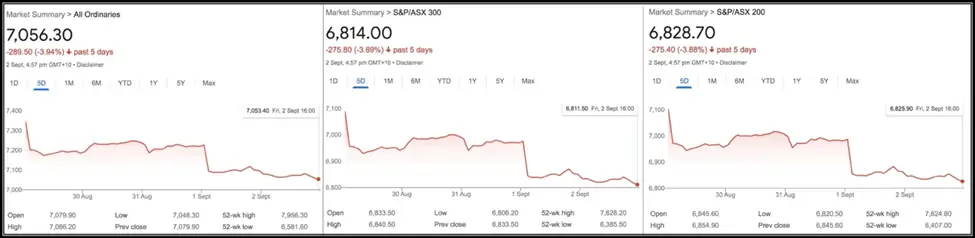

The Australian markets had a rough week stemming from Fed chair Jerome Powell’s hawkish statements at Jackson Hole last Friday.

Weak economic data and a worsening COVID situation in China coupled with a correction in energy and industrial commodities prices took their toll on the heavyweight materials and energy sectors to drag the market down further, in the latter part of the week.

The local bourse, therefore, clocked its worst weekly result in 12 weeks.

While Materials, Energy, Utilities, and Real Estate sectors dragged the market, the Consumer Staples and Healthcare sectors supported it.

The ASX200, ASX300, and ASX Ordinaries closed the week down 3.88%, 3.89%, and 3.94%, respectively.

Table of Contents

Last Week In ASX Stocks

ASX Materials Index (ASX:XMJ)

The ASX Materials Index (ASX:XMJ) had a brutal week, closing lower by a mammoth 10.94%.

Heavyweights BHP (ASX:BHP), Mineral Resources (ASX:MIN), South32 (ASX:S32), Rio Tinto (ASX:RIO), and Fortescue Metals (ASX:FMG) ended lower by 13.43%, 5.15%, 3.28%, 6.77%, and 11.63%, respectively on the back of weak industrial production data out of China.

Exotic metals producers were a mixed bag with IGO (ASX:IGO) and Pilbara Minerals (ASX:PLS) closing up 0.88% and 3.96%; however, Lynas Rare Earths (ASX:LYC) and Allkem (ASX:AKE) lost 4.70% and 3.09%.

Gold miners Newcrest Mining (ASX:NCM), Evolution Mining (ASX:EVN), and Northern Star Resources (ASX:NST) ended lower by 4.35%, 10.44%, and 0.67%.

Over the week BHP went ex-dividend after paying out A$2.47/share to shareholders while Fortescue Metals announced better than expected earnings and a A$1.21/share dividend.

IGO metals also surprised to the upside with record earnings of A$717 million.

Lastly, Northern Star Resources announced a A$300 million buyback to reduce the overhang and close the valuation gap with peers.

Also, uranium miners Paladin Energy (ASX:PDN) and Boss Energy (ASX: BOE) rose 4.67% and 8.58% as major economies such as Japan announced plans to increase nuclear capacity.

ASX Energy Index (ASX:XEJ)

The ASX Energy Index (ASX:XEJ) too had a painful week, losing 3.18% due to weak energy prices triggered by slowdown fears, but still outperforming the broader market by a hair.

Majors Woodside Energy (ASX:WDS), Beach Energy (ASX:BPT), and Santos (ASX:STO) ended down 4.88%, 5.04%, and 0.26%.

Coal miners had New Hope Corporation (ASX:NHC), Whitehaven Coal (ASX:WHC), and Yan Coal (ASX:YAL) close higher by 1.8%, 1.66%, and 11.69% while Stanmore Resources (ASX:SMR) and Coronado Global (ASX:CRN) ended down 1.72% and 5.59%, respectively.

In major news, Woodside Energy announced record results of US$1.64 billion for 1H’22 along with a 3x dividend hike in dividends to US$1.58/share while coal miner New Hope Corporation broke an all-time high before retracing slightly.

ASX Industrials Index (ASX:XNJ)

The ASX Industrials Index (ASX:XNJ) did comparatively well gaining 0.41% down for the week.

Construction materials makers Brickworks (ASX:BKW), ADBRI (ASX:ABC), and Boral (ASX:BLD) closed down 3.04%, 3.2%, and 4.73%, respectively on the back of prospects of a slowdown in the highly leveraged real estate sector due to persistently high-interest rates.

Industrial majors Amcor CDI (ASX:AMC), Brambles (ASX:BXB), Reece (ASX:REH), and Reliance Worldwide (ASX:RWC) lost 1.89%, 0.81%, 1.84%, and 6.05%.

Infra players Transurban Group (ASX:TCL) and Qube Holdings (ASX:QUB) declined 0.36% and gained 0.69%, respectively.

Lastly, Qantas (ASX:QAN) and Air New Zealand (ASX:AIZ) closed up 3.94% and 3.42% on the back of commentary on pent-up travel demand.

ASX Financials Index (ASX:XFJ)

The ASX Financials Index (ASX:XFJ) was also a good performer closing 0.41% up for the week, bolstered by the banks that benefit from high rates.

The big banks Commonwealth Bank of Australia (ASX:CBA), Australia New Zealand Bank (ASX:ANZ), Westpac (ASX: WBC), and National Australia Bank (ASX:NAB) closed up 0.42%, 1.89%, 0.42%, and 1.46%.

Smaller banks, Bank Of Queensland (ASX:BOQ) and Bendigo Adelaide (ASX:BEN) closed higher by 0.86% and 0.56%.

Insurers Suncorp (ASX:SUN) and Insurance Australia Group (ASX:IAG) closed up 0.83% and 3.52% while QBE Insurance (ASX: QBE) ended down 1.31%.

Wealth managers Magellan (ASX:MFG) and Platinum Asset Management (ASX:PTM) tanked 2.12% and 11.38% while AMP (ASX:AMP) closed up 4.75%.

ASX Consumer Discretionary Index (ASX:XDJ)

The ASX Consumer Discretionary Index (ASX:XDJ) closed down 1.88%, despite strong retail trade figures in Australia.

Hospitality companies Star Entertainment (ASX:SGR) and Skycity Entertainment (ASX:SKC) ended down 3.89% and 0.97%.

Travel companies Webjet (ASX:WEB), Flight Centre (ASX:FLT), and Corporate Travel Management (ASX:CTD) ripped up 10.76%, 2%, and 3.24% after remarks from managements about strong demand.

Temple and Webster (ASX:TPW) and Kogan (ASX:KGN) closed up 7.51% and 5% while Nick Scali (ASX:NCK) 14.97%, Harvey Norman (ASX:HVN), and JB Hi-Fi (ASX:JBH) tanked 3.87%, 3.02%, and 3.99%.

Food companies Dominos (ASX:DMP) and Collins Foods (ASX:CKF) ended down 9.2% and 0.41%.

Both Webjet and Flight Center managements made comments about demand crossing pre-pandemic level and a strong outlook, with the latter announcing a potential US acquisition.

The ASX Consumer Staples Index (ASX:XSJ)

The ASX Consumer Staples Index (ASX:XSJ) had a stellar week benefiting from a flight to safety in markets and rising 1.40%.

Coles Group (ASX:COL) and Woolworths (ASX:WOW) inched up 1.35% and 0.91% while Wesfarmers (ASX:WES) tanked 3%, mostly due to going ex-dividend.

Food producers Bega Cheese (ASX:BGA), Costa Group Holdings (ASX:CGC), and GrainCorp (ASX:GNC) closed lower by 3.44%, 2.22%, and 0.95% while Tassal Group (ASX:TGR) ended higher by 0.19%.

Processed food makers a2M Milk (ASX:A2M) and Bubs Australia (ASX:BUB) ended up 9.51% and down 2.62%, with the latter tanking due to poor results.

Over the week, a2M rocketed after reporting solid double-digit sales growth and a NZ$150M buyback while Bubs tanked on reporting a loss for the year, albeit due to one-time expenses.

The ASX Technology Index (ASX:XTX)

The ASX Technology Index (ASX:XTX) ended up at a surprising 0.47%.

Platform companies REA Group (ASX:REA) and Carsales (ASX:CAR) ended up 0.62% and 0.51% while RedBubble (ASX:RBL) and Domain Holdings (ASX:DHG) ended down 0.67% and flat.

SaaS companies Xero (ASX:XRO) and Appen (ASX:APX) closed down 0.63% and 3.96% while WiseTech Global (ASX:WTC), Nuix (ASX:NXL), and Nitro Software (ASX:NTO) closed up 0.11%, 0.77%, and 45.05%.

BNPL players Block (ASX:SQ2) and Zip Co (ASX:Z1P) ended in the green at 3.68% and 2.96% while Sezzle (ASX:SZL) and MoneyMe (ASX:MME) slumped 0.81% and 31.91%.

Semiconductor and data center companies Altium (ASX:ALU) and NextDC (ASX:NXT) ended up 0.08% and 0.20%.

Nitro software shot up after rejecting a PE offer of A$1.58/share; on the other hand, many BNPL players were in pain due to a record loss from Swedish BNPL major Klarna.

MoneyMe tanked big time despite reporting record revenues as it announced an equity issue at a whopping 28% discount.

The ASX Healthcare Index (ASX: XHJ)

The ASX Healthcare Index (ASX: XHJ) also benefited from the market’s flight to safety, having closed up 1.40% for the week.

Healthcare providers Ramsay Healthcare (ASX:RHC), Fisher, and Paykel (ASX:FPH) went up 3.22% and 0.29% for the week while Healius (ASX:HLS) fell 3.99%.

Healthcare equipment makers Cochlear (ASX:COH), CSL Ltd. (ASX:CSL), and Resmed CDI (ASX:RMD) rose 0.8%, 1.15%, and 1.07% while Sonic Healthcare (ASX:SHL) gave up 2.1%.

The ASX Real Estate Index (ASX:XPJ)

The ASX Real Estate Index (ASX:XPJ) ended the week down a painful 3.32% on the back of an overly hawkish Fed and expectations of an RBA hike on Tuesday.

However, sector leaders Mirvac Group (ASX:MGR), Vicinity Centres (ASX:VCX), and Scentre (ASX:SCG) ended up 1.46%, 2.04%, and 2.13% due to strong retail trade figures and their focus on the same while Goodman Group (ASX:GMG) and Stockland Group (ASX:SGP) fell sharply by 1.8% and 3.81%, respectively.

The ASX Telecom Index (ASX:XTJ)

The ASX Telecom Index (ASX:XTJ) fared rather well, down just 0.36%. Sector players Telstra (ASX:TLS), Chorus (ASX:CNU) and TPG Telecom (ASX:TPG) fell by 1%, 0.14%, and 0.19%.

In other news, Aussie Broadband (ASX:ABB) tanked 15% with the market despite a record EBITDA of nearly A$40 million and a 46% growth in broadband connections.

The ASX Utilities Index (ASX: XUJ)

The ASX Utilities Index (ASX: XUJ) took a heavy beating and slumped 4.27%.

Sector leaders APA Group (ASX:APA), Origin Energy (ASX:ORE), and AGL Energy (ASX:AGL) ended lower by 4.48%, 3.35%, and 6.43%, with the lattermost tanking due on going ex-dividend.

This Week In ASX Stocks

| Sep-22 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|

| ANNUAL REPORT | ALI, CFO, CIN, HLO, JAL, PGD | EPD, GTI, IHL | DTL, EDV, EOL, STM | AHC, CWN, MXO | ALB, AUR, HRZ, NOX, SFX, SXL |

| INTERIM REPORT | LCL, NVU | ||||

| PRELIMINARY REPORT | CCR, LSX | AYU | SGI | ||

| QUARTERLY REPORT | – | – | – | – | – |

| Name | Ticker | Date | Business | Price/Share | Amount Raised |

|---|---|---|---|---|---|

| Atlantic Lithium | ASX: A11 | 8th September, Thursday | Lithium Mining and Exploration | A$0.58/share | A$13.253M |

| Terra Uranium | ASX: T92 | 8th September, Thursday | Uranium Mining and Exploration | A$0.20/share | A$7.5M |

Economic and Market Outlook

Last Week’s Print

Over the last week, markets the world over opened on a sour note in reaction to Fed Chair Powell’s hawkish remarks about the Fed’s commitment to driving down inflation, meaning persistently higher interest rates.

On Monday, Australia reported a 1.3% rise in retail trade, but the good news couldn’t do much to stem the fall.

The big news on Wednesday was China’s most anticipated Manufacturing PMI, which came in at an underwhelming 49.5 against expectations of 50.2.

A complete lockdown of the Chinese city of Chengdu, which has a population of a whopping 21 million people, made things worse.

On Thursday, markets were eyeing US Crude Oil Inventories and Initial Jobless Claims.

The former was reported at -3326K versus expectations of 1826K while the latter declined by 5K to 232K.

Lastly, on Friday the US reported much-awaited Non-Farm Payrolls and the Unemployment Rate at 315K (vs consensus 300K) and 3.7%, respectively.

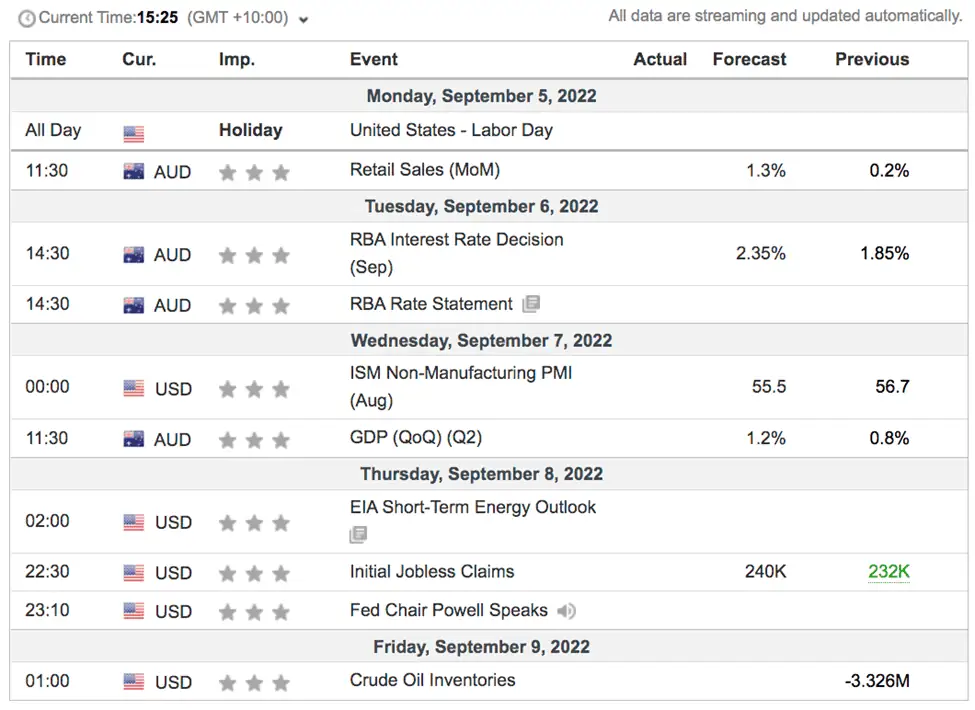

This Week

Important data events for next week are as follows :

Forex Outlook

AUD/USD

AUD/USD closed at 0.68059, well below the previous weekly close of 0.68900, after breaking down through the key support zone at 0.68500, as shown in the red ellipse.

The pair is weighed under by USD buying.

The Dollar Index has painted an ominous picture of strength on the weekly time frame with a highly bullish ‘three-white-soldier’ pattern that has taken the index out of its recent correction and to a 20-year high.

It looks primed for more bullishness, unfortunately.

The US Dollar is underpinned by a continuing stream of data, including on jobs and manufacturing, that reflects a resilient US economy.

This trend is only likely to pave the way for the FED to maintain its inflation-busting trajectory of rate hikes, reinforced by jawboning from Cleveland Federal Reserve President Loretta Mester that plotted rates above 4% by early next year.

Meanwhile, the Chinese COVID rigmarole continues alongside the flow of downbeat economic data, nurturing apprehensions of a global slowdown that would hurt demand for Australia’s bread-and-butter resource exports.

This climate only makes the Aussie’s outlook murkier.

Technically, AUD/USD is now likely to move lower to test (and likely fail), the 0.67000 support zone.

AUD/NZD

AUD/NZD ended the week at 1.11360, sharply below the previous week’s close of 1.12263.

Technically, AUD/NZD has pulled back after breaking out of the rectangle pattern shown between horizontal black lines.

However, next week, Australia reports monthly Retail Sales data on Monday, and on Tuesday, the RBA is expected to hike interest rates by another 0.50% to 2.35%.

Both are expected to be bullish for AUD/NZD, and the pair is likely to resume its upward trajectory.