (ASX:SKC) fell 4.24% and gained 1.15% respectively.

Star posted a full year loss of $198.6 million driven by COVID related closures during the year and a writedown against its flagship Sydney casino.

Travel companies Webjet (ASX:WEB), Corporate Travel Management (ASX:CTD), and Flight Centre (ASX:FLT) all had another down week and headed south by 0.39%, 4.58%, and 1.68% respectively.

Volatility in Temple and Webster (ASX:TPW) and Kogan (ASX:KGN) continued – while KGN lost another 10% this week, TPW was up 1.83%.

Kogan reported a full-year loss of $35.5 million, with founder and chief executive Ruslan Kogan admitting that “we were wrong” by betting that surging e-commerce sales during the pandemic wouldn’t slow down after the lockdowns ended.

Amongst their peers, Nick Scali (ASX:NCK) and Harvey Norman (ASX:HVN) were up 12.10% and 0.92%; however, JB Hi-Fi (ASX:JBH) gave up nearly 2%.

Nick Scali reported an 18.2% jump in revenue during the year ended June 30, 2022, and declared a fully franked final dividend of 35 cents a share, up 40%.

Appliance maker Breville (ASX:BRG) gained nearly 3%; food brands were mixed: while Dominos (ASX:DMP) plunged 5.56%, Collins Foods (ASX:CKF) was up 2.15%.

ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) corrected after two weeks of straight gains and shed 5.70%.

Sector heavyweights Coles Group (ASX:COL), Woolworths (ASX:WOW), and Wesfarmers (ASX:WES) corrected and clocked losses of 8.64%, 6.10%, and 0.50% respectively.

Coles beat earnings expectations but said it was expecting volumes to fall as inflation and rising interest rates bit into household budgets.

Food producers Bega Cheese (ASX:BGA), and Costa Group Holdings (ASX:CGC) shot up 13.55% and 0.36%.

Bega announced it had generated net operating cash flow of $158 million and reduced its debt by $60 million to $265 million.

GrainCorp (ASX:GNC) and Tassal Group (ASX:TGR) were up 2.93% and down 0.10% respectively.

Amongst processed food makers, Bubs Australia (ASX:BUB) and A2 Milk were up 0.52% and 1.03%.

ASX All Technology Index (ASX:XTX)

The ASX All Technology Index (ASX:XTX) continued its bearish trajectory and lost 1.65%.

Amongst platform companies REA Group (ASX:REA) closed flat, however, RedBubble (ASX:RBL) plunged nearly 12%.

Carsales (ASX:CAR) and Domain Holdings (ASX:DHG) headed in opposite directions, gaining 2.61% and falling 2.20% respectively.

SaaS players Xero (ASX:XRO) and WiseTech Global (ASX:WTC) again clocked gains of 0.95% and 11.97% respectively.

WiseTech reported its full-year net profit had risen 80% to $194.6 million and forecast 2022/23 earnings growth of as much as 30%.

Appen (ASX:APX) and Nuix (ASX:NXL) were again thrashed by investors and fell 8.92% and 2.94% respectively.

BNPL had another losing week: Block (ASX:SQ2), Sezzle (ASX:SZL), Zip Co (ASX:Z1P) and MoneyMe (ASX:MME) lost 1.69%, 11.92%, 9.55%, and 1.40% respectively.

Link Administration (ASX:LNK) was down 0.11%.

In semiconductor and data center companies Altium (ASX:ALU) was up a spectacular 22.65% but NextDC (ASX:NXT) gave up 1.71%.

Altium said its full-year profit after tax had risen 57% to $US55.5 million.

ASX Healthcare Index (ASX:XHJ)

The ASX Healthcare Index (ASX:XHJ) ended marginally in the red by 0.31%.

Healthcare providers Ramsay Healthcare (ASX:RHC) and Fisher and Paykel (ASX:FPH) fell 3.41% and 0.17% respectively; however, Healius (ASX:HLS) shot up 2.80%.

Healthcare equipment makers ended mixed for the week – while Sonic Healthcare (ASX:SHL) shot up 6.69%, CSL Ltd. (ASX:CSL) and Cochlear (ASX:COH) lost 0.27% and 1.50% respectively.

Sonic announced a record full-year net profit of $1.5 billion, on revenue of $9.3 billion, $2.4 billion of which came from processing over 55 million COVID-19 PCR tests.

Resmed CDI (ASX:RMD) was down this week too, and lost 3.20%.

Biotech firms Imugene (ASX:IMU) and Mesoblast (ASX:MSB) continued their downtrend from the previous week and declined 3.92% and 5.75%.

ASX Real Estate (A-REIT) Index (ASX:XPJ)

The ASX Real Estate (A-REIT) Index (ASX:XPJ) was up 1.28%.

Among sector majors, Mirvac Group (ASX:MGR) slipped 2.09% but Scentre (ASX:SCG) and Stockland Group (ASX:SGP) shot up 5.05% and 1.24% respectively.

Scentre’s half-year operating profit rose17.6% to $540.5 million, with occupancy up and rents increasing.

Vicinity Centres (ASX:VCX) and Goodman Group (ASX:GMG) also ended in the green by 0.68% and 2.34% respectively.

ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) declined 1.65% for the week.

Sector companies were a mixed lot; while Telstra (ASX:TLS) fell 1.95%, Chorus (ASX:CNU) went up 0.85%.

TPG Telecom (ASX:TPG) slumped this week too and declined 6.65%.

ASX Utilities Index (ASX:XUJ)

Lastly, the ASX Utilities Index (ASX:XUJ) turned around from last week and closed higher by 1.94%.

Among sector majors AGL Energy (ASX:AGL) and Origin Energy (ASX:ORG) gained 3.38% and 7.24% respectively, while APA Group (ASX:APA) fell 1.83%.

APA reported a disappointing $259.7 million in full year profit.

This Week In ASX Stocks

| AUGUST/SEPT 2022 | 29 | 30 | 31 | 1 | 2 |

|---|---|---|---|---|---|

| ANNUAL REPORT | ABB, ACW, AFI, AHX, APL, ARA, ASG, AVA, BET, BSE, CCV, CVN, CYP, DBF, DDB, DUR, EBG, EGH, FMG, GNP, GVF, HLA, HPP, IGN, IHL, IMM, JHC, KAM, LDX, LER, LRT, LVH, MCA, MEM, MME, MOQ, MSM, MTO, NC6, NOU, NTI, NUC, NYR, OIL, OPT, PIQ, PTX, RCL, SKS, SRL, SWK, TOM, TPW, TTT, TZL, VRS, WRK, ZLD | 8CO, ADO, AGH, AGJ, AHF, AIR, AKL, AND, APW, ASH, ATP, AUA, AYI, BBT, BCT, BID, BKY, BNZ, BUB, CCA, CTT, CWL, DTI, DW8, ECS, EMV, EVE, EXO, FFT, FGR, FNX, FOR, GTG, HIL, HMY, IAM, ICS, IGO, IMB, JAT, JYC, KIN, KKC, KOV, KTG, LCT, LNU, MDC, MEB, MGF, MGOC, MOZ, MRM, NBI, NNG, NOV, NTD, NZS, OPH, PBH, PCG, PIL, PNC, PPK, PTG, QML, QRI, RCE, RDG, RFA, RGI, RHP, RHY, RLG, RXH, SGI, SIX, SPX, T3D, TMH, TOP, TSN, VBS, WOA, WTL, YOJ, ZMM | 8CO, ATH, AVC, BBT, COG, CSE, DCX, EGG, IBC, LAN, NOR, QTG, SFG, TEK, VN8 | AHK, AIR, SGQ | ALU, CSL, LM8, PNV, S32, VUL |

| INTERIM REPORT | AKP, BOC, DEM, DTZ, EOS, FGG, FGX, HGL, HSC, IME, IVC, MOB, MRC, NXS, OMH, ONE, SBW, SCL, SST, TOM, UOS, WHK, DBI, IVC | 3MF, 99L, AIQ, AQS, CAG, CPH, CTV, D2O, DLT, DRO, EPN, FFG, FLC, GFN, GPS, ICI, ICQ, IS3, IVO, LAW, MMI, MTR, NCL, NEW, NVU, OLL, OSX, PAL, PET, PGG, RHP, ROO, RTE, SPT, SRJ, TPP, URF, VMT, VPR, WJA, YPB, ZBT | CAQ, DTS, ECG, IRX, JTL, KSS, MIH, RAB | KGL | |

| PRELIMINARY REPORT | 1ST, 3DA, ABB, ABV, ABY, AC8, ACW, ADS, AEG, AER, AFA, AFL, AHX, ALI, APL, AQN, ARA, AVA, BCC, BKG, CCV, CII, CLU, CLX, CWN, CYP, DBF, DDB, EBG, ECL, EGH, FMG, FOD, GLE, GNP, GVF, HIQ, HLA, HLS, HMI, ICR | 14D, 3DP, 5GN, 8CO, AAP, AEI, AGH, AGJ, AHF, AHI, AIB, AIM, AIR, AIY, AKL, ALA, ALT, AND, APW, ASH, ASW, ATP, AUA, AUK, AWN, AYI, BBT, BCN, BCT, BDX, BEE, BHD, BID, BNO, BPP, BUB, BUD, BXN, BYI, CCA, | ATH, AUP, AVC, BBT, BPH, CIO, FFT, FPC, HHI, HHY, K2F, LAN, MCE, MMR, MRG, MXC, MXO, NOR, RED, SFG, SIL, TEK, TNY, UUL, VN8, WFL, XTE, ALX, HVN | PTG, TNY | REF |

| QUARTERLY REPORT | – | – | – | – | – |

New Listings

| Date | Company | Ticker | Business | Type of Sh | Per Share | Issue Amount |

|---|---|---|---|---|---|---|

| 01-09-2022 | Aeramentum Resources Limited | ASX: AEN | Mineral exploration | Ordinary Fully Paid Shares | AUD 0.20 | $7 million |

Economic and Market Outlook

Last week’s data prints

The PBoC cut China’s one-year loan prime rate (LPR) by 5 basis points (bps) to 3.65% at the central bank’s monthly fixing on Monday last week, while the five-year LPR was slashed by 15 bps to 4.30%.

The Chinese central bank took the steps in the face of a property crisis and rising COVID cases.

Sales of newly constructed homes in the US fell by 12.6% in July from June and were down 29.6% from a year ago, according to a joint report from the US Department of Housing and Urban Development and the US Census Bureau.

It was the second consecutive month of declines, and was attributed to stretched construction periods, high prices, and rising mortgage rates.

Pending US home sales, a measure of signed contracts on existing homes, dropped 19.9% in July compared with July 2021.

The figure has fallen for eight of the past nine months as rising mortgage rates make the economics of owning a home more difficult. It slipped 1% from June to July.

According to the National Association of Realtors in the US, higher rates pushed the typical mortgage payment up by 54% from a year ago.

Second quarter (April-June) US GDP fell 0.6%, annualised, less than the 0.9 percent drop the Commerce Department announced in the initial estimate last month.

Coming after the steep 1.6% contraction in the first quarter, the data print raised worries of a recession in the US.

At the Jackson Hole conference last Friday, Fed Chair Jerome Powell set an unmistakably hawkish tone in a short speech, saying the Federal Reserve must continue raising interest rates and hold them at a higher level until it is confident inflation is under control – even if unemployment rises.

Powell warned that the hikes would bring some pain to households and businesses (the “unfortunate costs of reducing inflation”).

“But a failure to restore price stability would mean far greater pain,” he added.

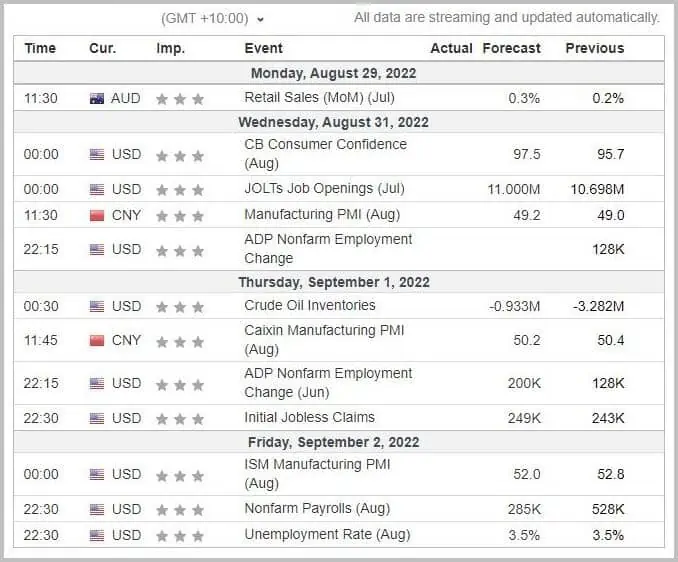

Next week

Important data events next week are as follows:

Forex Outlook

AUD/USD

AUD/USD closed at the support line of 0.68900, marginally above the previous weekly close of 0.68746, and poised to test the lower support zone at 0.68500.

Technically, the pair appears to be set on a downward path after breaking down from its recent short-term rising channel, pulling back towards the channel, and then again printing a bearish engulfing candle in preparation for a shy at the support area in green dotted lines.

The grimly hawkish pronouncement by Powell at Jackson Hole underlines further rate hikes and resulting strength in the US dollar.

This would work against AUD/USD and the pair could head much lower if the 0.68500 line is broken.

AUD/NZD

AUD/NZD ended the week at 1.12263, sharply above the previous week’s close of 1.11304.

Technically, AUD/NZD has broken out of the rectangle pattern shown between horizontal black lines, indicating the potential for further upside.

The measuring implication of the breakout is 1.14300.

The breakout may be ascribed to weaker economic prints out of a New Zealand economy undergoing a scenario of rate hikes.

One example is the Retail Sales number which was surprisingly weak.

Statistics New Zealand said the volume of total retail sales fell 2.3% in the June 2022 quarter, after a 0.9% decrease in the March 2022 quarter when adjusting for price and seasonal effects.

This is the second time retail sales volumes have fallen over two consecutive quarters since the Covid-19 outbreak.

The first was in the March and June 2020 quarters.

According to some experts, the economy may already be in a recession.